Forex Trading Strategies

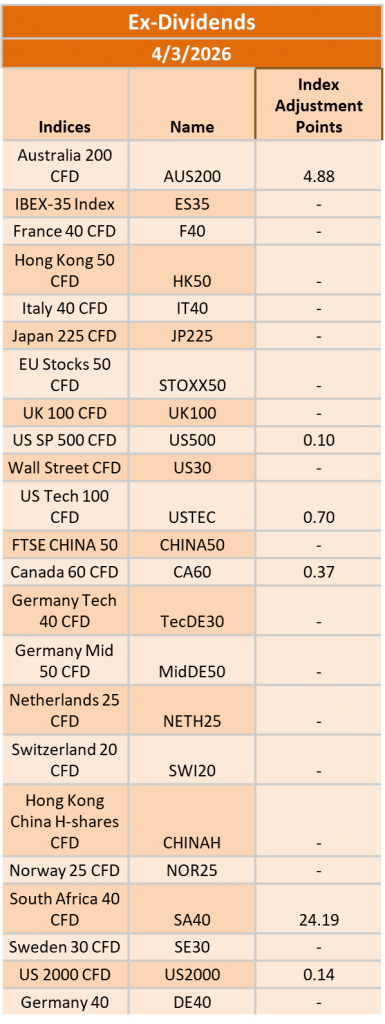

Ex-Dividend 04/03/2026

The post Ex-Dividend 04/03/2026 first appeared on IC Markets | Official Blog.

IC Markets Global – Europe Fundamental Forecast | 03 March 2026

IC Markets Global – Europe Fundamental Forecast | 03 March 2026 […]

The post IC Markets Global – Europe Fundamental Forecast | 03 March 2026 first appeared on IC Markets | Official Blog.

IC Markets Global – Asia Fundamental Forecast |03 March 2026

IC Markets Global – Asia Fundamental Forecast |03 March 2026 What […]

The post IC Markets Global – Asia Fundamental Forecast |03 March 2026 first appeared on IC Markets | Official Blog.

General Market Analysis – 03/03/26

Middle East Conflict Rocks Markets – Brent Crude up 7% Global […]

The post General Market Analysis – 03/03/26 first appeared on IC Markets | Official Blog.

Tuesday 3rd March 2026: Asian Markets Slide as Middle East Tensions and Oil Surge Rattle Investors

Global Markets: News & Data: Markets Update: Asian stock markets […]

The post Tuesday 3rd March 2026: Asian Markets Slide as Middle East Tensions and Oil Surge Rattle Investors first appeared on IC Markets | Official Blog.