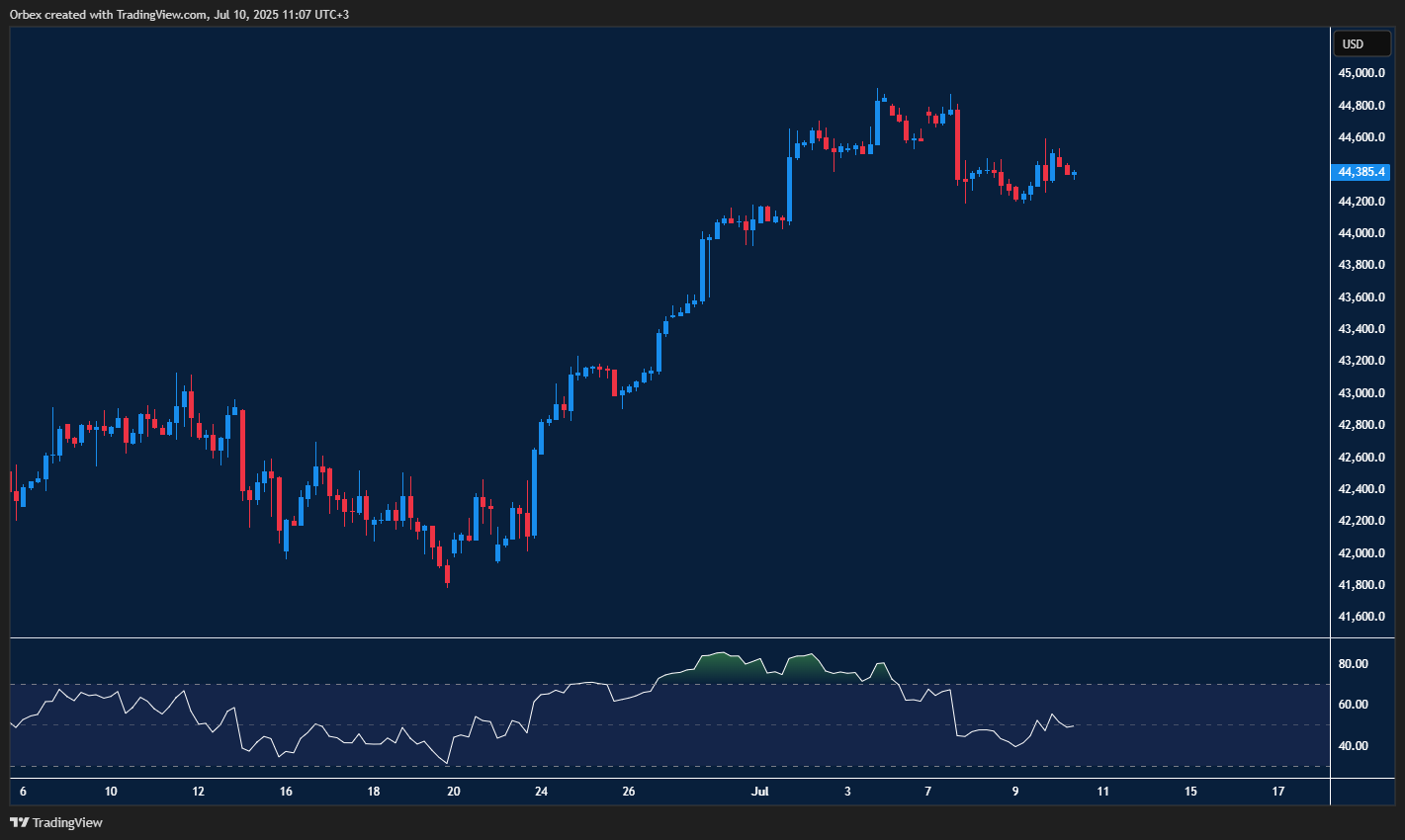

(Dow jones) US 30 creeping higher

The (Dow jones) US 30 keeps its sideways stance as price action remains undecided. The index is pulling back from its recent peak, just below 45,000, and is now testing 44,500 with the RSI dropping back into the neutral area. A bearish breakout would force leveraged long positions to liquidate and cause a correction towards 42000 at the base of the recent bottom. However, sentiment generally remains upbeat, and bulls would be looking for a stable entry point. A close back above 44600 could put the index back on track.

USDCHF remains indecisive

The Dollar found more resistance as price action attempts to recover from last month’s slump. After a slight progression for the early part of this month, a sharp turnaround saw sellers step back into the frame. Bulls will need to clear the first hurdle of 0.8000 before a recovery can materialise. 0.7880 is a fresh support, and its breach would invalidate any rebound and send the pair to a fresh low around 0.7750.

EURJPY pushing for a reversal

The Euro recouped some losses after a slight dip away from its multi-month high. Bulls have doubled down after reaching the previous peak of 172.10, resuming the uptrend with 171.70 as the next milestone ahead. The RSI’s new top in the overbought zone could lead to a temporary pullback, and 170.00 is the first support level if sellers enter the market. 168.40 at the base of the recent bounce would be a crucial level to maintain the momentum.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 11.07.2025 appeared first on Orbex Forex Trading Blog.