(Nasdaq) NAS 100 still more room to grow

The (Nasdaq) NAS 100 continues its bullish trajectory as tech stocks continue to deliver. With another record high on the horizon, traders will be wondering if a correction is around the corner. The third quarter of the year is expected to be the last two, with AI being the lead focus, and pushing stocks higher. Should prices pull back, 22000 is a critical floor, with 22900 the next level to crack for buyers.

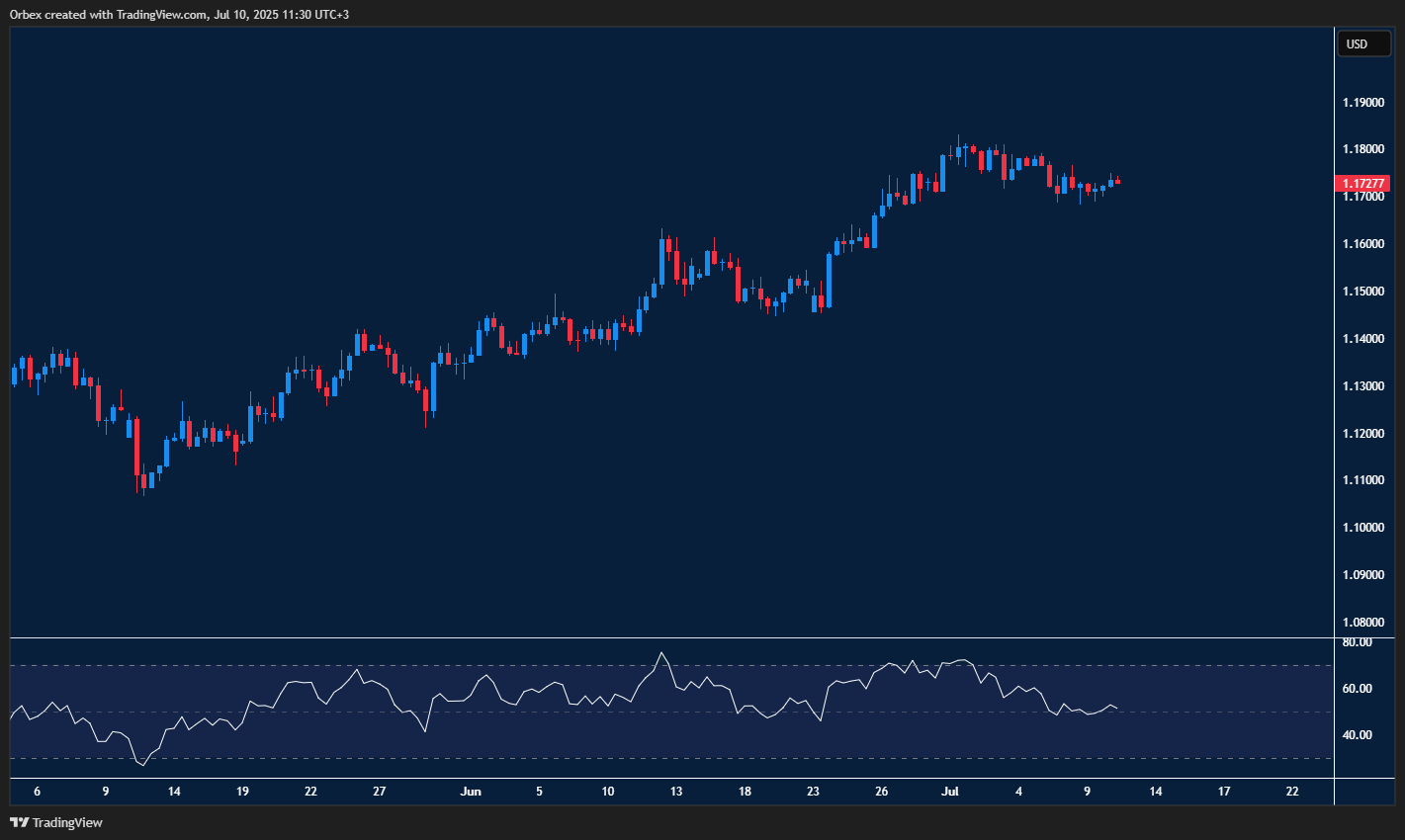

EURUSD awaits inflation data

The tariff theme for the past week has been another burden on the dollar as the euro aims for a fresh peak. With the Fed showing its concerns over a potential spike in inflation, no clear signals were given at last week’s FOMC meeting. With this week’s inflation data expected to creep higher, the second half of the year is expected to be a long one for the greenback. 1.1650 is a key support, and 1.1800 is the first hurdle ahead.

XAUUSD attempting a fightback

Gold continues its choppy price action after moving to its lowest level in a week. The safe-haven glow appears to have slightly diminished, particularly with treasury yields rising and the dollar index attracting buyers to the market. As prices bounce away from the psychological 3300 level, this becomes a critical support as a deeper correction in the bullion price would send it to 3270. On the flip side, 3360 at the previous swing high is the first target for bulls,

Test your forex and CFD trading strategy with Orbex

The post The Week Head – More Tariffs, Higher Inflation appeared first on Orbex Forex Trading Blog.