(EURUSD) Euro attempting full recovery

The (EURUSD) Euro advances as the pair hit another high, as the greenback remains on the back foot. With the latest CPI reading being tame as inflation crept up to 3%, this managed to limit the aggression with the dollar. As the ECB is expected to maintain its gradual rate cutting, all eyes will be on the Fed in their September meeting to see if they will finally adjust their monetary policy. The pair is on its way towards 1.1750 with 1.1600 as a fresh support.

XAUUSD remains pressured

The recent weakness in the US Dollar provides some support for the yellow metal as it continues its choppy price action. Another swing at the recent high failed, causing prices to fall away from the 3400 area. Momentum has seemingly shifted away from the gold market in recent sessions as traders remain undecided if another record high is on the radar. On the flip side, the ongoing geopolitical fallout and economic uncertainty could boost the safe-haven flows. The price is bouncing towards 3380 with 3300 as a critical support.

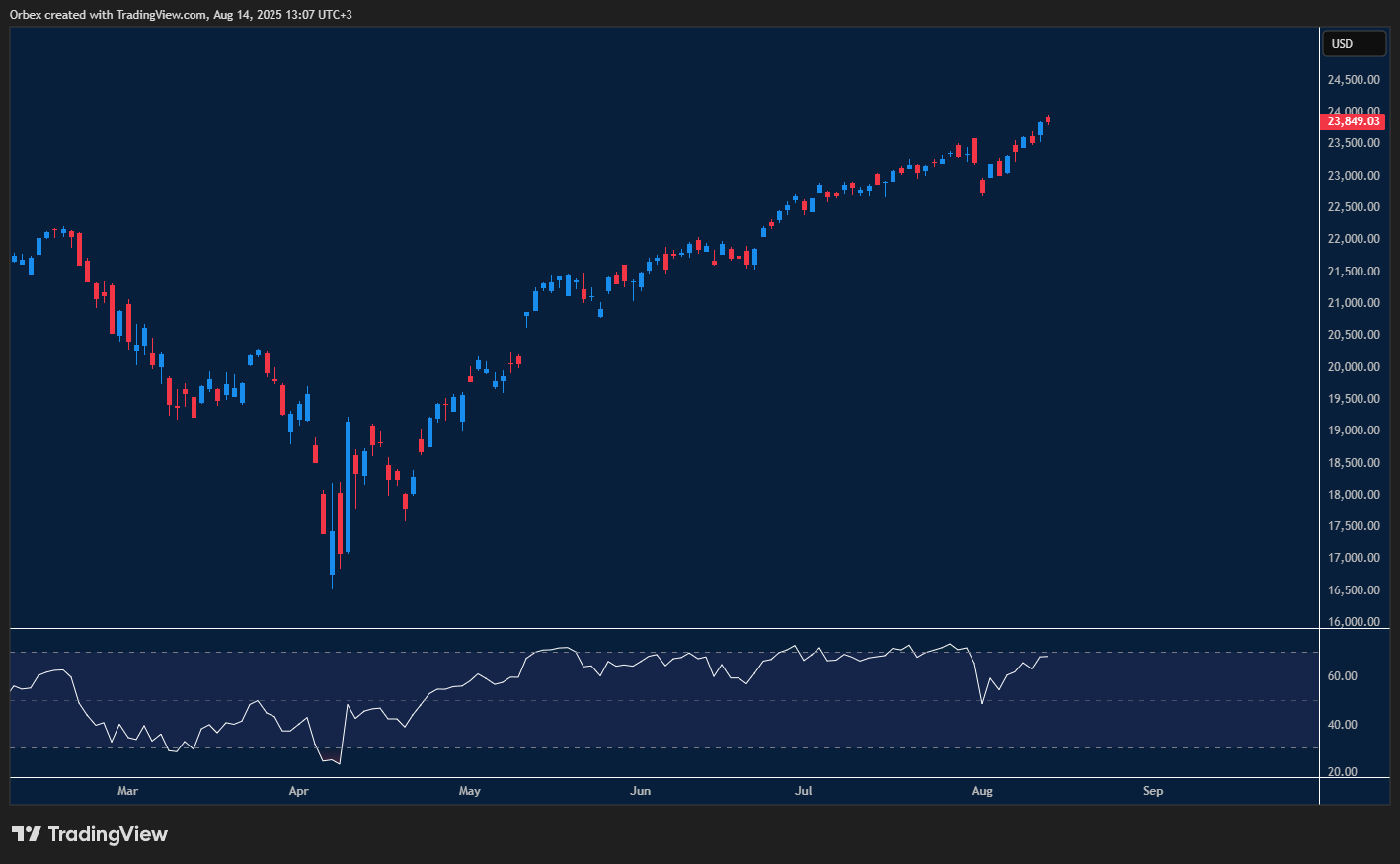

NAS 100 record after record

Indices edged higher to top more records as the stock market is the gift that keeps on giving. Recession fears seem to have been swept away and led to a rebound after the beginning of the month’s sharp sell-off. With a soft landing back on the table, the Fed will likely lower interest rates at the September meeting. The focus will now shift to how aggressively they will cut, with a soft approach being the most likely option. The index is testing 24200 and 23400 being the first support.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Peeking through the darkness appeared first on Orbex Forex Trading Blog.