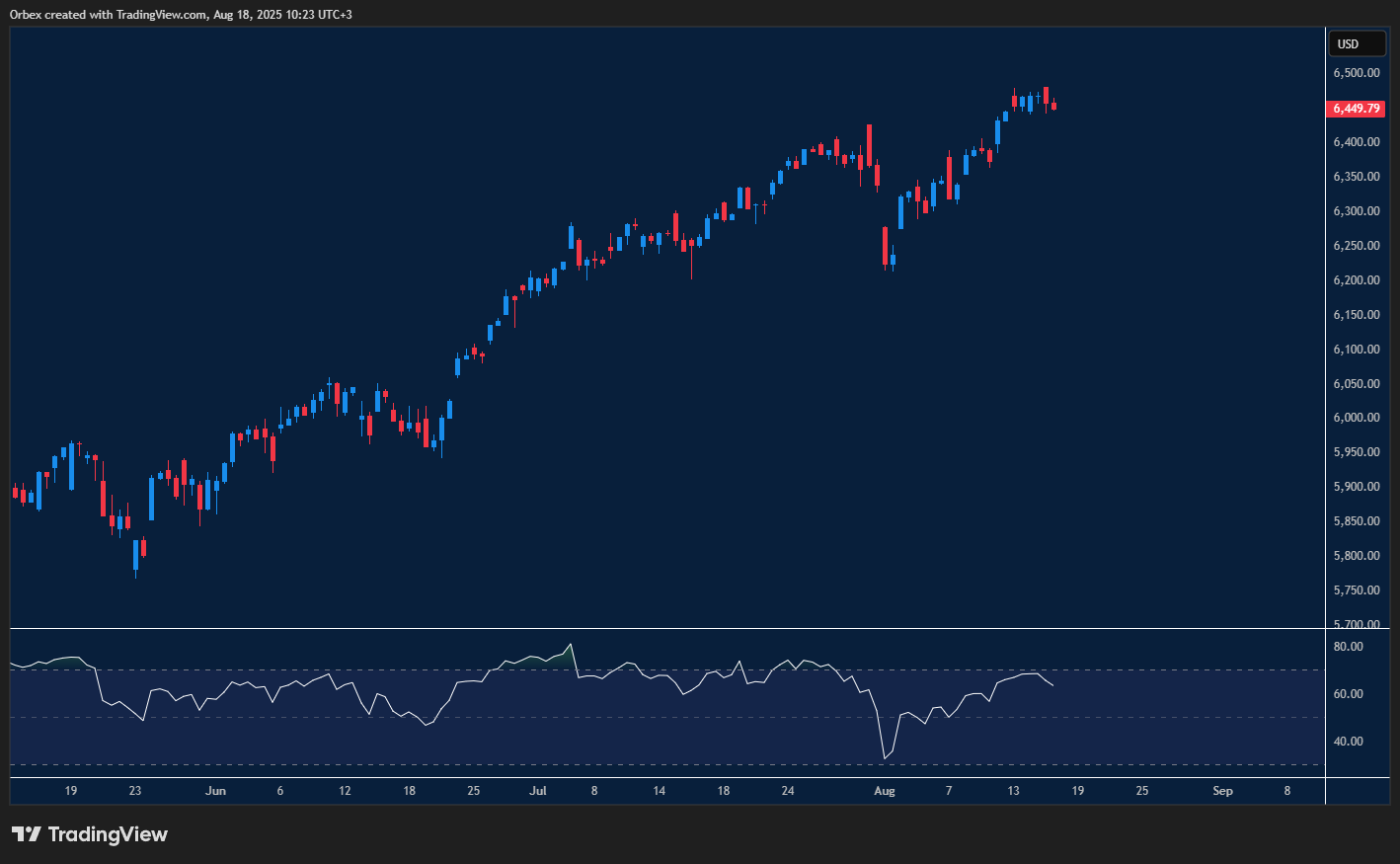

(S&P) US500 probes resistance

The (S&P) US500 moves towards another fresh peak as the stock market continues to outperform. While a close above 6450 supports the bullish trajectory, the latest horizontal grind is a sign of exhaustion. A retracement has started as short-term buyers take profit. As the RSI dips into the overbought zone, the fallback could be seen as an opportunity as sellers step in. 6350 is the first level to expect follow-up bids, and 6200 is an important support at the previous bottom.

NZDUSD regains confidence

The Kiwi took a slight breather after dropping over 100 pips, but remains under a strong bearish influence. A rally towards the mid-0.5900 area has prompted sellers to trim their exposure. After a brief consolidation, 0.5950 is the key obstacle to lift before the pair could break free of its corrective path, potentially opening the door to 0.6050 at the previous high. 0.5900 is a critical support to prevent the pair from hitting fresh lows.

EURGBP hits critical floor

The Euro rallied as the pair tested a critical double bottom, which led to a drive above 0.8600. The bullish pattern has continued to force some sellers to bail out. A revisit of this month’s high at 0.8740 would show a lack of commitment from bears to step in to bring prices lower. As the RSI moves into the neutral area, the bulls will need to clear 0.8680 before they can regain control. Otherwise, a bearish reversal would extend losses below 0.8550.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 19.08.2025 appeared first on Orbex Forex Trading Blog.