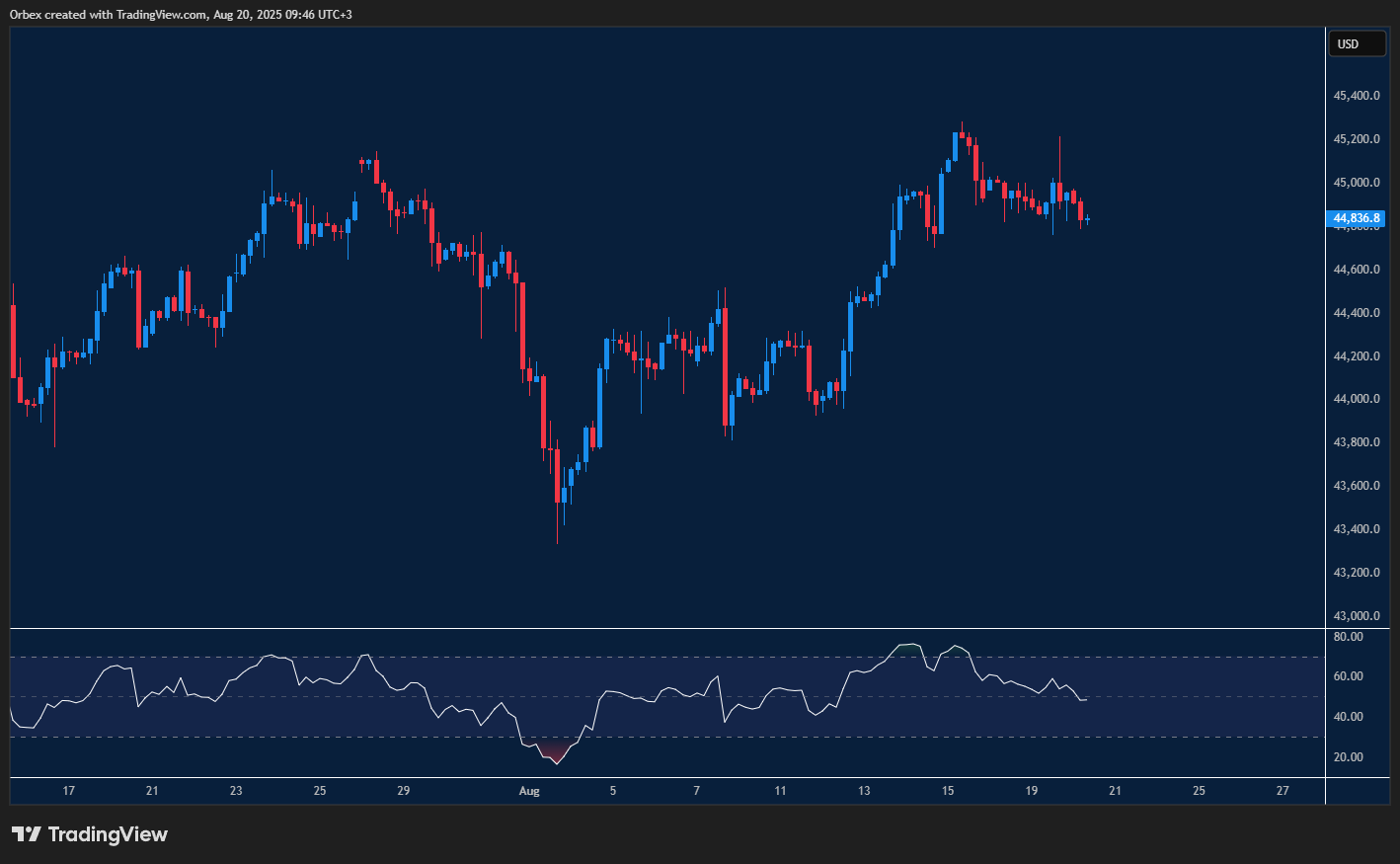

The (Dow) US30 waiting for the next signal

The (Dow) US30 took a breather as the market turned its attention to the Fed’s FOMC minutes. The index is testing the previous swing high and daily resistance at 45000, a critical level to keep the bullish momentum going, as its invalidation would force bulls to abandon ship and cause a deeper correction. The top of a limited bounce at 45200 is the first hurdle to clear. In case of a bearish breakout, 43800 at the base of last week’s breakout rally could be in the crosshairs.

USDJPY fails to break resistance

The Dollar fell away from testing the recent high above 148.50 as the pair remains undecided with its next move. Prices cut through the round number of 148.00, which sat at the previous swing high, sending a downbeat signal. 147.00 is the next level to see if bulls will step in before the pair extends losses to the latest bottom at 146.20. The RSI’s move towards the oversold zone could cause a limited pullback towards 147.80.

EURGBP maintains bear run

The pound maintained its bullish stance after hitting lower lows, which has pressured the pair. As price action remains in a bearish channel, the next divergence on the RSI will suggest either a loss of momentum or a continuation lower. A breach below 0.8600 would confirm another swing lower and prompt buyers to cover. On the upside, a move above 0.8660 could trigger a turnaround towards the previous peak at 0.8740.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 21.08.2025 appeared first on Orbex Forex Trading Blog.