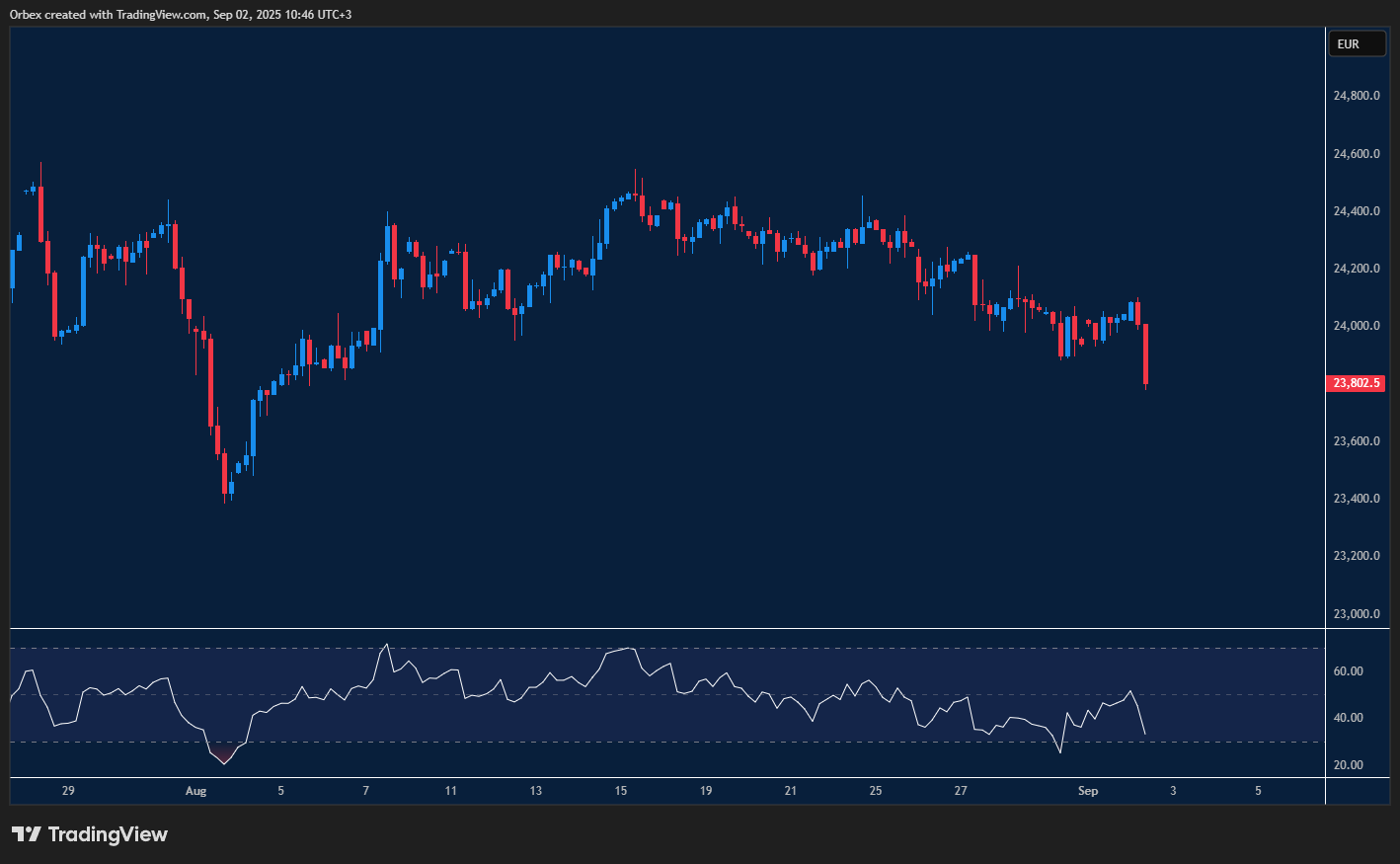

(GER40)DAX remains pressured

The (GER40)DAX continues its bearish stance after fading further away from its August peak. A close below the previous swing low of 24100 gave more pressure to the index. This suggests that overall sentiment has remained downbeat despite a temporary upswing. 24000 becomes the latest resistance level to turn things around. On the downside, 23400 at last month’s low is a key support level to maintain any kind of rebound momentum.

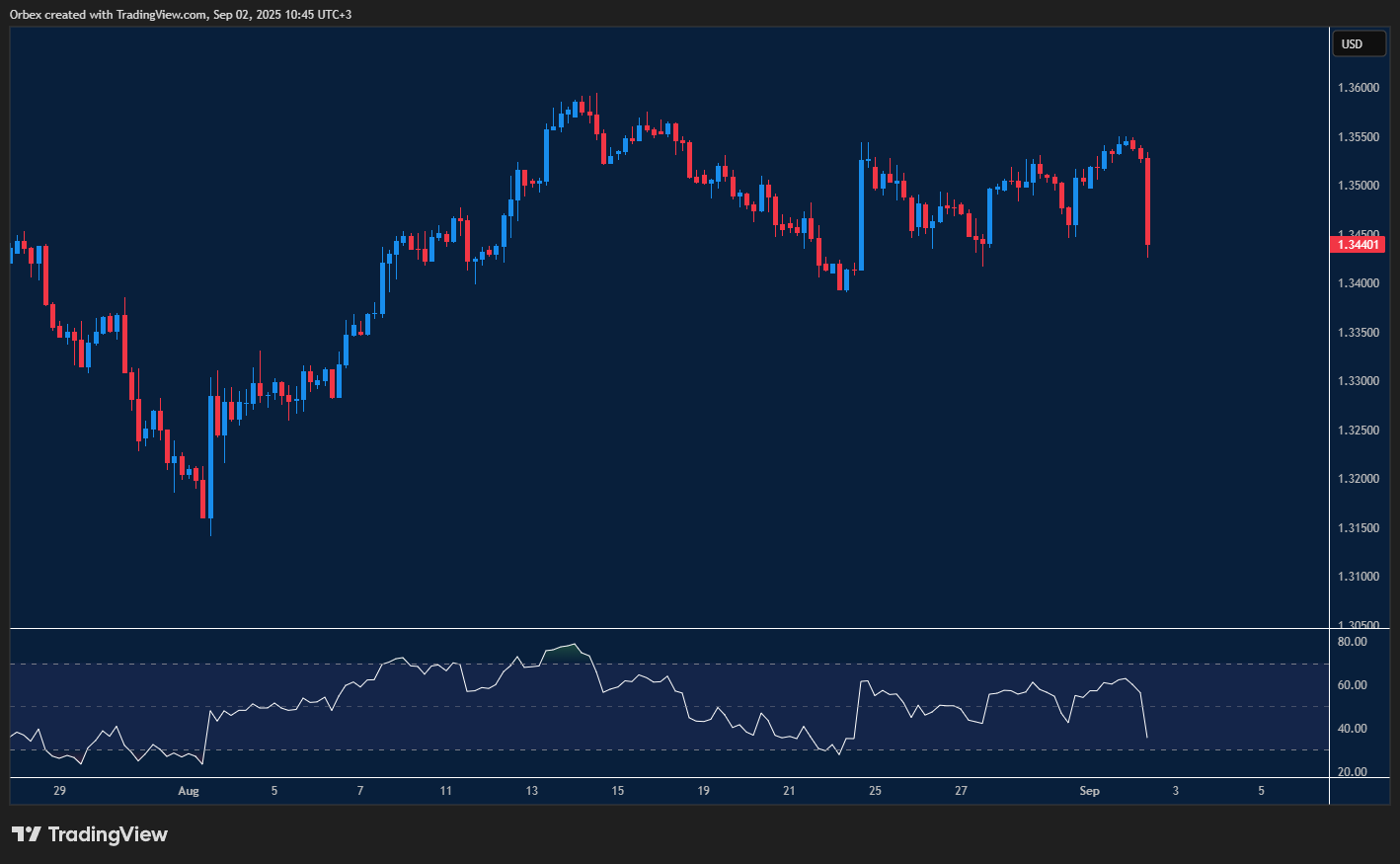

GBPUSD probes for support

Cable moved lower as over 100 pips were shed from the pair in recent sessions. A break below 1.3500 has put the bulls on the defensive. On the chart, the pound remains in a downtrend, which means that the correction is still probing for support. 1.3400 is the next stop to see if buyers will return and is a critical floor to prevent a deeper sell-off. A bullish divergence on the RSI would be an encouraging sign, suggesting that the downturn has lost some momentum.

USDCAD attempts to rebound

The American dollar continues to claw back losses after moving towards the 1.3800 level. After a tentative consolidation, a bounce off 1.3730 indicates that buyers are attempting to hold on. A retest and a breach of the major obstacle of 1.3780 would flush out some sellers and potentially extend the rally towards 1.3900, opening the door to a broader recovery. A fall below the said key support would invalidate the rebound and send the pair towards 1.3650.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 03.09.2025 appeared first on Orbex Forex Trading Blog.