(Nasdaq) Nas100 looking for a fresh record

Stock continued to climb as the (Nasdaq) Nas100 rallied over the past week. From the recent selloff, the index is looking to make a full recovery after breaking through the 23500 barrier. A break above the recent high of 23750 would keep the latest trend followers in the market and pave the way for a further rally. The psychological level of 23000 sits near a daily support, making it a major level to gauge the bulls’ resolve. 23900 is the new top as stocks look to progress this week.

USDJPY breaks lower

The Japanese Yen ignored any signs of a slowdown as prices fell back through the 148.00 level. Last week’s bounce came to a halt as an overbought RSI signalled further weakness in the dollar. A lack of follow-up support has put early buyers on the defensive. The recent daily low of 146.50 is the next level to see if the rebound from the past two weeks can hold, and 147.80 is the key obstacle to remove for bulls to gain some control over the pair.

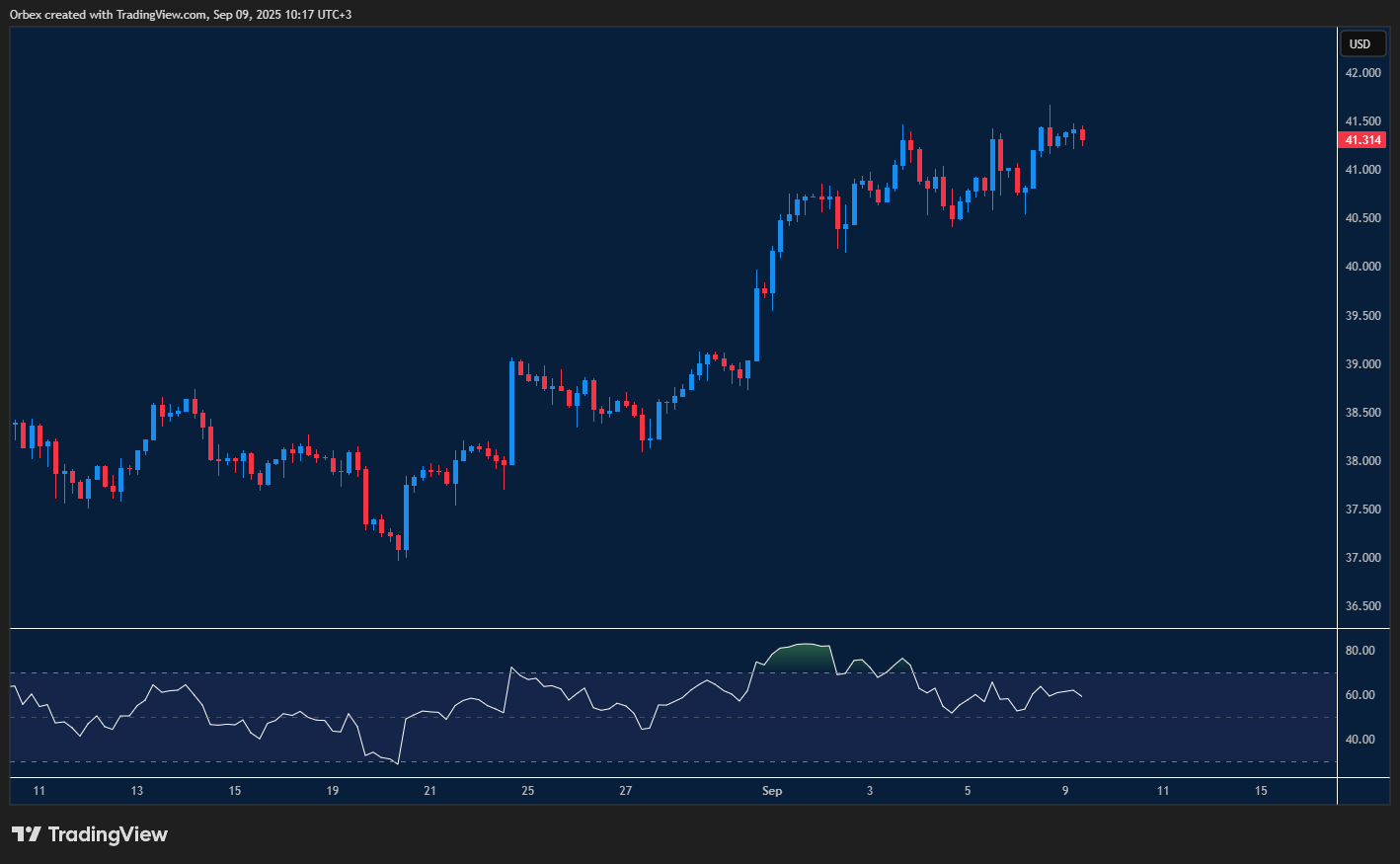

XAGUSD pushing higher

Silver saw a continuation of its recent rally after clearing the 41.00 level. The price has sought to consolidate its gains after it cleared this month’s top as the latest bounce produced a fresh high. Any signs of a slowdown need a fall below the swing low of 40.50 and would be a sign of liquidation, forcing leveraged short-term buyers to bail out, with the psychological level of 40.00 becoming a firm support. 42.00 is the next target for bulls as the metal market continues pushing.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 10.09.2025 appeared first on Orbex Forex Trading Blog.