(EURUSD)Euro remains bullish

The (EURUSD)Euro advances as the pair moved over 300 pips in recent sessions, as the greenback remains on the back foot. With last week’s inflation report showing a jump, this managed to limit the aggression with the dollar. With an interest rate all but assured this week, all eyes will be on the Fed to see if they have left it too late to salvage a battered economy and a weakened labour market. The pair is on its way towards 1.1800 with 1.1620 as a fresh support.

XAUUSD gearing up for another record

The recent weakness in the US Dollar provides some support for the yellow metal, as this came after another failed swing at the recent record high, as price action fell away from the 3680 area. Momentum has seemingly shifted away from the gold market due to the expectation that the Fed will only cut its rate by 25 basis points instead of 50 in its next meeting. On the flip side, the ongoing geopolitical fallout and recession fears could boost the safe-haven flows. The price is bouncing towards 3675, with 3600 as a key support level.

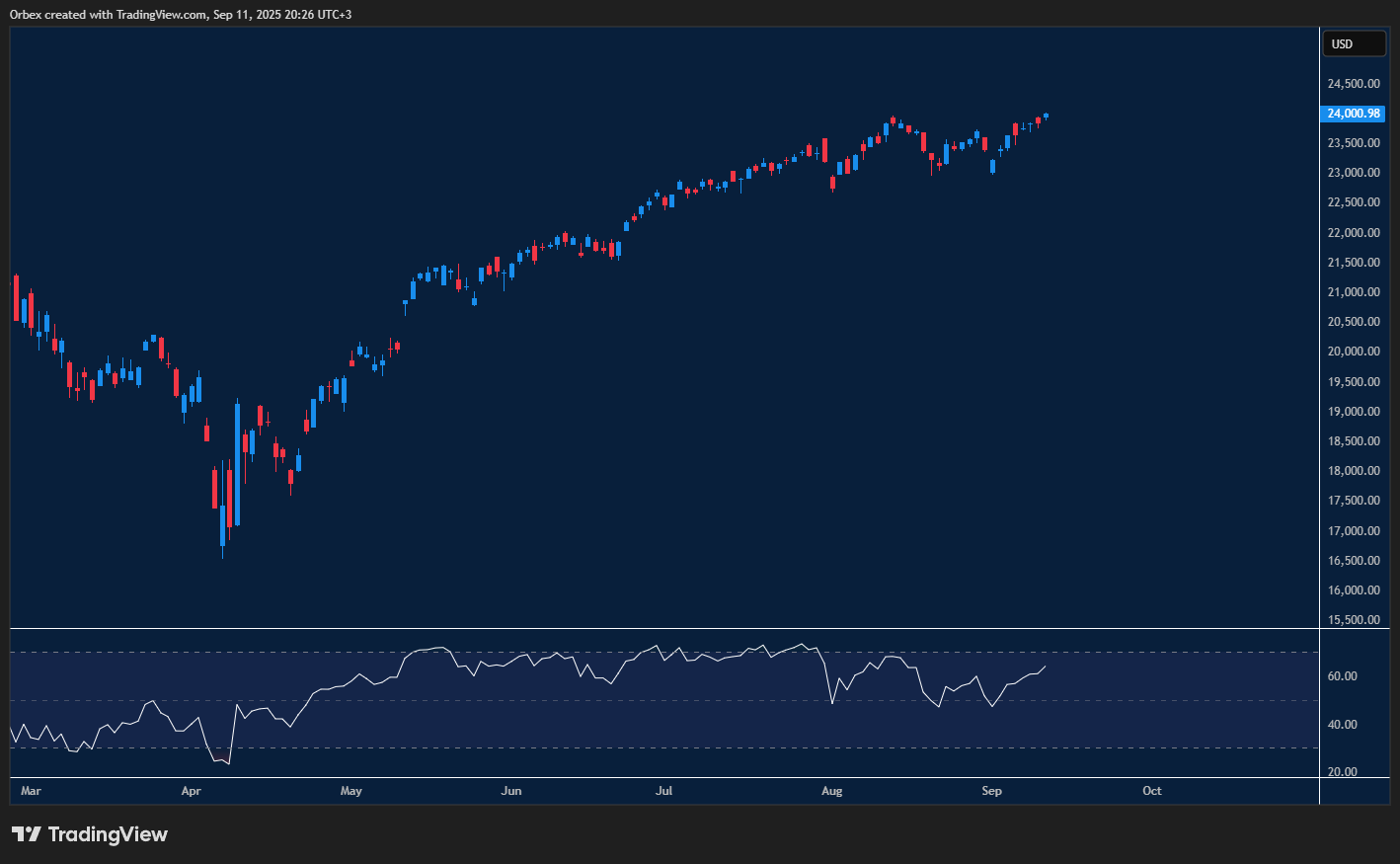

NAS 100 no slowing down

US Indices and most global stocks remain bullish as the Dow closed above 46000 for the first time on record. That wasn’t the only good news for bulls, as the Nasdaq and S&P kept their fresh peaks going as the Fed’s 2% inflation target looks like a distant memory. The focus will now shift to how aggressively the Fed will cut, with a soft approach being the best, but surprises can happen. The index is testing 24300, and 23500 is the first support level.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – All Eyes on the Fed! appeared first on Orbex Forex Trading Blog.