(SPX 500) S&P hitting records

The (SPX 500) S&P confirmed its bullish stance after a remarkable continuation after jumping past the 6500 level. 6650 is the next hurdle to reach and a key level to see if bulls progress as the RSI pushes into overbought territory. Any sign of a slowdown would first see 6450 tested, and then 6350 for a complete reversal to take shape at the previous swing low.

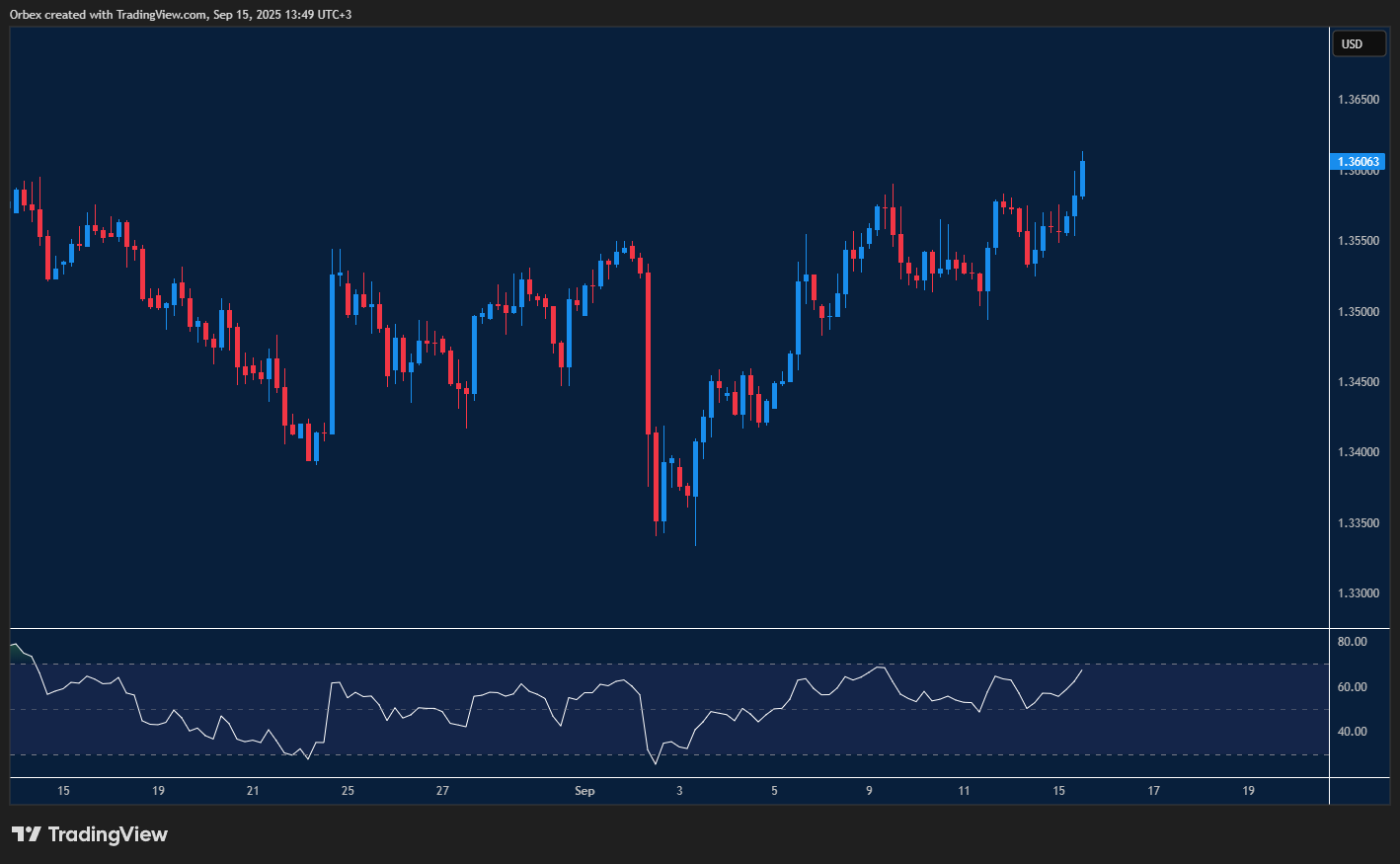

GBPUSD hits another high

Cable’s bullish run continued as prices touched a multi-month high. The pair has been pushing higher after it broke above the dynamic resistance of 1.3550. From a daily chart perspective, the swing low of 1.3480 is a critical level to keep the uptrend momentum going, as its breach could open the door to a deeper pullback. A continuous overbought RSI suggests a slowdown is imminent, but buying interest could continue. A break above 1.3620 would be a confirmation, leading to a test of 1.3700.

USDCHF probes support

The US dollar fell as traders began to price in the Fed’s first rate cut of the year. Another downturn from the recent bottom at 0.7910 suggests the dollar sell-off could continue. The bearish rally is also an opportunity for the greenback to probe for support. A turnaround first needs a 0.7980 break and would force early buyers to jump on board and send the pair to the last swing high towards 0.8100.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 16.09.2025 appeared first on Orbex Forex Trading Blog.