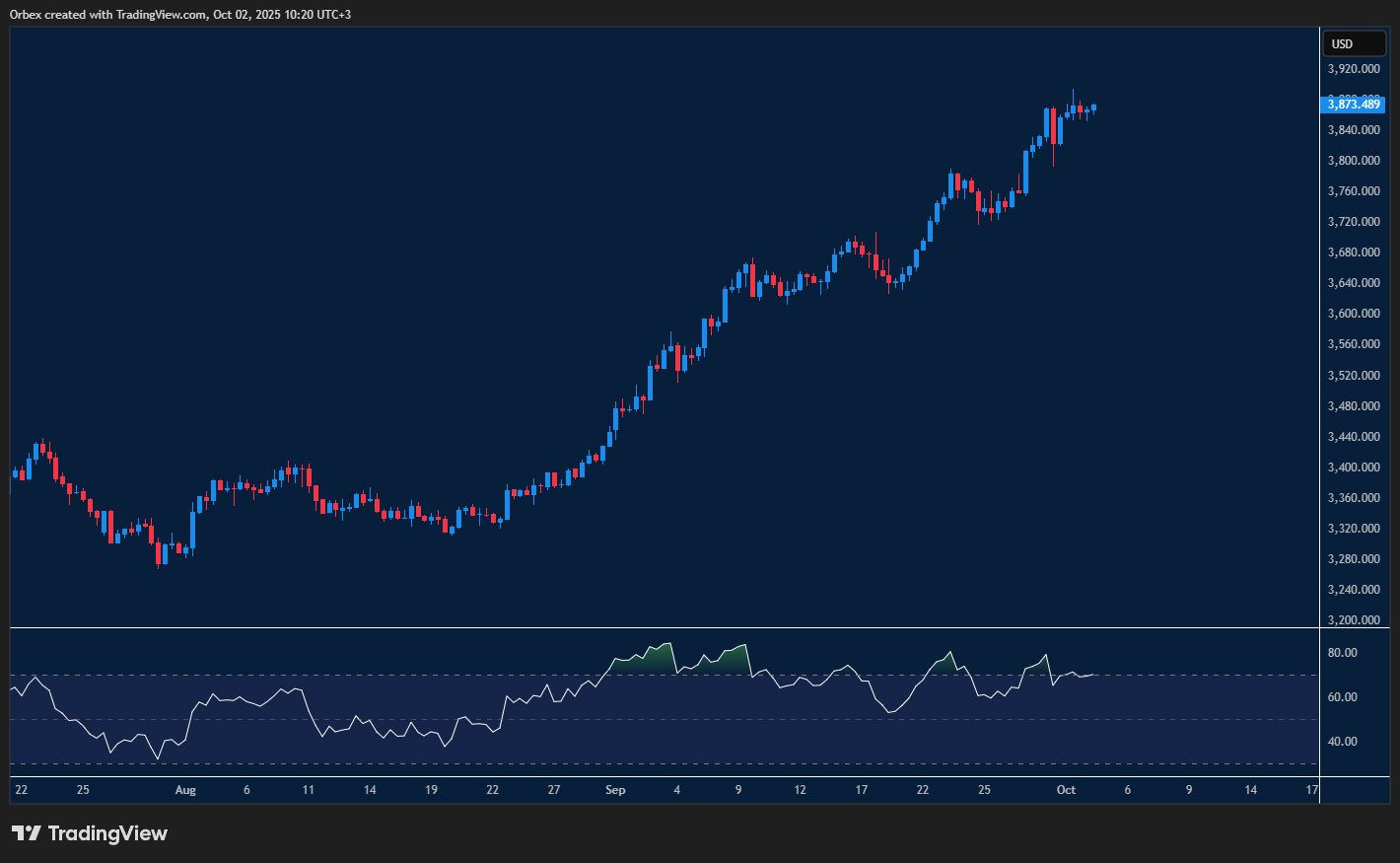

( Gold )XAUUSD looking for another record

As ( Gold )XAUUSD breaks another monthly record, the main concern is whether a deep correction is around the corner. Last week’s US data saw a shift in the dynamic, and there could be another rally in sight, as some traders believe that gold is destined for $4k before the end of the year. With the yellow metal making continuous higher highs, the Fed could turn things around with its signals this week. 3800 is a major support level, and 3930 is the hurdle to clear in order to confirm another milestone.

GBPUSD awaits unemployment data

Sterling remains under modest pressure as prices attempt to regain the recent peak above 1.3700. The outlook suggests that sellers are regaining control as focus shifted to this week’s FOMC minutes. Progressive data, including a decent NFP jobs number, could be the catalyst for a deeper correction, as there are no major fundamental factors for the pound on the horizon. Concerns over worsening job market conditions could make it difficult for the pair to drive higher. 1.3350 is a fresh support, and 1.3600 is the first resistance.

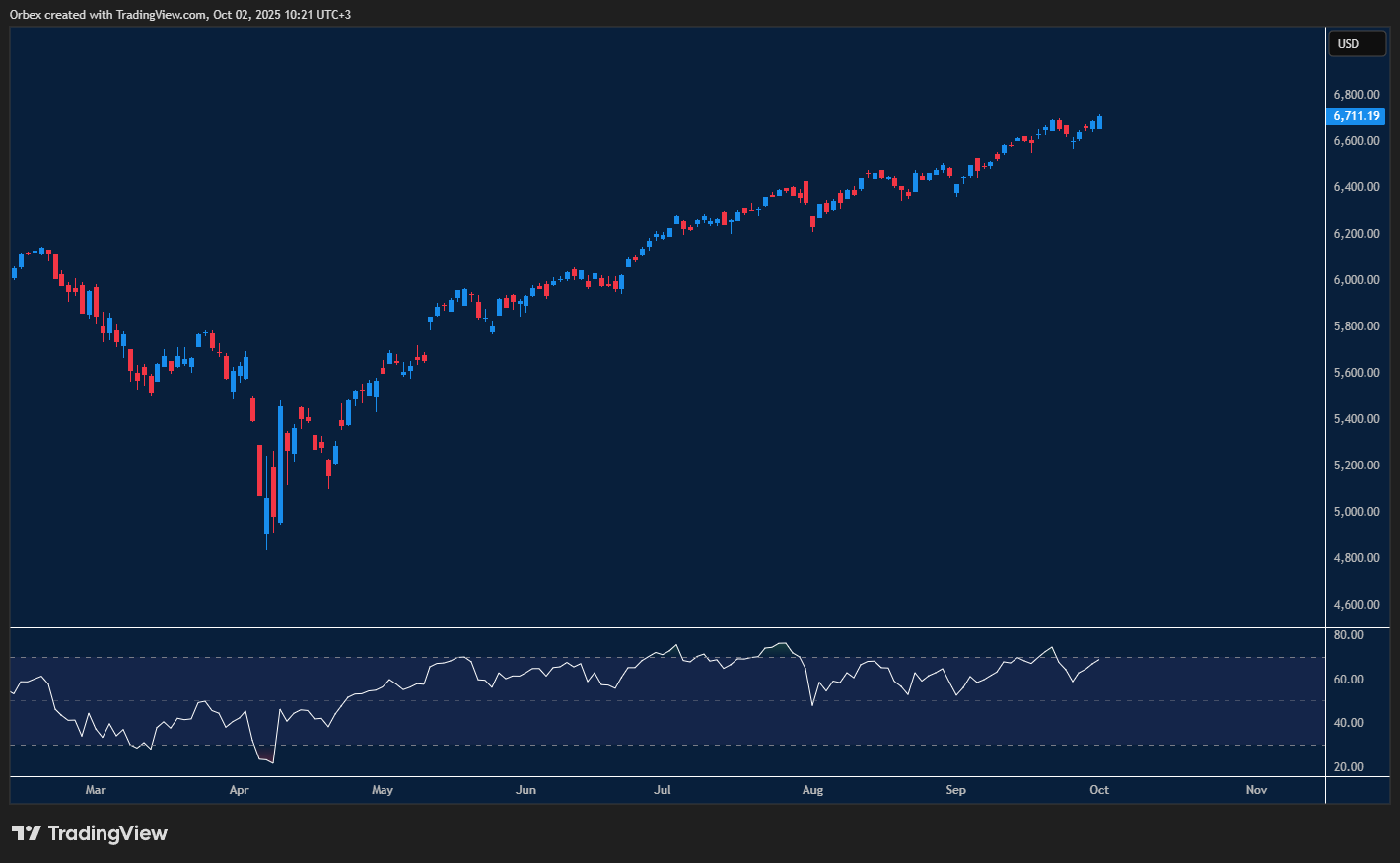

SPX 500 stocks keep on giving

Indices continue to push to new records as healthcare stocks remain in the spotlight. The market appears to be highly sensitive to any incoming data, as traders seem to have largely ignored the recent government shutdown. As the three leading indices continue to close in positive territory, all eyes will be on the upcoming earnings season to see if they can maintain the bullish rhetoric. The index is hovering above 6700, with 7000 as the next resistance level.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Continuing the Climb appeared first on Orbex Forex Trading Blog.