AUDUSD on the comeback trail

The AUDUSD looks to break out of its stiff consolidation as the greenback’s momentum continues. This week’s business confidence data and the next round of central bank meetings will be crucial for determining the pair’s next direction. With uncertainties persisting around domestic activity and inflation, the Aussie could be in for a rough ride ahead. Prices bounced at 0.6560, confirming a firm support level, with 0.6700, the recent peak, being the first resistance.

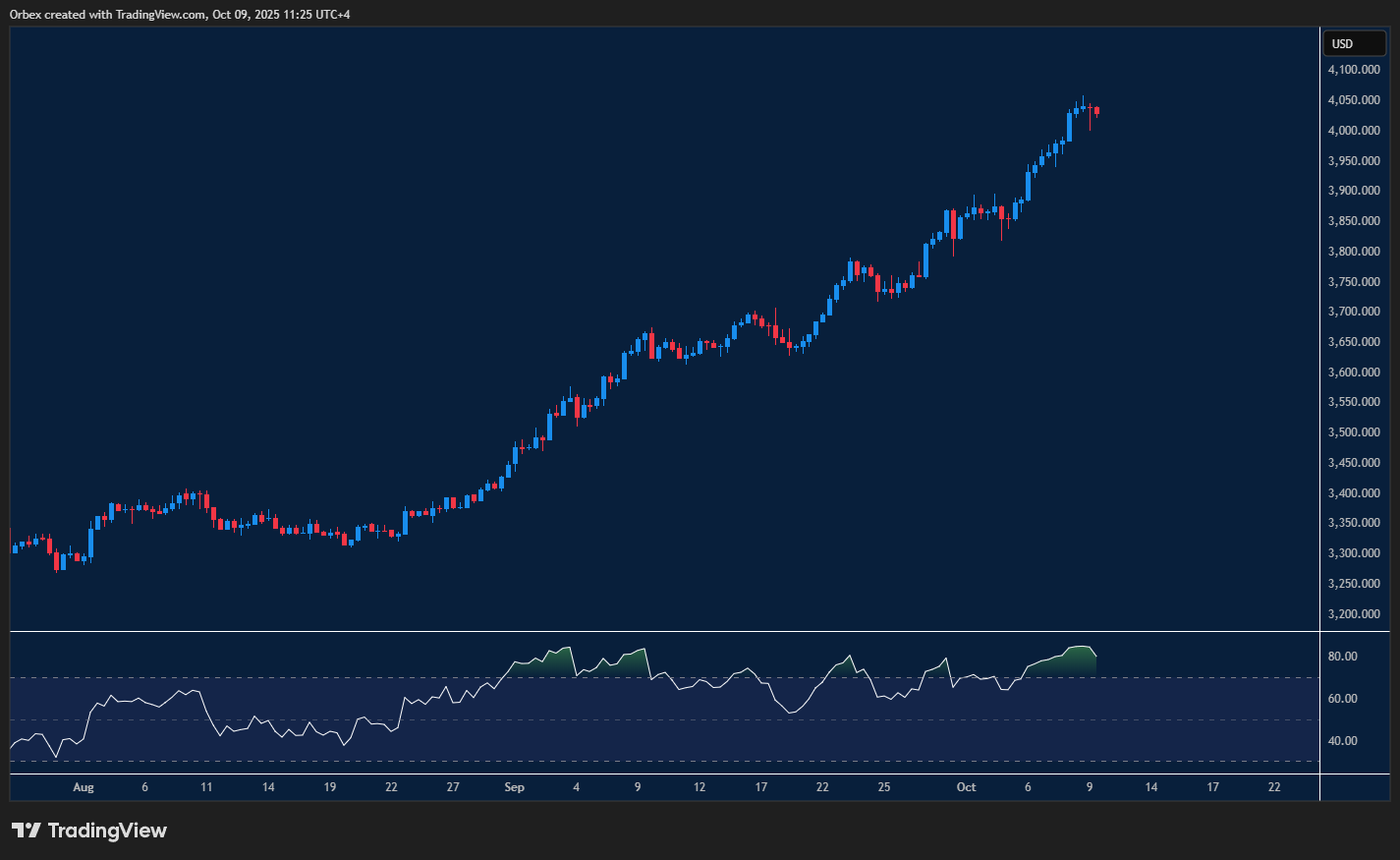

XAUUSD hits another record

Gold is testing a key resistance level as it pushes above its all-time highs. The precious metal is seeing solid bullish momentum as the Fed all but confirms two more rate cuts before the end of the year. With the gold rally expected to continue, traders are convinced that the $ 4,000 level is a comfortable support. As this week’s inflation data is expected to hit 3%. 4100 is the first resistance ahead, and 3950 remains the support level.

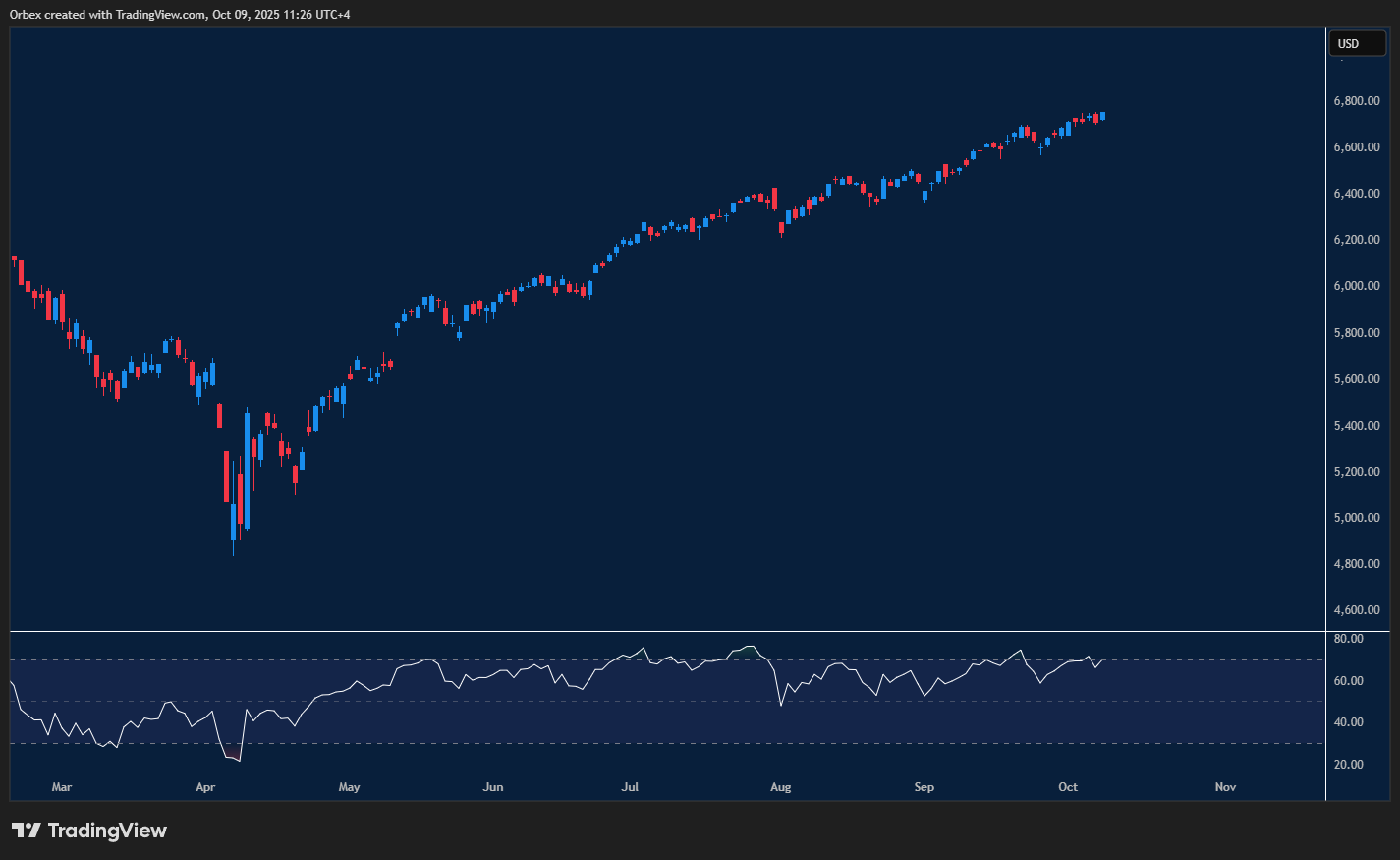

SPX 500 AI propels the indexes

Tech companies led the rally on Wall Street, with AI-linked stocks. Nvidia led the charge again, with shares soaring more than 2%. The love affair with AI shows no signs of slowing down, as the index looks to shrug off warning signs of a correction, with prices poised to reach another record. With the Fed looking to have the last word on the direction of the market, a dovish policy could lead to a significant shakeup for the S&P 500. The closest support is 6400, and 7000 is the target ahead.

The post The Week Ahead: Reaching the Summit appeared first on Orbex Forex Trading Blog.