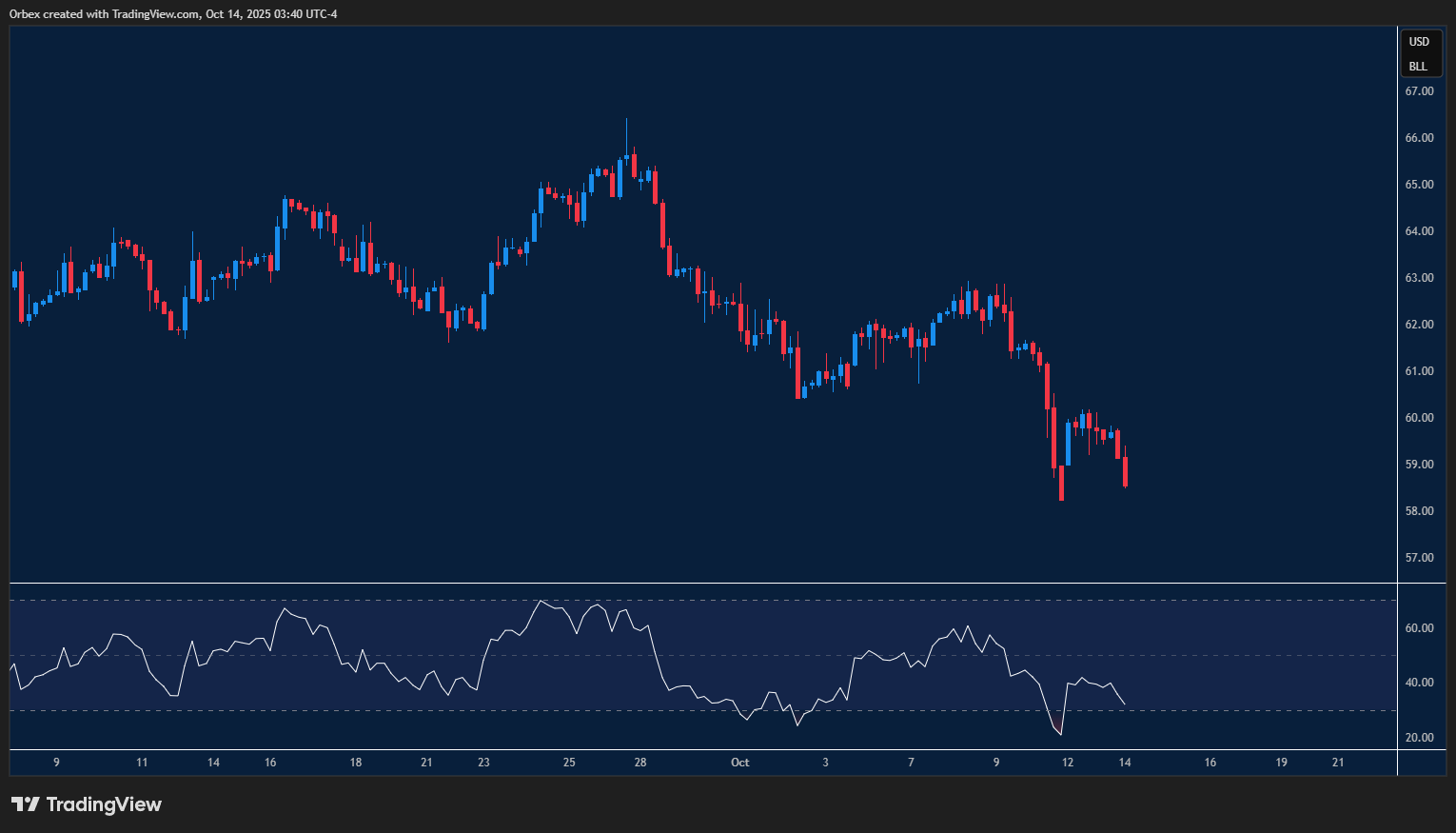

( WTI )USOIL struggles to bounce

( WTI )USOIL remains pressured after hitting further multi-month lows. On the chart, a new low below 59.00 has kept the commodity in a bearish channel and could lead to a broader sell-off with the psychological level of 55.00 as the next target. In the near term, another venture with the RSI in the oversold area could cause a pullback, with 59.80 as the first resistance.

AUDUSD remains pressured

The greenback continued to rally as the positive mood remains on the US dollar. With prices falling to multi-week lows, a clean cut below 0.6500 has forced early buyers to bail out and could signal a new round of sell-off. The RSI’s oversold condition can contribute to a potential bounce higher. Support at 0.6450 needs to hold to reverse the bearish situation, with 0.6520 as the first resistance to clear.

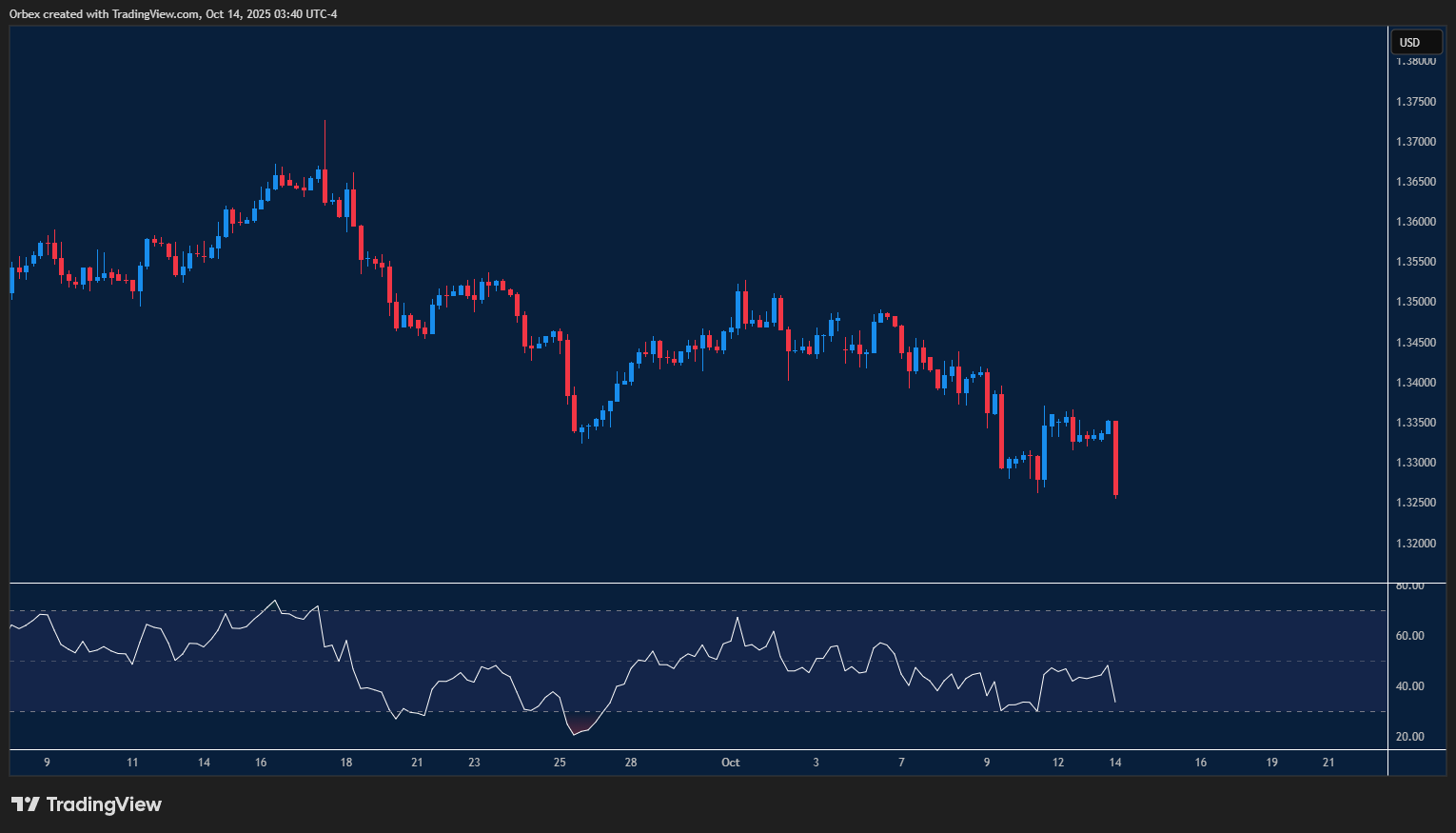

GBPUSD heading south

Cable is another casualty of a progressive dollar as the pair dropped over 100 pips. A move below the recent support at 1.3300 indicates that bears mean business. On the upside, 1.3350 is the target to see if buyers will reemerge after the RSI sinks back into oversold territory. The resistance at 1.3280 is the first hurdle for a turnaround, as the previous downturn and the current sentiment could worsen if sterling breaks below 1.3200.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 15.10.2025 appeared first on Orbex Forex Trading Blog.