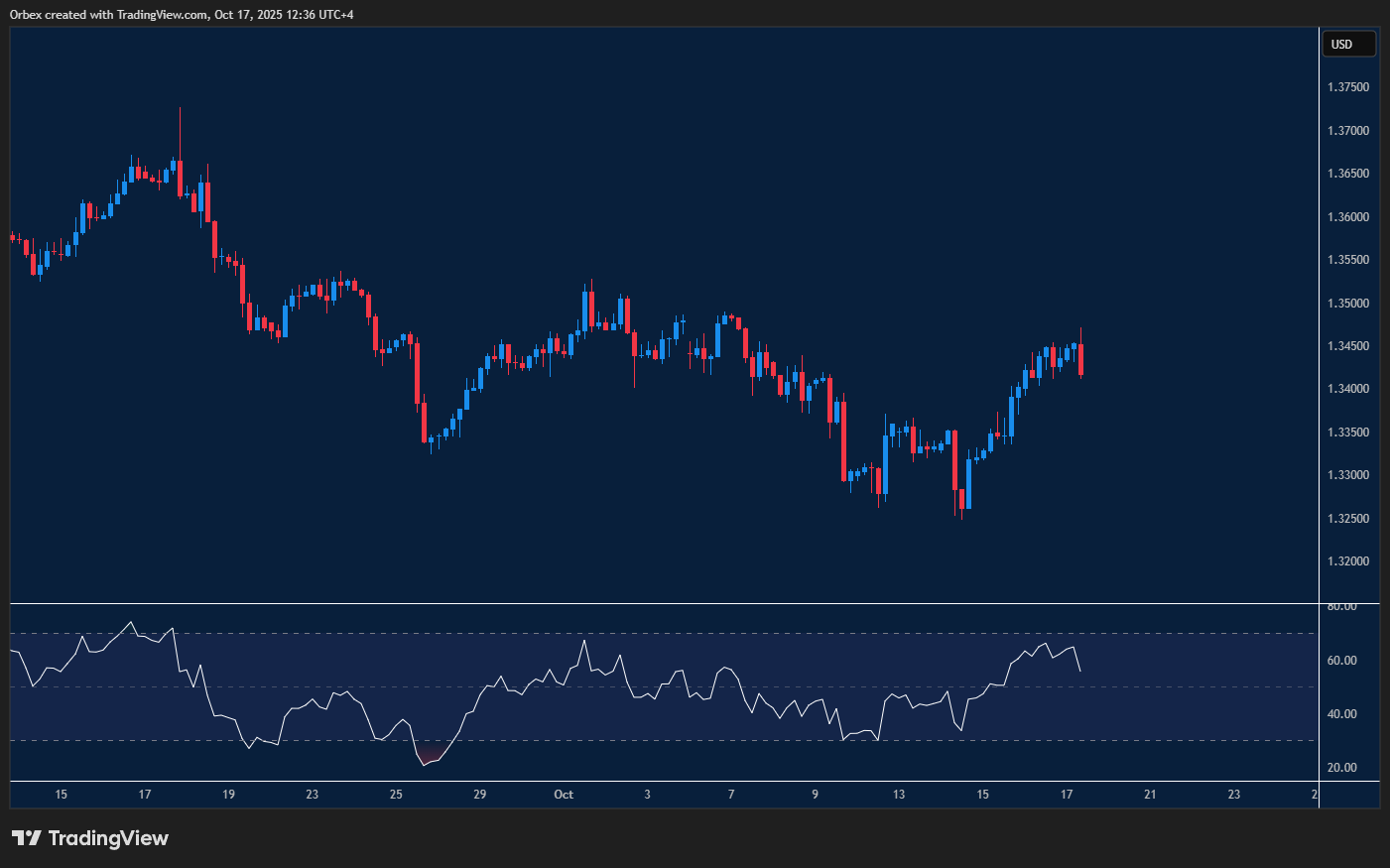

GBPUSD on the comeback trail

The pound popped higher as price action found some rhythm, moving away from the recent bottom. The recent bounce at the firm support of 1.3250 is a key level to keep cable afloat from the medium-term perspective as its breach could cause a bearish reversal towards 1.3100. The buy side will need to clear 1.3500 before they can hope for a continuous recovery, as the pair looks to keep its 200 pip move validated.

USOIL keeps the pressure on

Oil fell further as global demand weakened, as the final quarter of the year is well underway. Despite an oversold RSI on the chart, WTI has kept its downward bias after a brief consolidation around the 59.00 area. A combination of fresh selling and profit-taking could test the bull’s resolve. 55.00 becomes the next support in case the bearish rally continues, whilst 57.80 is a major level to turn the price around.

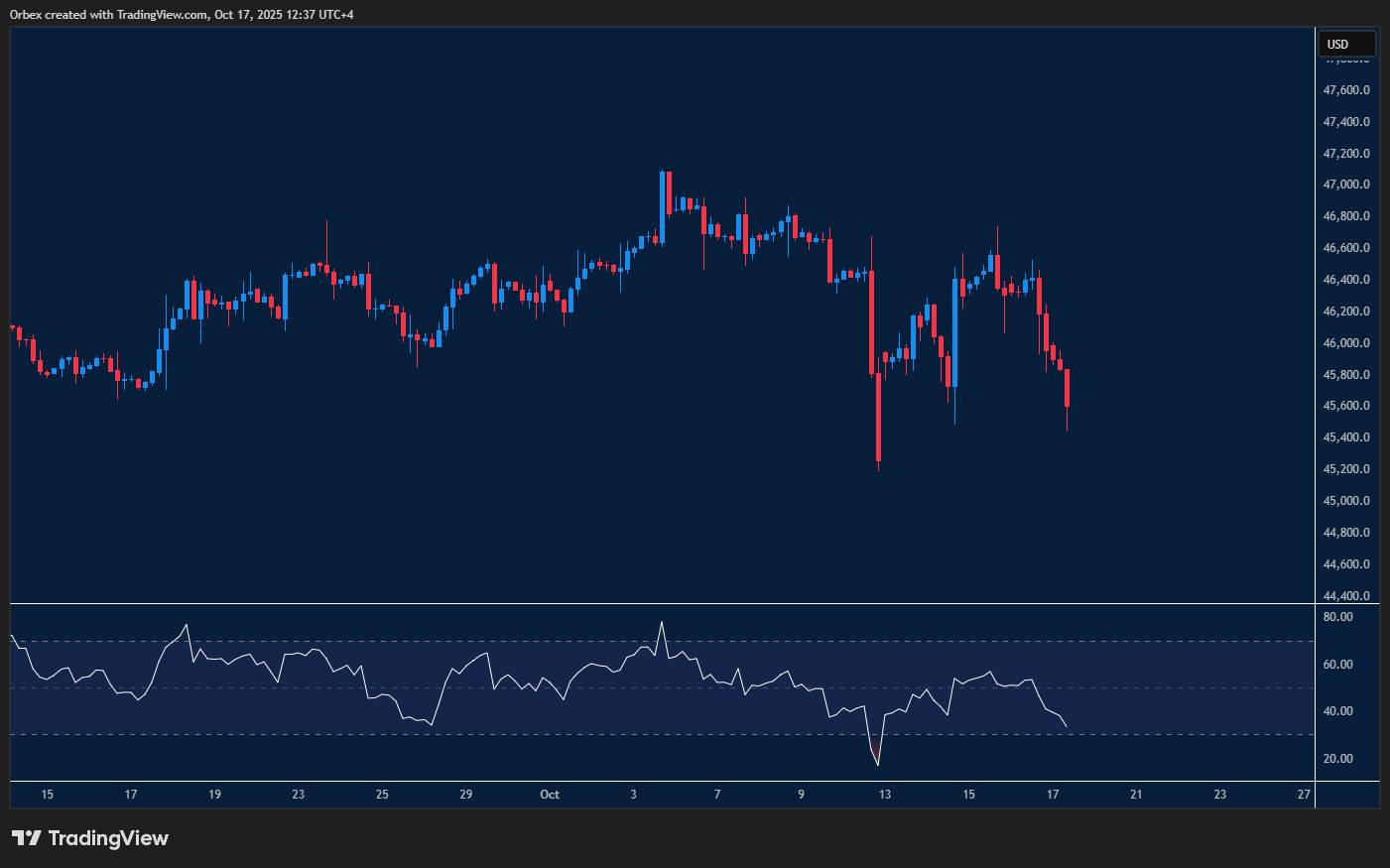

US 30 drops lower

The Dow index fell further from performing another record high after witnessing another sell-off. A drop below 46000 has shaken out some bullish hands, and the bears remain in the market. 45300 at the recent low is a critical support as its breach could lead to a spiral towards 44400. On the upside, 45800 is the closest target, and the daily resistance of 46600 is a critical top to move the index back on track.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 20.10.2025 appeared first on Orbex Forex Trading Blog.