GBPUSD looks for support

The pound, like many others of the dollar’s competitors, continues to fall behind. The pair is looking to find a bottom after the continuous downward progression since the beginning of October. However, with traders buying the dip, this has triggered a bounce at 1.3000, confirming this as a firm psychological level. A close above 1.3065 would extend the rebound above 1.3100, where a bullish breakout could open the door to a sustained recovery.

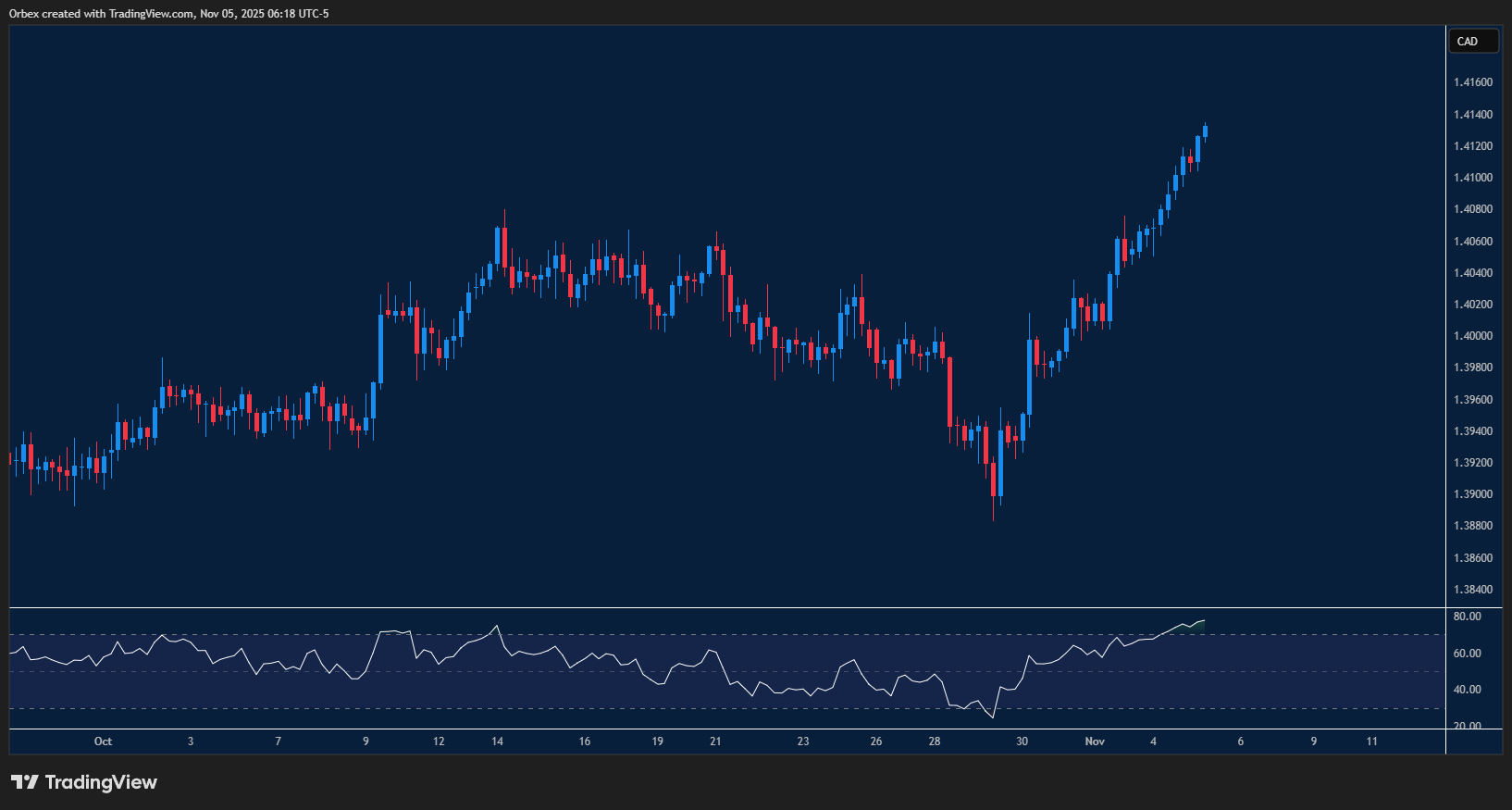

USDCAD hits multi-month high

The Canadian dollar continued to slide as price action moved towards another multi-month high at 1.4150. A clean break above 1.4000 forced sellers to cover, fuelling the bullish momentum and closing in on a potential bullish continuation in the days to come. 1.4100 is now a fresh support, and on the upside, 1.4150 is the intermediate hurdle to lift before the pair can test April’s peak above 1.4300.

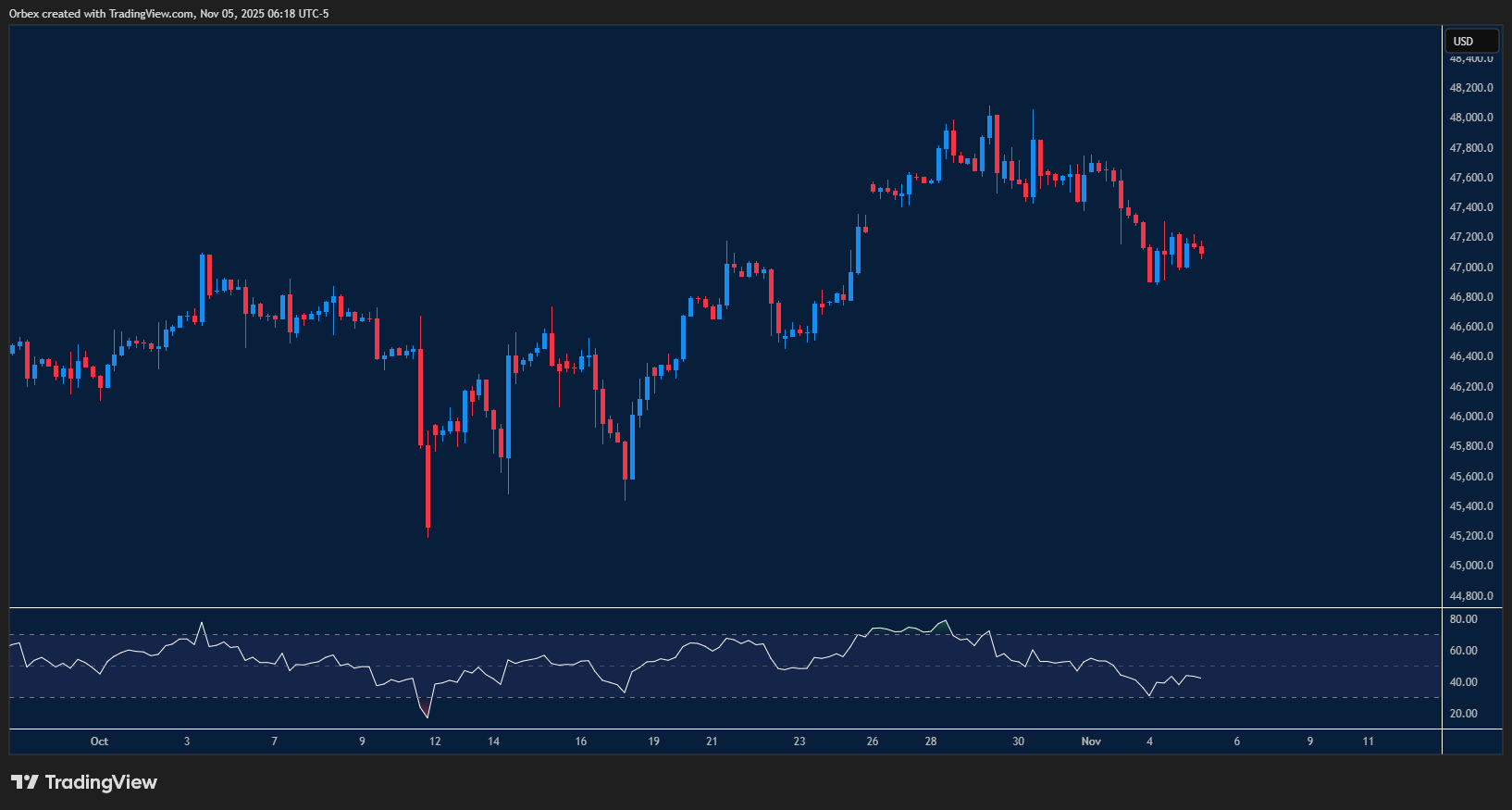

The Dow (US30) looking for momentum

The Dow (US30) remains subdued after failing to recapture its recent record high. As sentiment remains cautious, a bounce above 47500 could give bulls what they need to re-enter the market and push for a new peak. On the chart, 47,200 is a fresh resistance level, and only its breach would prompt more sellers to cover, easing the bearish pressure. On the downside, a fall below 46800 would trigger a new round of selling and send the index back to the previous consolidation level towards 46000.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 06.11.2025 appeared first on Orbex Forex Trading Blog.