NZDUSD finds more support

The Kiwi finally found some firm support after a month long sell off. The pair is attempting a full recovery, which is a strong indication that buyers are not yet out of the game. A close above the recent peak of 0.5700 could extend a potential rally towards 0.5780, as sellers would begin to exit. The psychological peak of 0.5800 is the first target to confirm a complete reversal. On the downside, 0.5640 is a critical support level in the event of a further sell-off.

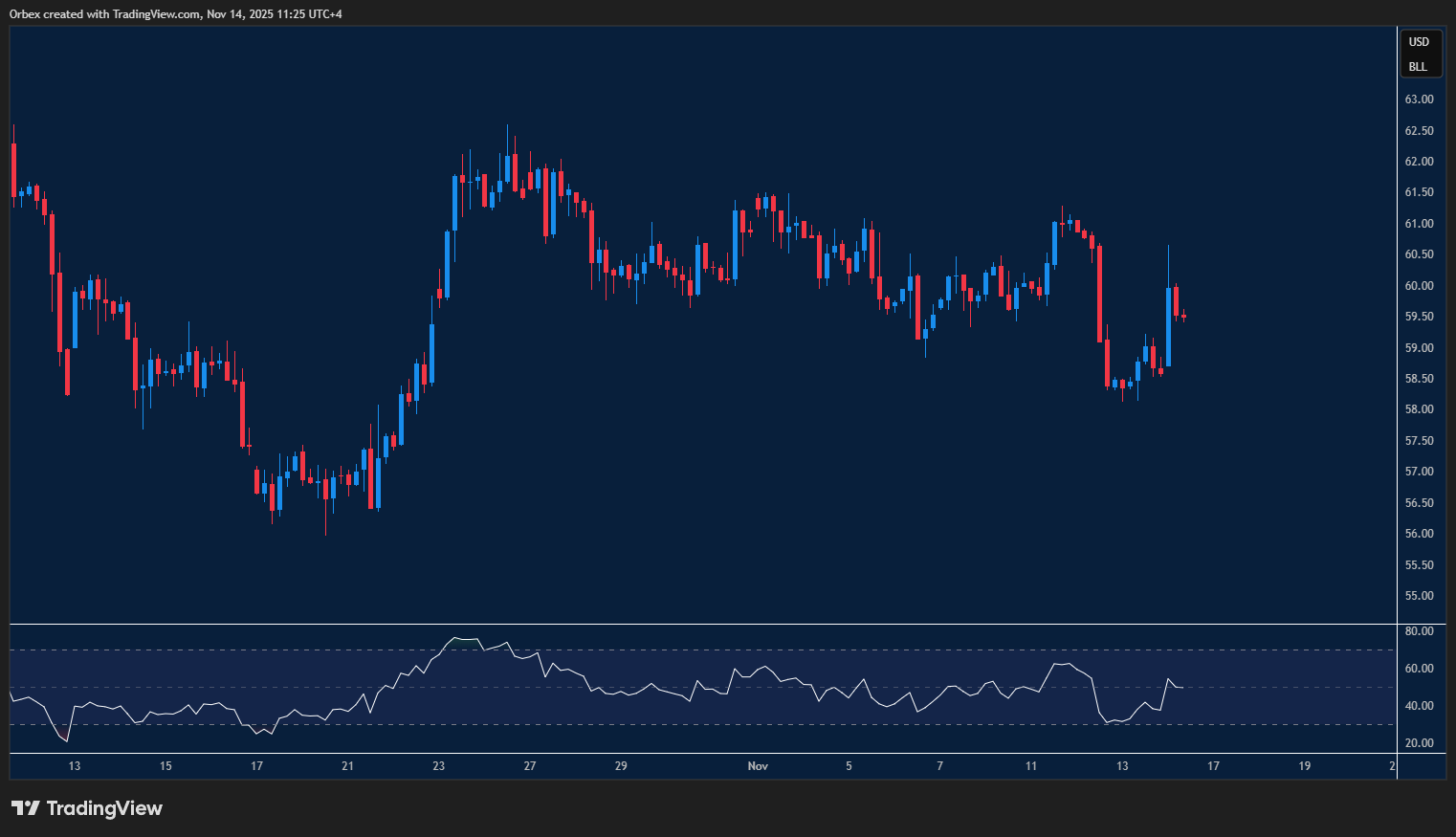

USOIL attempting a turnaround

Oil bounced back with a $2 lift in Friday’s trading session. The price is attempting to erase most of its losses from the recent sharp downturn, as this is crucial to maintaining the potential rally intact. The psychological level of 60.00 represents a firm resistance to breaking, which would turn the short-term mood around and keep buyers in the game. The base of recent support at 58.20 is a critical floor that prevents a reversal.

NAS 100 snaps lower

The Nasdaq index lost momentum as another sell-off in the AI world came into focus. On the chart, bulls have not capitulated just yet, however, they will need to hold onto 24500 in order to avoid a deep correction. The price is looking to secure a base around 24800, and a subsequent jump back above 25250 could put the index on a path of recovery.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 17.11.2025 appeared first on Orbex Forex Trading Blog.