NZDUSD tests critical floor

The New Zealand dollar hit a fresh low as prices gave up most of yesterday’s gains. The pair is struggling to hold as the RSI attempts to move away from oversold territory. The support-turned-resistance at 0.5640 is the hurdle for bulls to clear to regain control. Otherwise, a fall below the critical bottom at 0.5580 would signal a bearish continuation and trigger a new round of sell-off towards 0.5500.

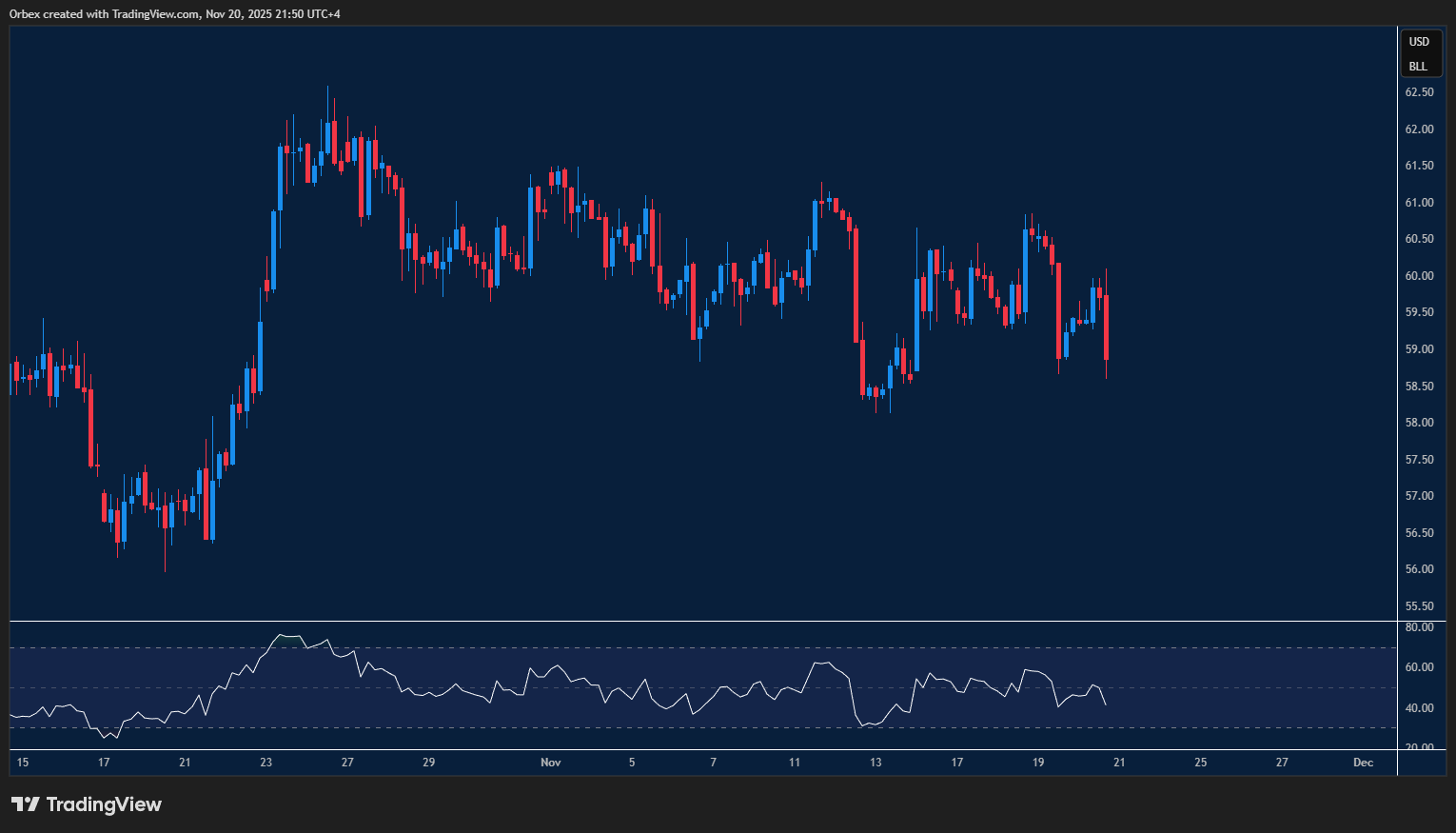

USOIL stuck in consolidation

WTI continues to move sideways after a lengthy consolidation, as prices look to test the bottom of the channel again. On the chart, the price is looking to secure a foothold above 58.50 at the base of the recent rally. A subsequent swing above 60.00 will prompt more sellers to cover their positions, as a lack of a lower low indicates that bulls remain in power. However, 61.20 will need to be broken to move past the consolidation zone; otherwise, 58.00 is the immediate support in case of a pullback.

The Dow (US30) drops again

The Dow (US30) gave up another 700 points as the euphoria of Nvidia’s latest earnings fizzled out. The index remains under pressure after falling away from its record high. Bulls now look to remain above 46000, as a break above this first resistance will take some of the selling pressure away. The next stage is 46300 to see if there are enough follow-through bids to continue higher. 45500 is the closest support if a pullback does happen, as the RSI remains indecisive.

The post Intraday Analysis 21.11.2025 appeared first on Orbex Forex Trading Blog.