XAGUSD bounces higher

Silver looked to shrug off the recent sell-off as it establishes itself around the 63.00 area. The retracement might be an opportunity for the bulls to take a breather before breaking higher. The tip of a previously faded bounce at 64.50 is a key hurdle to overcome to turn short-term sentiment around and progress to another record. 62.40 is the first lever, and 61.00 is an important support to keep buyers interested, as its breach would open a multi-week low.

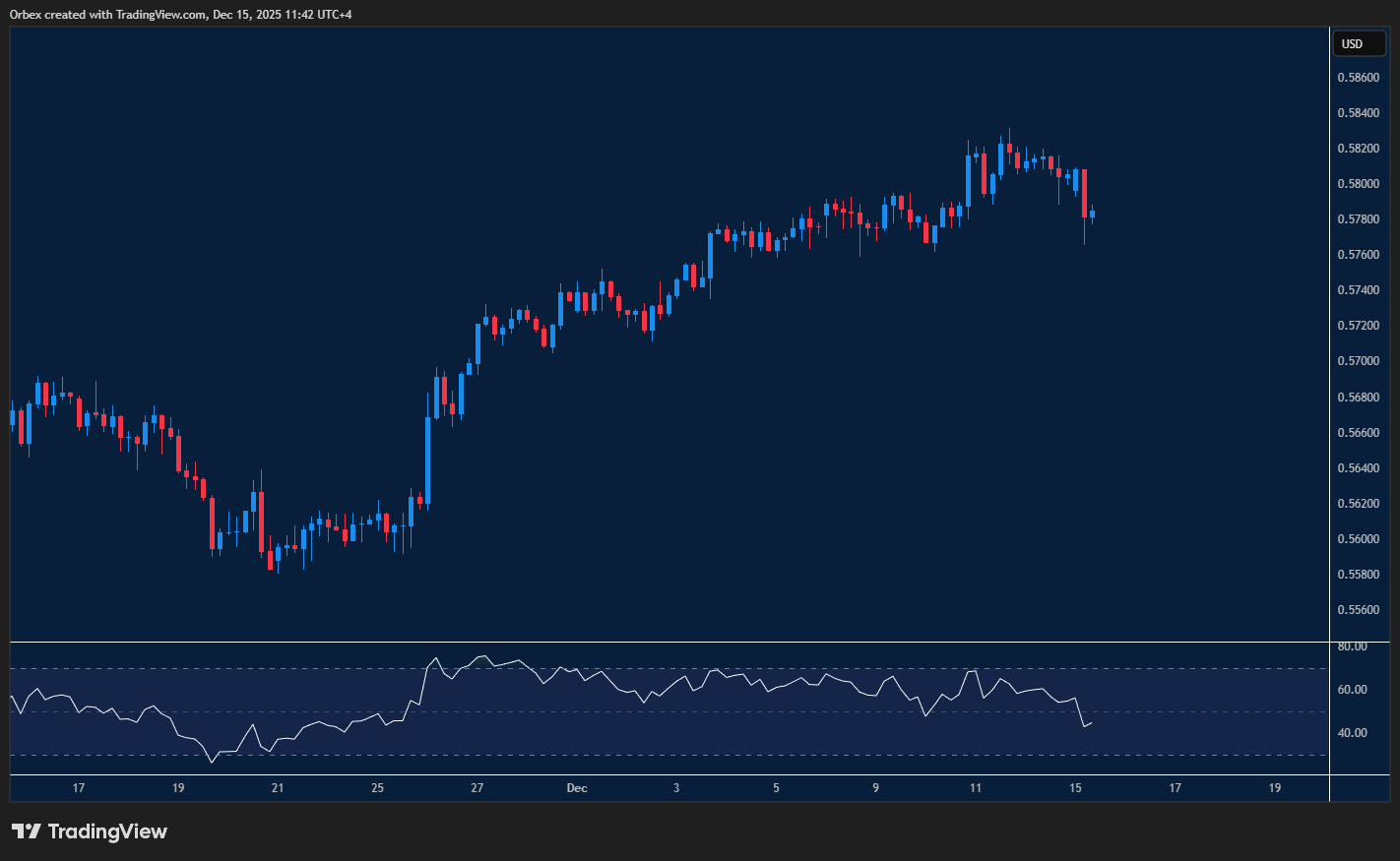

NZDUSD slides lower

The New Zealand dollar saw a price decline as prices moved away from the recent top. The choppy nature of the pair has led to a fall from the psychological level of 0.6000. However, a break above the recent peak at 0.5830 could trigger a recovery as 0.5800 is the first hurdle. Further down, the recent bottom of 0.5760 is a critical floor to prevent a fresh round of sell-off.

SPX 500 takes a breather

The S&P rode a solid week for tech stocks as the index neared another record. On the chart, the index is testing the latest high of 6900. A bearish RSI divergence led to a loss of momentum, which could be due to fresh selling and profit-taking in this congested area. 6800 then 6720 are the next two layers in case of a correction. However, a bullish breakout would force sellers to scramble for the exit, opening the door to an extended rally above 6960.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 16.12.2025 appeared first on Orbex Forex Trading Blog.