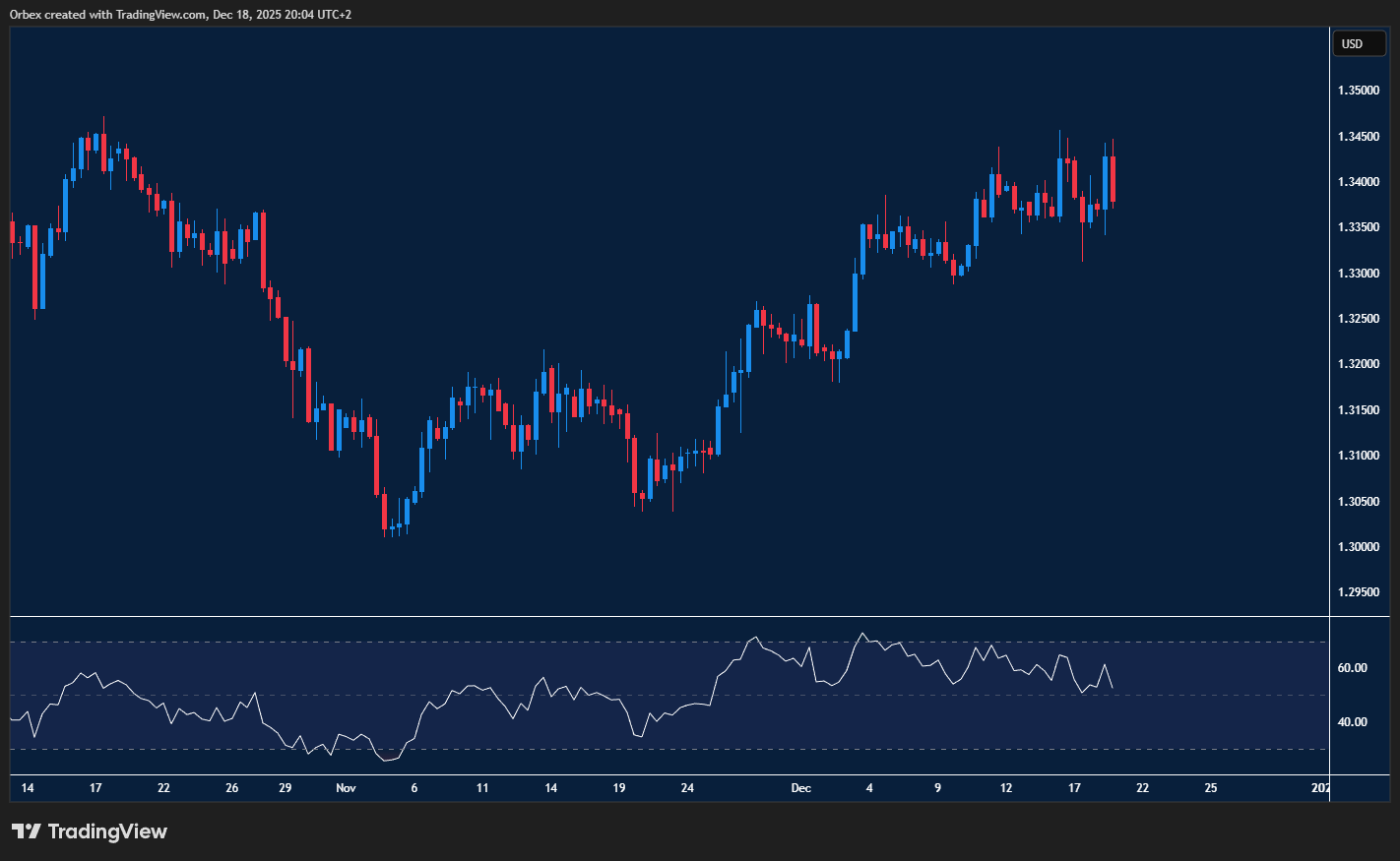

GBPUSD remains bullish

Cable remains bullish as last week’s inflation data caused a spike in price action. With inflation falling sharply in November, this fuelled the likelihood of a rate cut in the Bank of England’s final meeting of the year. Easing inflation and growing signs of economic uncertainty forced policymakers to act, leaving cable at the mercy of a dollar upturn as we close out the year. A break at the double top at 1.3450 would open the way for a continuation higher, with 1.3320 the closest support.

XAUUSD rallies as the Fed looks to cut

Gold continued its ascent as geopolitical tensions and a more hawkish Fed outlook increased its appeal. More anxiety over the Russia-Ukraine deal, which failed to gain traction, sparked a rally in the yellow metal. As the worry over inflation persists, gold is traditionally viewed as a hedge against inflation, as lower interest rates make it more attractive to investors. A fall in the US dollar could give further demand for gold and lift prices towards the next target at 4000, with 4240 being the closest support.

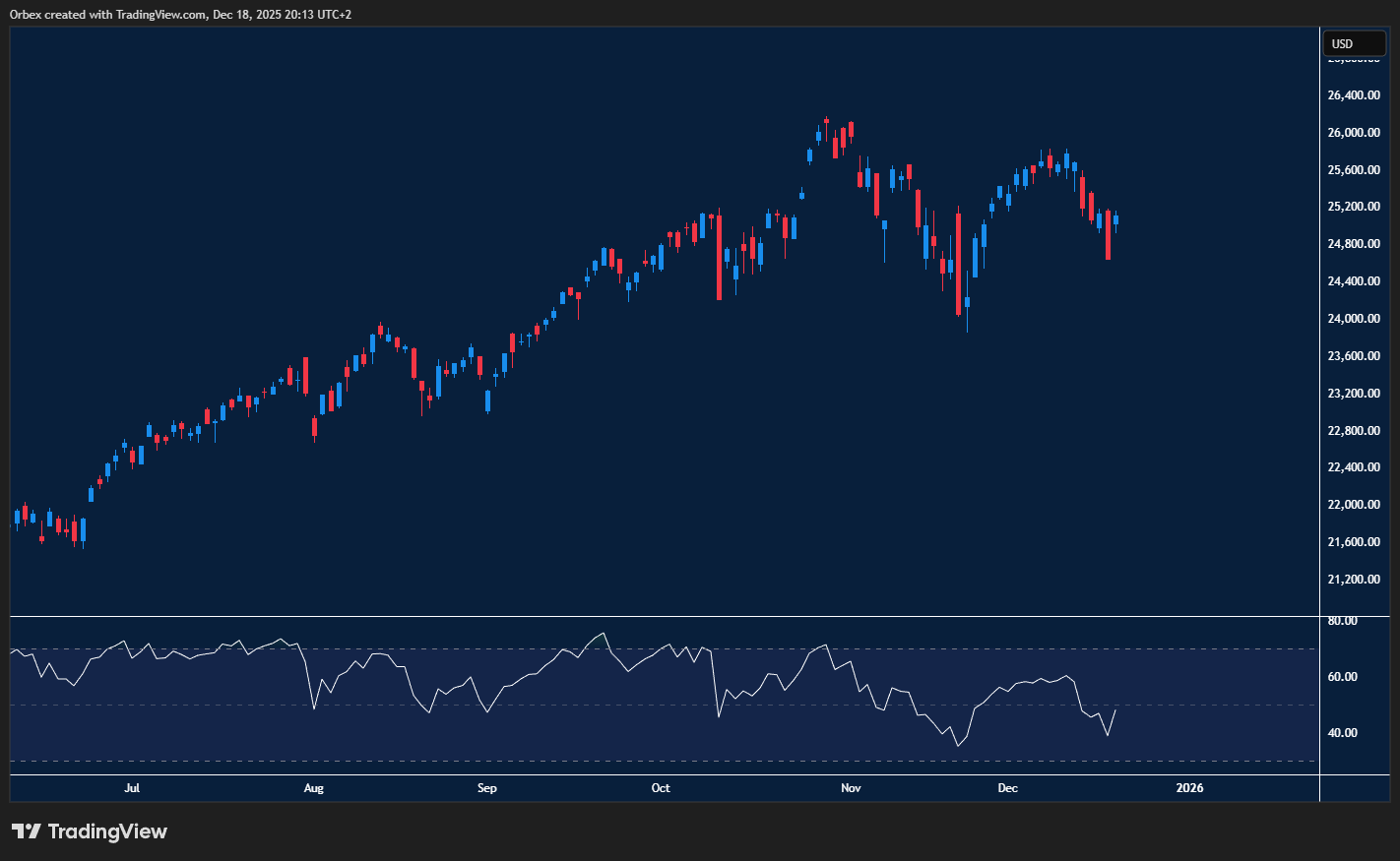

NAS 100 attempts to halt the sell-off

The Nasdaq100 halted its recent slide as traders kept a close eye on the next move for tech stocks. Economists appear to be waiting on the potential impact of the Trump administration’s policies on the economy, and the possibility that the Fed could increase its rate-cutting as we head into next year. Prices are drifting towards 24400 with 25350 the closest resistance.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Tech Bubble Begins to Burst appeared first on Orbex Forex Trading Blog.