USDCAD probes support

The pair continues to languish as prices hit another fresh low. On the chart, the greenback is poised to lift above the 1.3700 target to switch the directional bias, after continuous support breaks since the beginning of the month. With 1.3700 being the immediate hurdle, its breach would expose a fresh high above 1.3760, which would be a step closer to a bullish continuation. On the downside, 1.3670 is the nearest support level.

XAUUSD slides lower

Bullion hit a massive correction as traders took profits and rebalanced their portfolios ahead of the new year. Resistance was expected at the recent peak of 4530 as the price fell to test the 4300 support. A further breakout would force the remaining buyers to cover, laying the foundation for a fall towards the 4275. In the meantime, a limited consolidation could send gold to retest 4380 should sellers take some chips off the table.

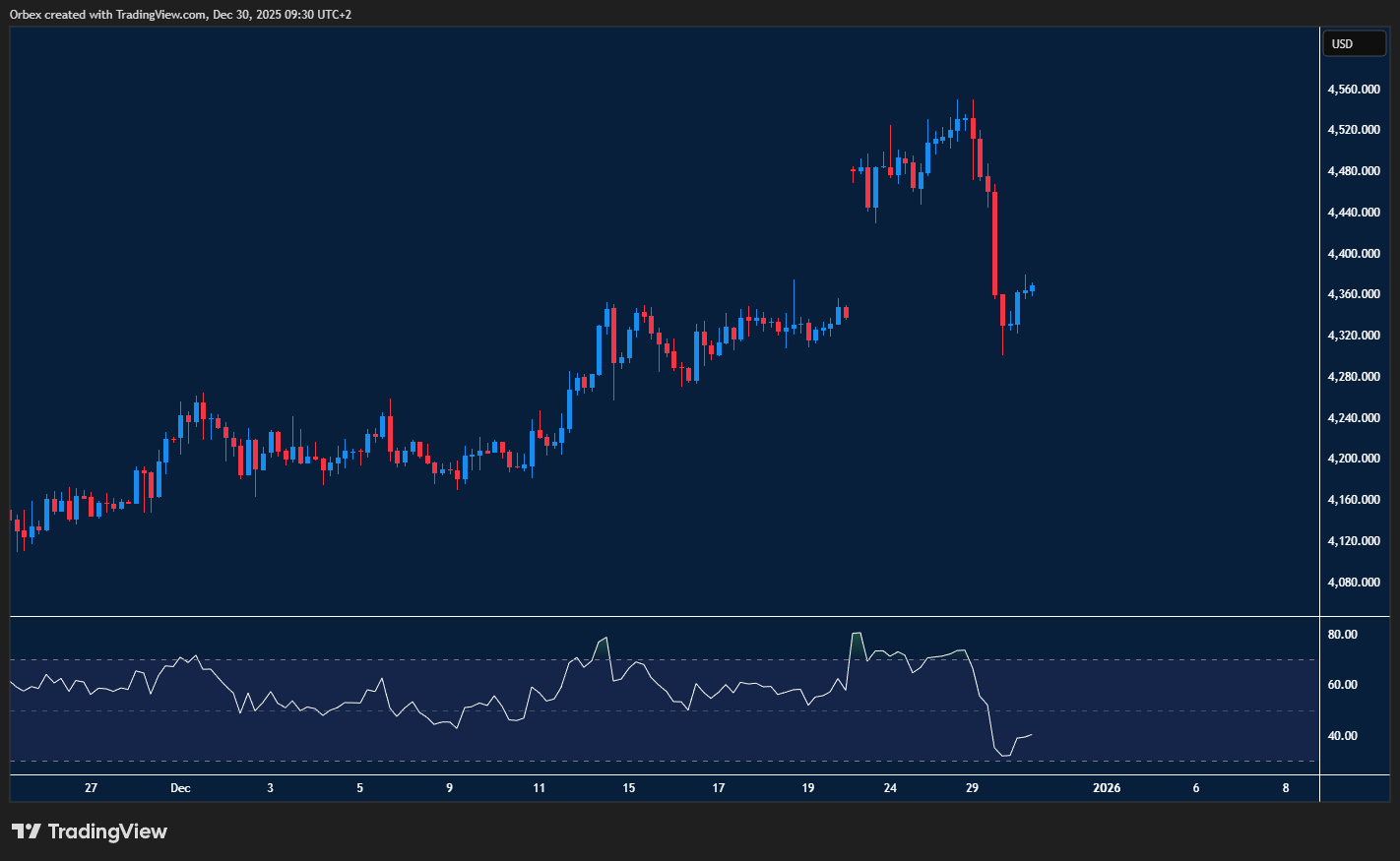

SPX 500 takes a breather

The S&P steadies itself after dropping off from its new record high. There is a sign that bullish energy remains strong among market participants, as a final stock rally of the year could be on the horizon. A breakout would open the door to the all-time high above 6960, potentially putting the index on a continuation course. Before that, a pullback could be due to give the rally some breathing room, with 6800 being the first level to prevent a deep pullback.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 31.12.2025 appeared first on Orbex Forex Trading Blog.