NZDUSD propels higher

The US dollar looked to stop the rot after the Kiwi bounced back. As the price grinds the previous peak of 0.5780, an overbought RSI has put pressure on the short-term enthusiasm. A fall below 0.5750 will force some weak hands out, put the Kiwi on a consolidation pattern, and potentially wipe out recent gains. On the upside, 0.5800 is the immediate obstacle to recovering losses over the past few weeks.

EURGBP struggles for buyers

The euro seems stuck in a choppy consolidation as buyers fail to enter the market. On the chart, successive failures to break above the double top at 0.8690 have put buyers on the defensive. If bargain hunters enter the market, the former support level of 0.8650 would be the last line of defence for bears. As the RSI lingers in the neutral zone, traders will be anxiously waiting for the next signal to buy or sell.

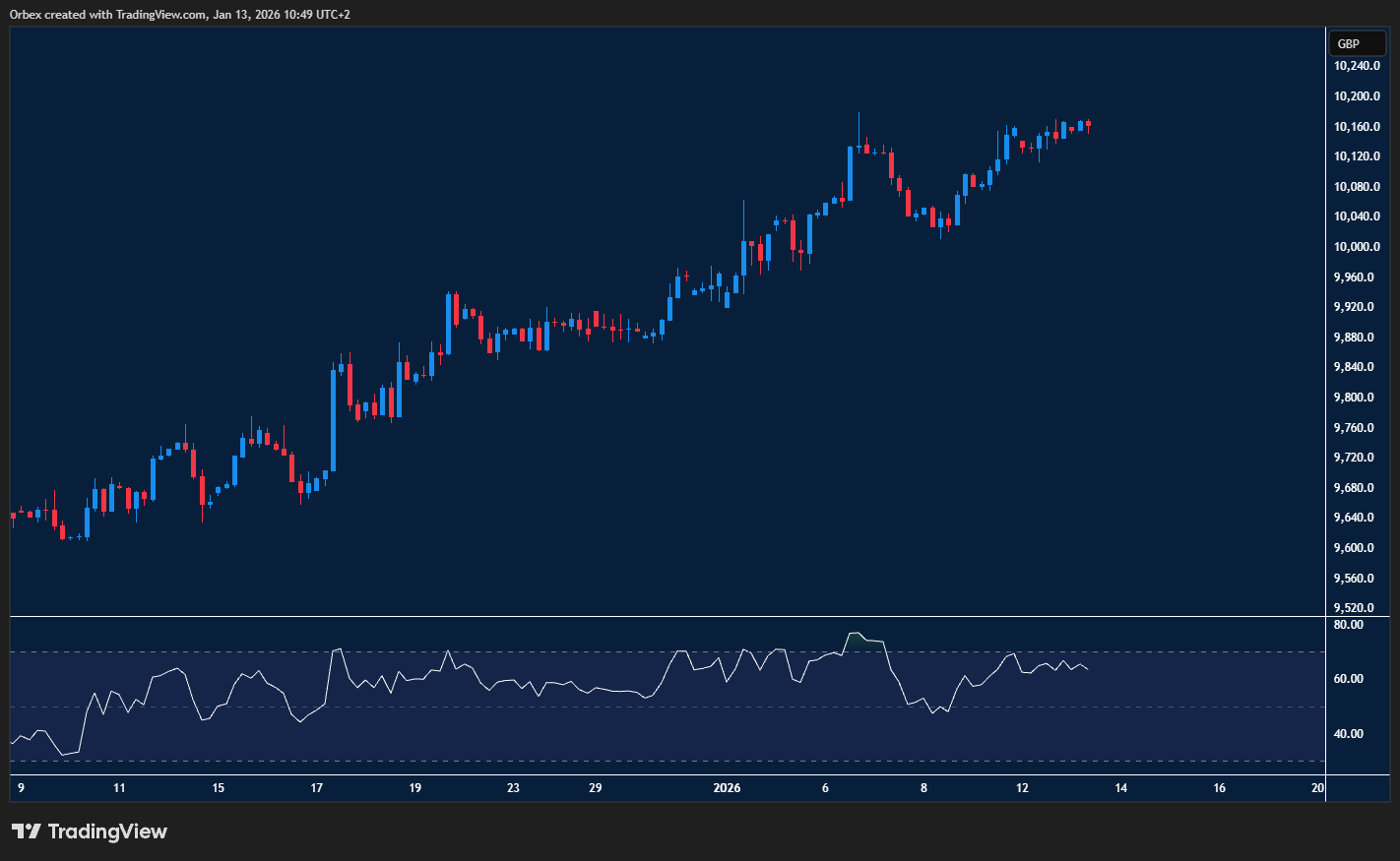

FTSE 100 targeting another record

The FTSE 100 index hits a slight consolidation as investors hold their breath ahead of another rally. The index so far has held onto its gains after a tentative break above 10100. A series of swing highs, with the latest at 10170, indicates mounting buying pressure. Any chance of a slowdown would see the 10000 level being tested, as a break here would send the index towards 9750.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 14.01.2026 appeared first on Orbex Forex Trading Blog.