USDCHF hits higher high

The US dollar hit another peak, with price action poised to test the recent high. The pair continues to drive higher, with a series of swing highs suggesting persistent buying pressure. A decisive break past 0.8000 would be the current support level to see whether sellers would start to make a comeback. On the upside, 0.8040 is the first resistance, and a failure to break higher in a meaningful way could send the greenback to the critical floor at the previous bounce at 0.7960.

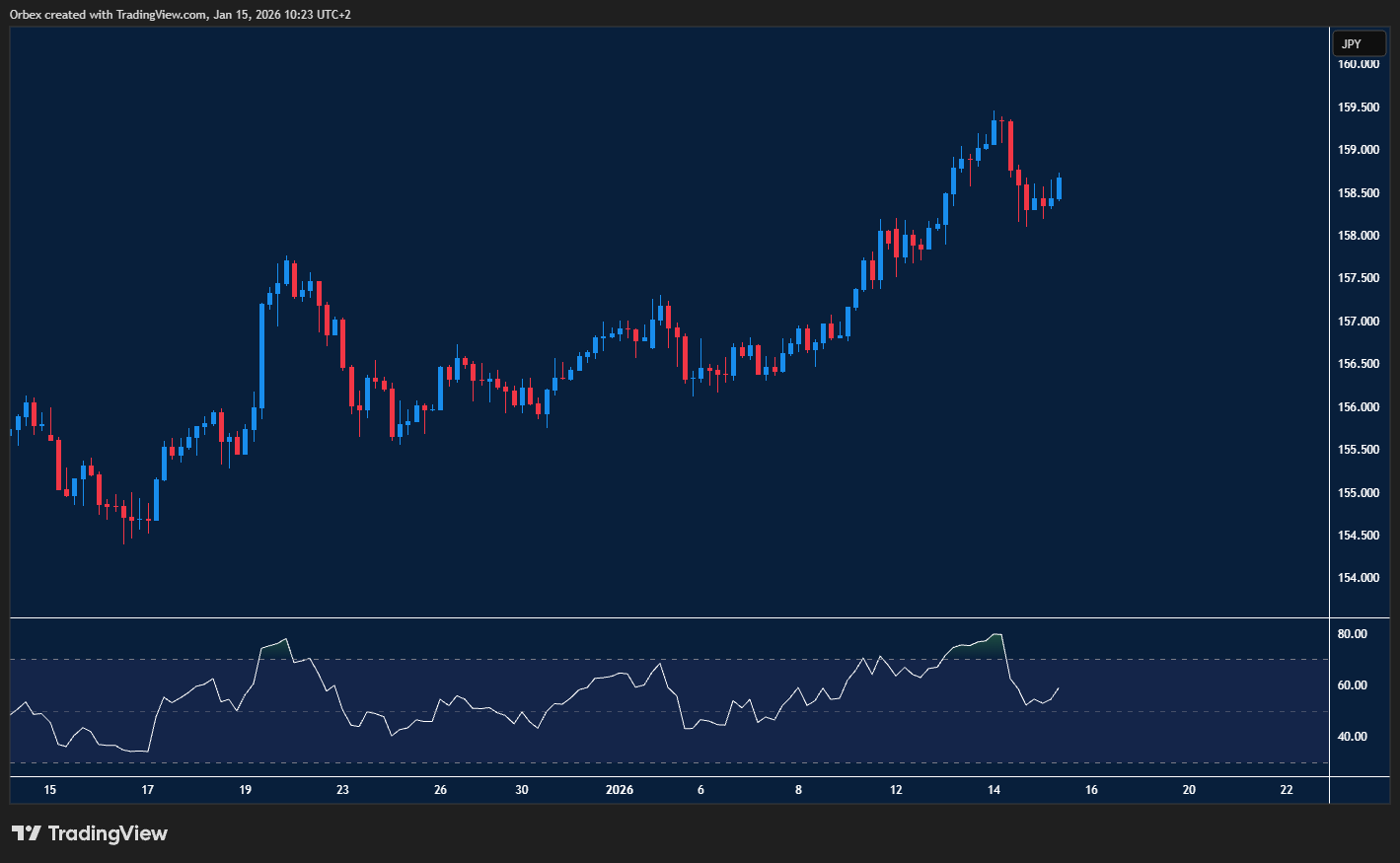

USDJPY remains bullish

The Yen saw a slight pullback amid attempts to derail the progressive dollar. The round number of 159.00 saw some selling interests after the RSI sank back towards the neutral area. Bulls will have the challenging task of clearing 159.50 before they can hope for a robust continuation. On the downside, the demand zone between 158.20 and 157.00 is important in preventing a deep correction.

SPX 500 attempts a swift rebound

The S&P holds on to another dip as stocks look to begin the year on a positive note. As the index reached its previous swing low at 6880, profit-taking and fresh selling could put the price under pressure. Sellers will look for a break below 6800 to trigger a liquidation of short-term positions, confirming the divergence play. A bullish breakout, though, would open the door to testing 7000 as the market begins to warm up.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 16.01.2026 appeared first on Orbex Forex Trading Blog.