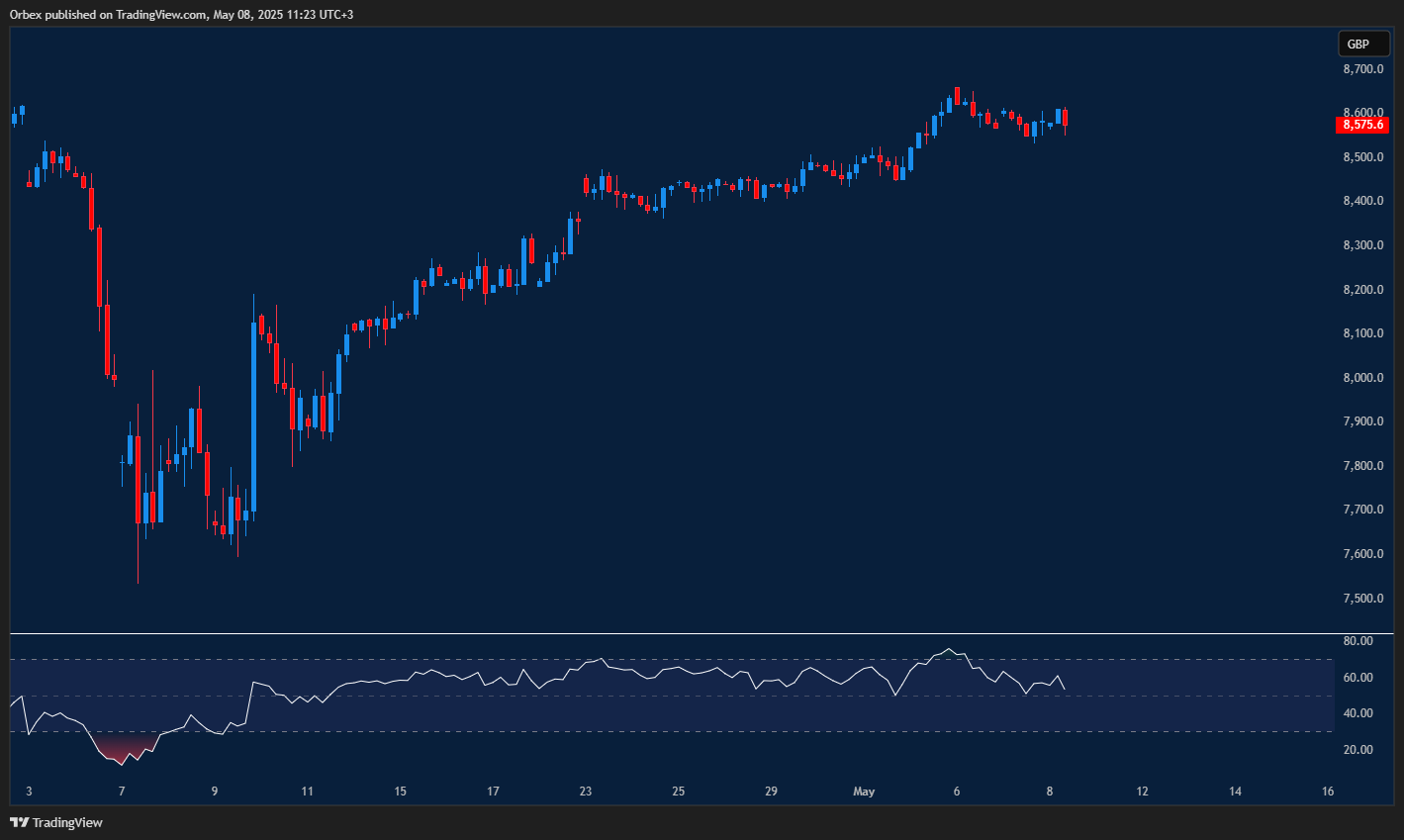

UK100(FTSE) hits resistance

The UK100(FTSE) maintained its bullish stance as prices remained above the 8500 level. The recent rally has put the index back right under this month’s high after bouncing towards 8600. A continuation could signal a move to a fresh peak above 8660. However, bulls would need to catch their breath and consolidate their gains. 8500 is the first level to assess follow-up interest with a deeper correction testing 8000.

EURUSD sliding lower

The Euro took another hit against its main competitor after sentiment shifted with the dollar. Prices remain resilient after finding support at the 1.1300 area. A drop below this level would open the door to weekly lows towards 1.1050 and could push short-term buyers to the sidelines. With the RSI moving into neutral territory, 1.1370 at the top of the previous bearish downturn is likely to be tested, and the recent high of 1.1400 is the key hurdle to break before bulls can regain control.

AUDUSD remains elevated

The pair continues to drive higher despite a recent downward spiral from the recent Fed interest rate decision. Bulls will need to clear the top at 0.6500 before an ongoing extension can take shape. Otherwise, a drop below 0.6400 will show little commitment to the buy side and could potentially lead to a broader liquidation below 0.6330. 0.6460 is a fresh resistance as the RSI attempts to recover into the neutral zone.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 09.05.2025 appeared first on Orbex Forex Trading Blog.