Brent oil (UKOIL) remains optimistic

With Brent oil (UKOIL) gearing up for another move higher, prices have seen over $3 added to the value over the past week. Bulls are striving to keep the latest bounce valid at 65.00 after the price seems to have secured a foothold. On the flip side, a close below 64.50 suggests that a bear rally will open up, with 62.50 at the recent bottom in sight. Further fresh selling could be expected as the market mood remains cautious as we enter the summer months.

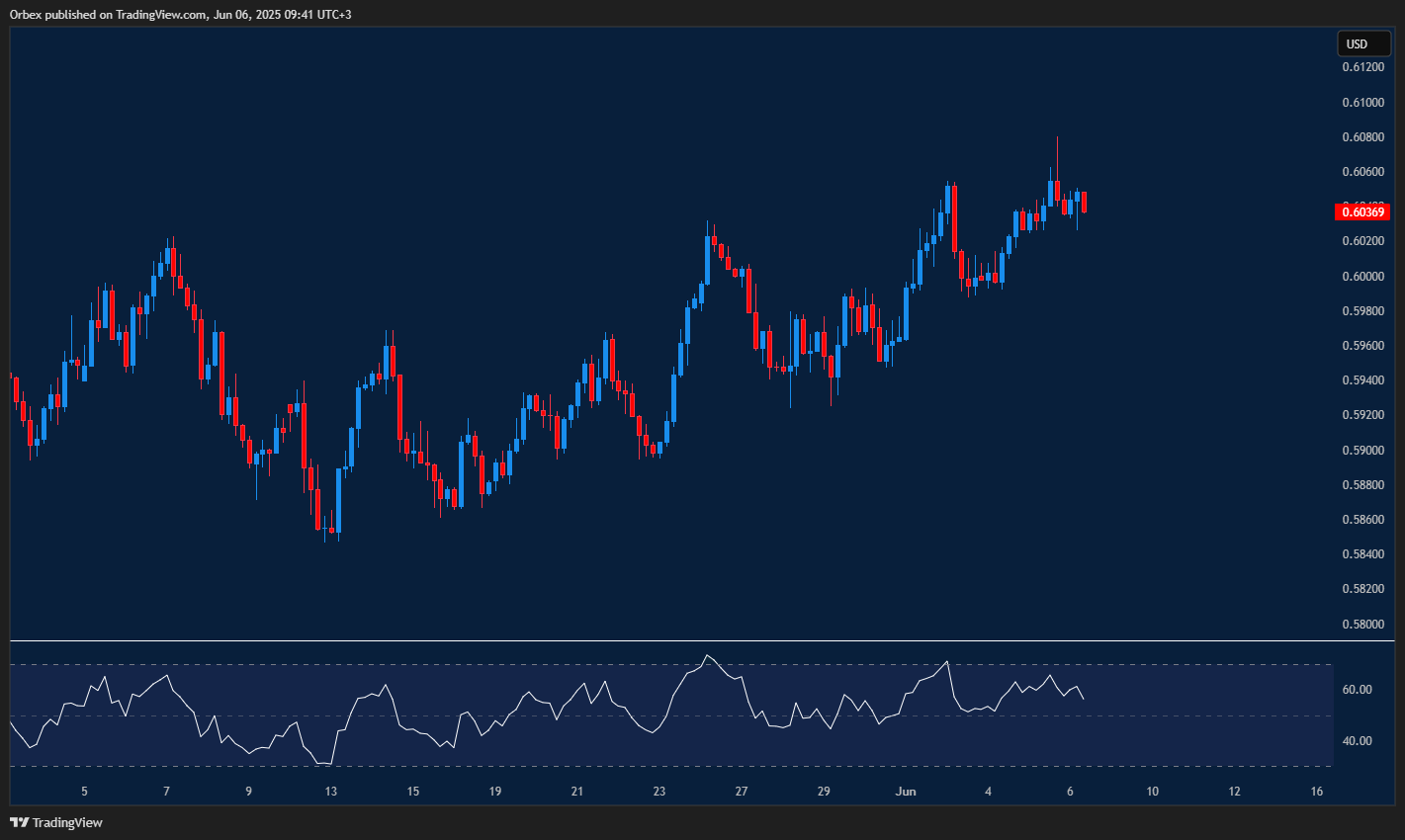

NZDUSD hitting critical resistance

The New Zealand dollar continued the bull trend after breaking above the psychological level of 0.6000. However, the recent false spike, which has seen a heavy rejection at 0.6080, coupled with a bearish divergence on the RSI, could see buyers trim their positions. Stiff selling pressure can be expected if the recent false spike loses some traction, with 0.6020 the closest support.

GBPUSD maintains bull rally

The pound moves into fresh territory as price action hits a new high. A move above the first daily resistance of 1.3500 has increasingly put the sell side on the defensive. After moving over 200 pips so far this month, bulls are increasingly optimistic that another multi-year high is in sight. On the downside, 1.3460 is the first obstacle for bears to bypass to stabilise prices before a sell-off can materialise.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 09.06.2025 appeared first on Orbex Forex Trading Blog.