The Nasdaq INDX (NAS100) remains bullish

The Nasdaq INDX (NAS100) hit some exhaustion as prices failed to break the 22000 level. The index is now consolidating, but, more importantly, it is remaining above 21500 after a slight pullback. As a show of force, the recent move has barely dented the upward momentum. Instead, trend followers saw it as an opportunity to buy in. A close above the recent peak of 21800 would carry the index to 22250 with a potential extension. Further below, 21000 is an important floor to maintain the bullish stance.

NZDUSD continues choppy downturn

The Kiwi failed to regain the previous losses from last Friday. After breaking below the daily support at 0.6050, the pair has been struggling to find buyers. The directional bias remains down as a series of lower lows would continue to attract trend followers. The slightly oversold situation on the RSI could alleviate some pressure, but prices will need a break above 0.6060 to attract bulls, as 0.6000 is firm support at the recent bounce.

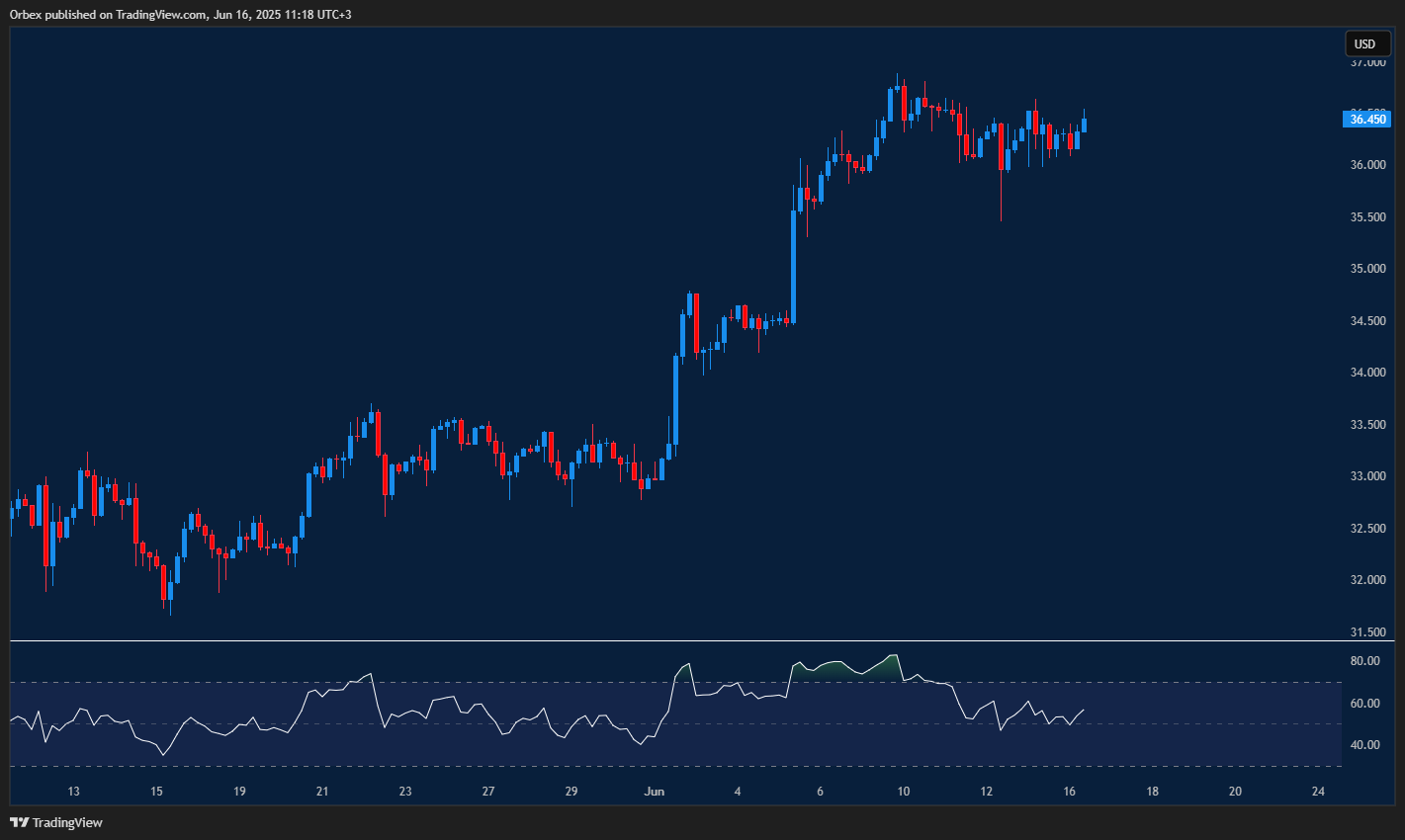

XAGUSD hits resistance

Silver remains stuck in consolidation as prices continue to look for direction. Since the upsurge a few sessions ago, bears have halted any major advance above 37.00, which is where firm resistance was set. For now, the rebound is likely to be driven by short covering. A close above 36.50 would attract stronger buying interest and send the metal to another fresh high. 35.80 is the first support as the RSI drops back to the neutral zone.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis17.06.2025 appeared first on Orbex Forex Trading Blog.