by Rami Abu-Draa | Oct 20, 2025 | Tecchnical Analysis

Gold managed to hit fast drop correction last week, as Intraday prices show the main resistance at 3280. As we see over the chart and if the market holds below 3280, a chance for another drop swing could hit the market with intraday supports at 3225, 3186 and 3160....

by Rami Abu-Draa | Oct 20, 2025 | Tecchnical Analysis

Last Friday, USDJPY print below the support at 149.75, which could lead a further drop. As we see over the Intraday chart, the market is facing resistance at 151.40-70, where as long as prices hold below it, the downward pressure could sustain towards the 147.00-45...

by Rami Abu-Draa | Oct 20, 2025 | Tecchnical Analysis

GBPUSD managed to print above the resistance of 1.33420-60 last Friday, which placed mix signals over the upcoming projection. As we see over the Intraday chart, the market looks towards a trading zone between support 1.3320 and resistance 1.3535-65. Below 1.3320,...

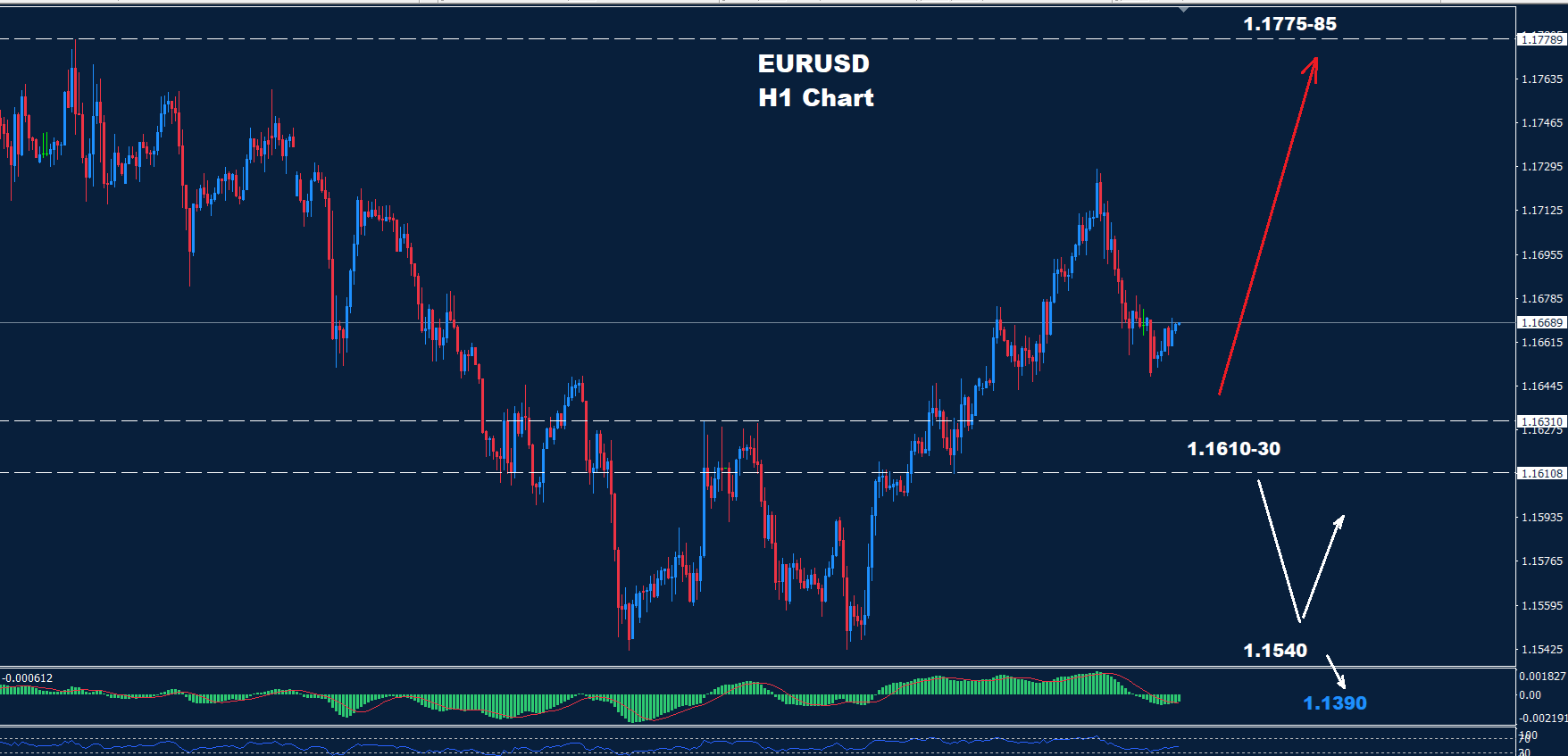

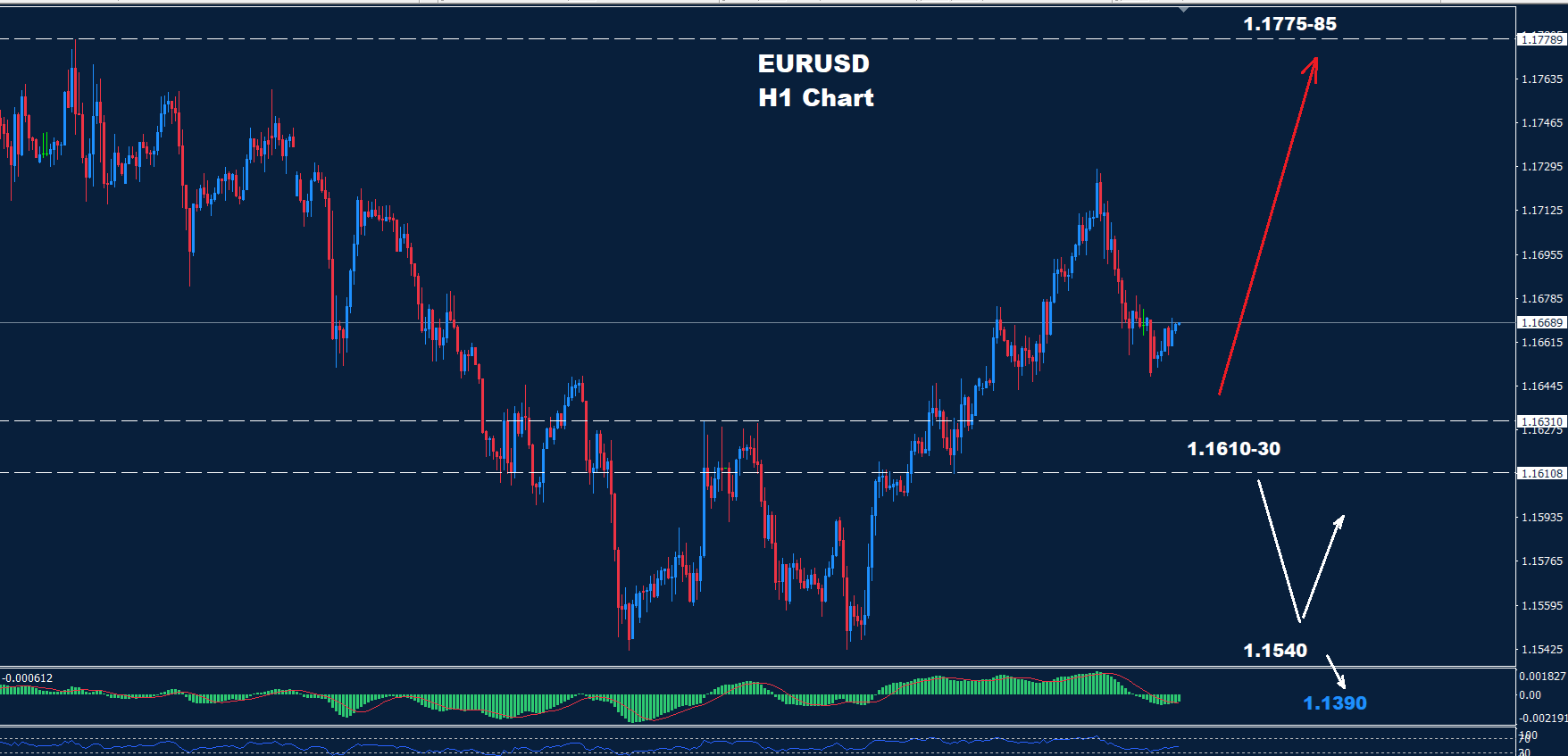

by Rami Abu-Draa | Oct 20, 2025 | Tecchnical Analysis

The Euro met the target and resistance zone of 1.1700-20 last Friday. As we see over the Intraday chart, prices still face a support zone at 1.1610-30. If prices remain above this zone, another advance toward 1.1775-85 will be expected. Below 1.1610 more of a drop...

by David Kindley | Oct 17, 2025 | Tecchnical Analysis

(UKOIL) Brent looks for reprieve (UKOIL) Brent remains pressured at a 5-month low as prices finally find some support. However, this might not be the last downturn we witness, as the global oil market could face a massive surplus next year, with supply expected to...

by David Kindley | Oct 17, 2025 | Tecchnical Analysis

( UK 100 )FTSE remains choppy The ( UK 100 )FTSE continues to grind sideways as the recent direction has left traders feeling uneasy. Following a tentative test to break 9400 on the downside, the index appears to have encountered resistance around 9520, with a...