(S&P 500)SPX keeps the momentum

The (S&P 500)SPX advances as the index notches another record. The rally accelerated after breaking above the previous gap at 6400, and a rising trend line with a steep angle indicates robust bullish pressure. The index is on its way to 6560, but the RSI’s move towards the upside could temporarily limit the upward movement if intraday buyers start to take profit. 6440 is the closest support in case this happens.

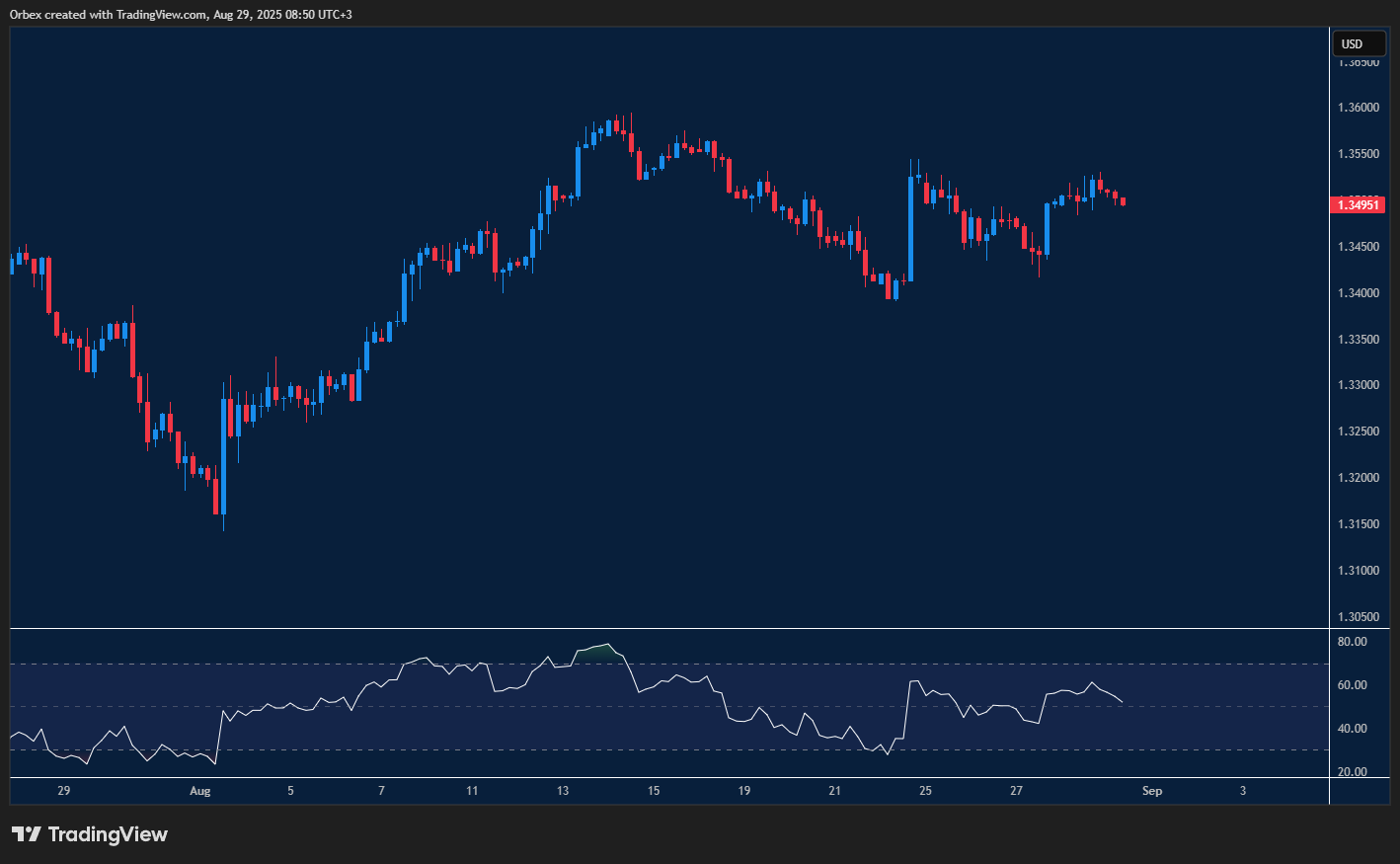

GBPUSD finds support

The pound attempts to bounce back after its choppy ride in the past few weeks and has finally found some stability. A clean cut above the first resistance at 1.3450 suggests that short-term sellers have trimmed their exposures. Medium-term sentiment remains upbeat, though, and the bulls could view the current pullback as an opportunity. As a bullish divergence emerges on the RSI, 1.3550 and then the peak above 1.3600 are the next targets.

USOIL shifts higher

Oil maintains its bullish stance as prices slowly creep away from the 62.00 zone. On the chart, a move above the major supply zone of 64.00 is a strong recovery signal by shifting the market mood. 63.20 is a fresh support, and 65.10 at the recent peak will offer bulls some breathing room, and a break back above this level would extend the rally towards the psychological level of 70.00.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 01.09.2025 appeared first on Orbex Forex Trading Blog.