( USOIL ) WTI testing triple bottom

( USOIL ) WTI prices plummeted further, with prices seeking the latest support. A subsequent drop below 66.00 invalidated the late September recovery, forcing early buyers to abandon ship. A new round of sell-off and a break at the triple bottom at 61.80 would send the commodity towards 61.00. The RSI’s oversold situation could offer some relief if short-term sellers take some chips off the table. However, bulls should be wary as 63.50 is the closest resistance overhead.

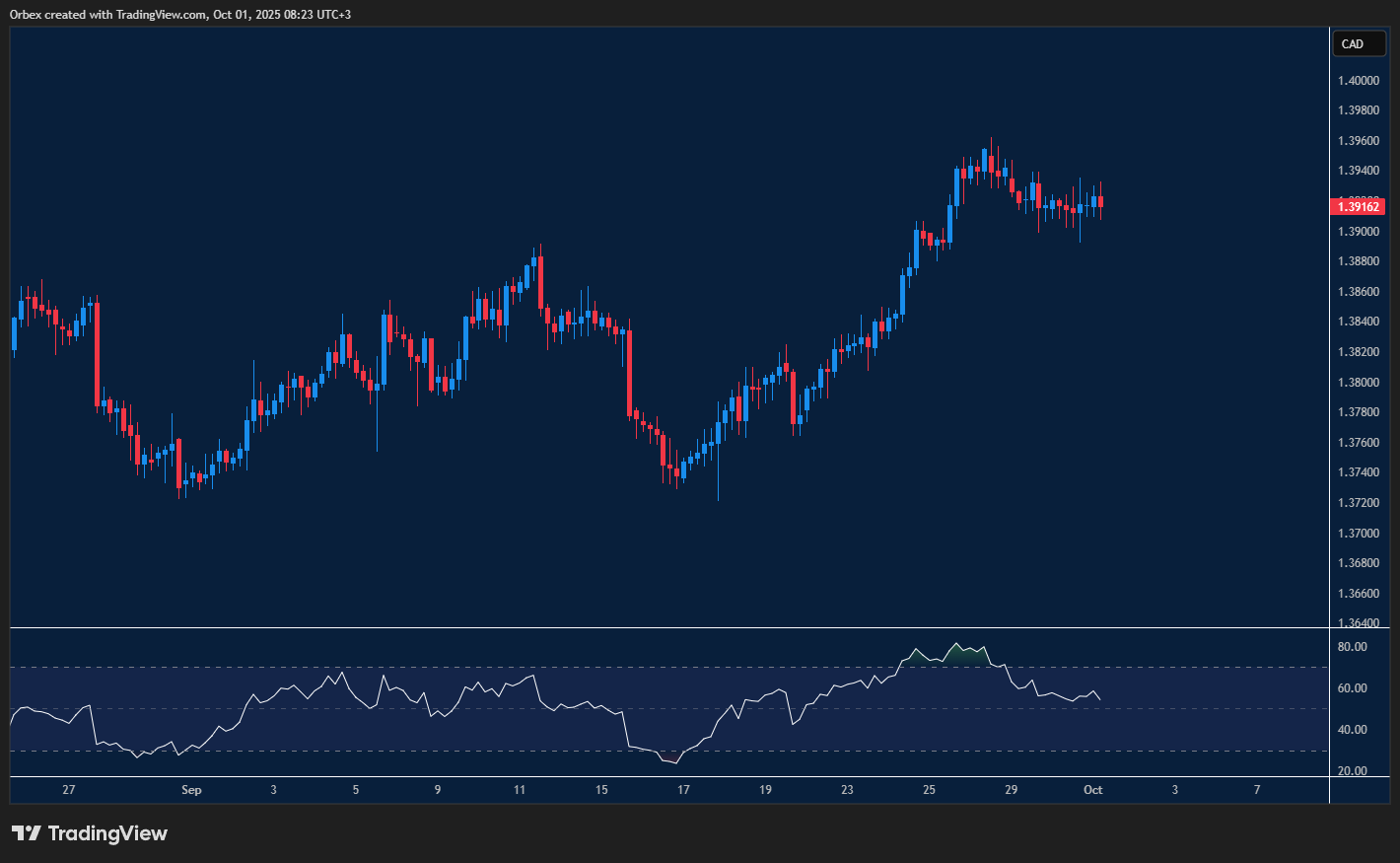

USDCAD grinding higher

The Canadian dollar lost further ground to the greenback as prices moved above the 1.3900 level. The price continues to grind its way higher, as a series of higher lows indicates mounting buying pressure and provides opportunities for trend followers to stake a position. As the pair consolidates, a close above 1.3950 could extend the rally above 1.4000, paving the way for a potential bullish continuation. On the downside, 1.3880 is the closest support to maintain the intraday momentum.

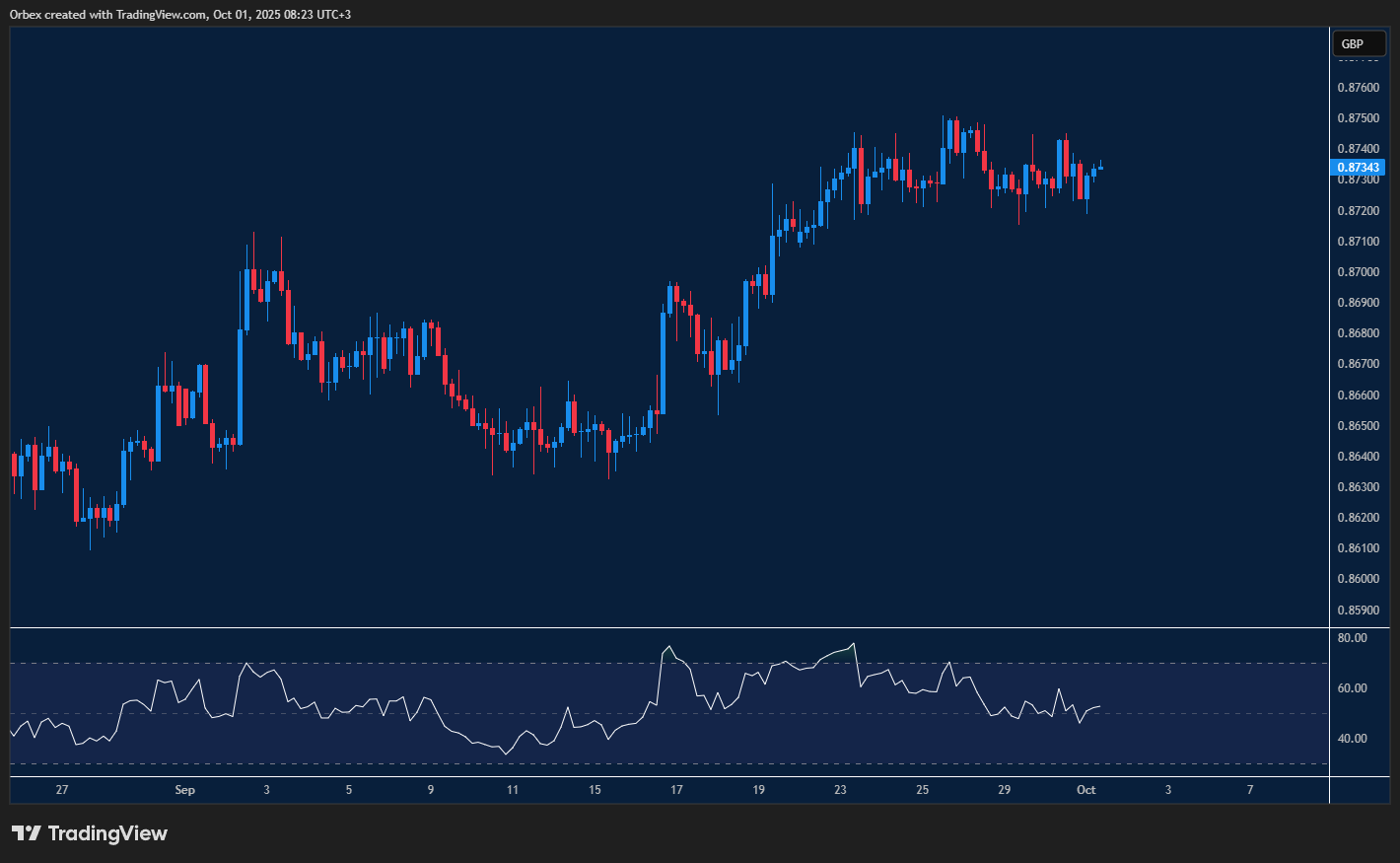

EURGBP waiting for direction

The Euro continues to remain at a steady bullish pace after lifting away from the previous psychological support of 0.8700. A brief test above 0.8750 has put the bears on the defensive, which could drive price action towards 0.8800, prompting sellers to trim their bets and ease the downward pressure. As prices await the next signal, 0.8750 is a major level to clear before a sustained continuation can take hold. 0.8660 at the base of the bullish momentum is a fresh support.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 02.10.2025 appeared first on Orbex Forex Trading Blog.