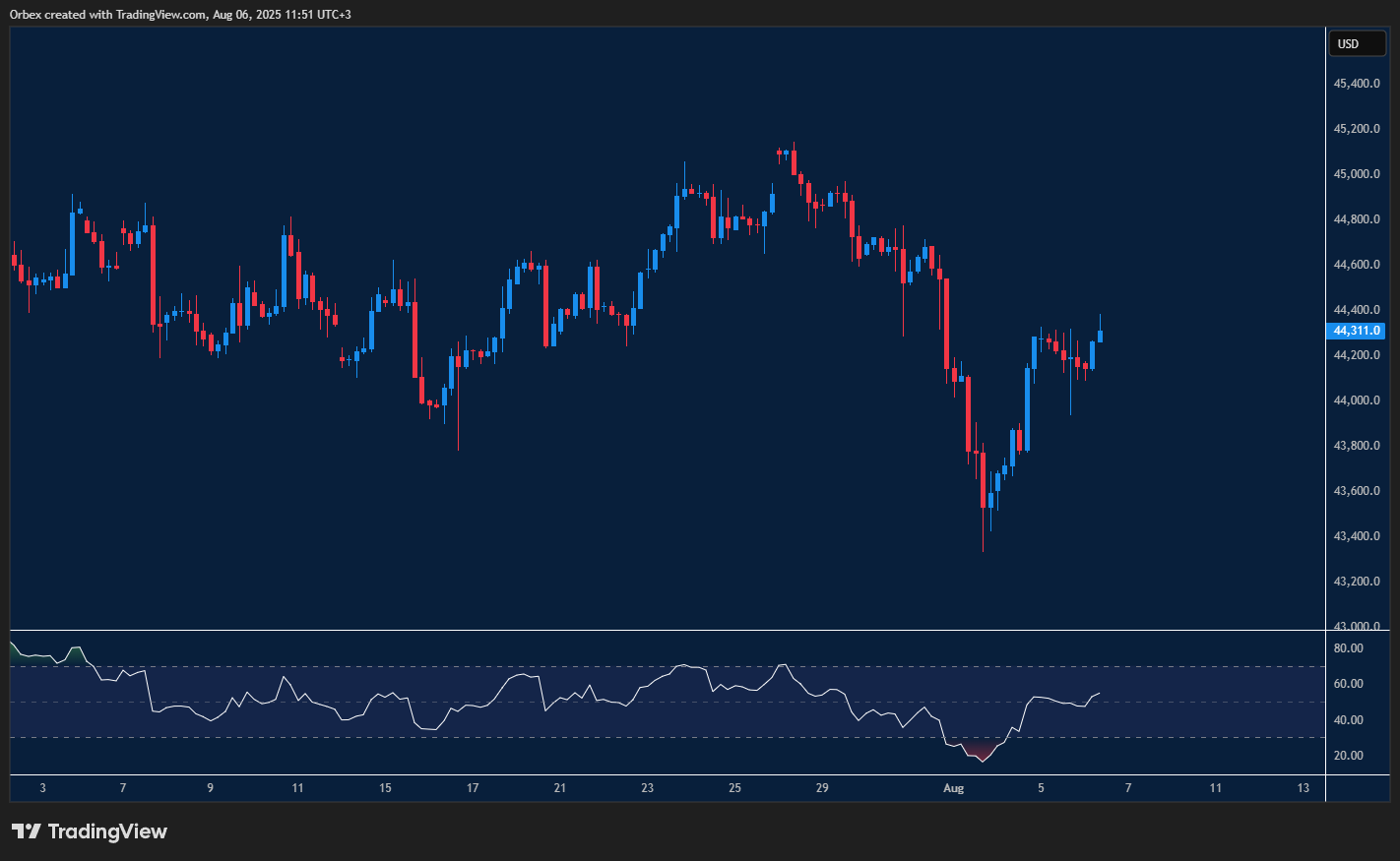

(US30) Dow pushing higher

The (US30) Dow jumps as earnings continue to outperform, as Donald Trump prepares his next tariff agenda. The index is still striving after lifting the key resistance of 44000. A fall below that level will put the short-term bulls on the defensive, leading to more profit-taking as they step to the side. 44600 is the next level to see whether buyers will continue pushing on the daily chart to potentially reach another fresh high.

USDCHF fighting back

The US dollar hit another high point as prices test the 0.8100 level. However, the bull’s attempt at a complete rebound came to a halt at that level after last Friday’s sell-off. A failure to break higher indicates that sellers have moved in to extend the recent bearish channel. A further breakout would force buyers to bail out and trigger a new round of selling towards 0.8000, potentially causing a bearish continuation.

EURGBP tests resistance

The euro continues to push the boundaries as its impressive comeback against the pound hit another peak. The latest spike prompted sellers to cover and eased the pressure. A long bullish candle towards the previous top at 0.8730 is a sign of continuation. On the flip side, a pullback is needed to stop the rot for the pound and enhance the bearish momentum at 0.8680 and could cause an extension to 0.8600. 0.8700 is the support as the RSI moves to the overbought area.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 07.08.2025 appeared first on Orbex Forex Trading Blog.