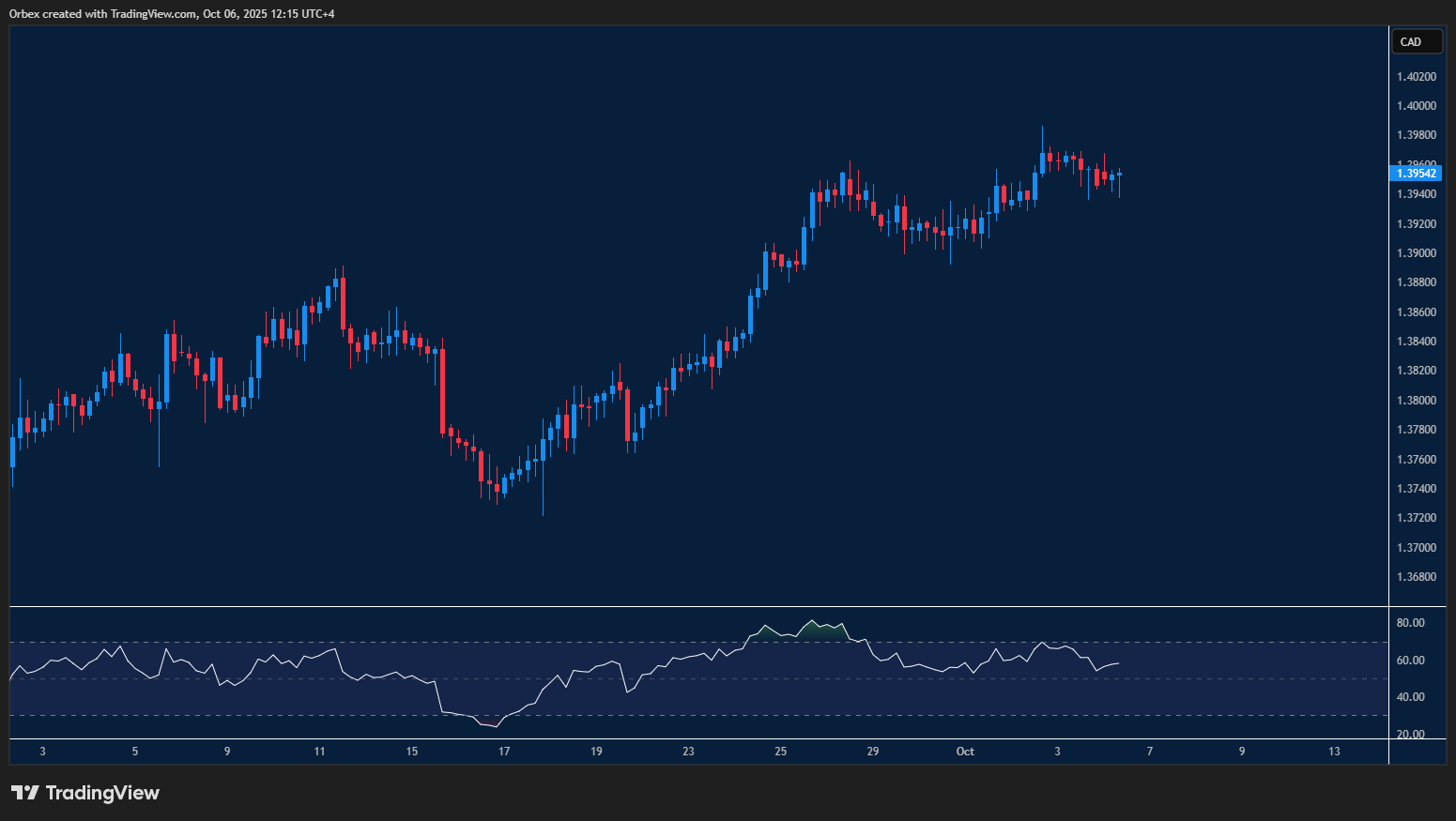

USDCAD tests major resistance

The US dollar remains firm as traders expect resilient data later this week regarding the government shutdown. On the chart, the price is testing the 1.4000 area, a major ceiling that so far has capped the greenback’s advance. Its breach would signal that the bulls are back in the game, with the recent peak of 1.3980 the potential target. As the RSI shows a pullback, this is a test of the bulls’ resolve, with 1.3940 serving as the first level of support and 1.3900 as a secondary layer.

AUDUSD stuck sideways

The Australian dollar clawed back some losses after the mid-September sell-off threatened to drive prices lower. The pair AUD / US dollar is looking to move back towards 0.6700 with a preliminary bounce at 0.6620, pushing a few short interests out of the way. 0.6650 is a significant resistance to lift to instil confidence and open the door to a broader rebound. On the other hand, a slip below 0.6560 would trigger a new round of selling towards 0.6500.

UK 100 probes resistance

The FTSE continues to climb, and the index has so far found support at 9440 as price action creates a bullish channel, offering buyers some relief. Still, they are not out of the woods yet, as the latest bounce could be due to short-term sellers’ profit-taking, with some support from bargain hunting. 9550 is the next test higher, and a bullish breakout could extend the rally. However, a fall below 9400 could cause a reversal towards 9180 at the base of the latest move.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 07-10-2010 appeared first on Orbex Forex Trading Blog.