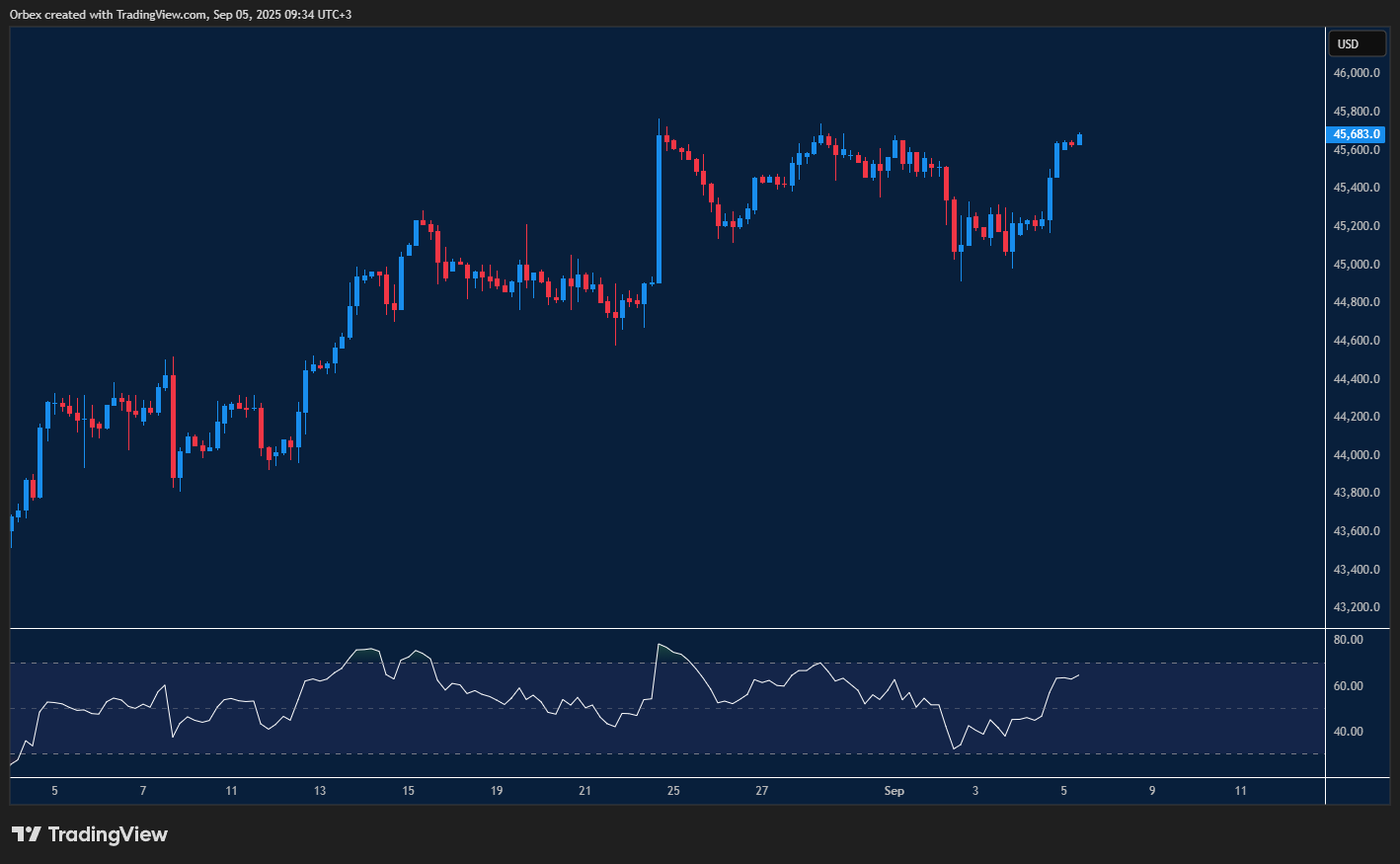

(Dow) US 30 moves towards 46K

The (Dow) US 30 bounces higher as stocks recover across the board. The previous sell-off saw many buyers bail out, but the index remained firm and is now on the path to a full recovery. However, the RSI’s bearish divergence, combined with its overbought status on the chart, is a sign of overextension, and buyers could refrain from being overexposed. 45800 is a fresh resistance, and a fall below 45000 would trigger a deeper correction towards 44600.

USDCAD gaining momentum

The greenback continues to gain more of a grip over the Canadian dollar after pushing past the 1.3800 level. The pair has been looking to move away from its recent bottom around 1.3720 fully, and a series of higher highs suggests mounting buying pressure. A brief pullback has led to a 50-pip drop and prompted buyers to cover some of their bets. 1.3760 is the next support, and its breach could attract momentum sellers and trigger an extended rally below 1.3700. On the upside, 1.3840 is the immediate resistance.

EURGBP looking for direction

The euro struggles to gain any traction over the pound as the pair awaits the next signal. The price has been drifting lower since it hit resistance around 0.8710. While the RSI’s drop away from the overbought area has brought in some bargain hunters, they will need to clear the top of the brief bounce above 0.8740 before a sustained recovery can take shape. Otherwise, the euro could be vulnerable to a sell-off and a further decline in the channel below 0.8600.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 08.09.2025 appeared first on Orbex Forex Trading Blog.