USDCHF pushes higher

The US dollar maintains its bullish rhetoric as the Fed gave more signals regarding its next rate cut. The franc came under more pressure as prices spiked above the psychological 0.8000 level. A bounce above the next target at 0.8080 will shake off weak hands, suggesting that bulls have the last word. On the downside, a close below 0.7960 at the previous consolidation zone would signal a strong willingness to dent the dollar’s recovery, with 0.7900 being the next support level.

EURGBP finds a bounce

The euro jumped back into action as prices found a bounce at the mid-0.8600 area. The pair is attempting to push back above 0.8700, and this suggests that the bulls have not capitulated yet. A break above the target will be an encouraging sign, potentially clearing more selling interests and paving the way for an extension. However, any signs of another dip towards 0.8650 could see a fresh bid to break recent lows and send the pair towards 0.8600.

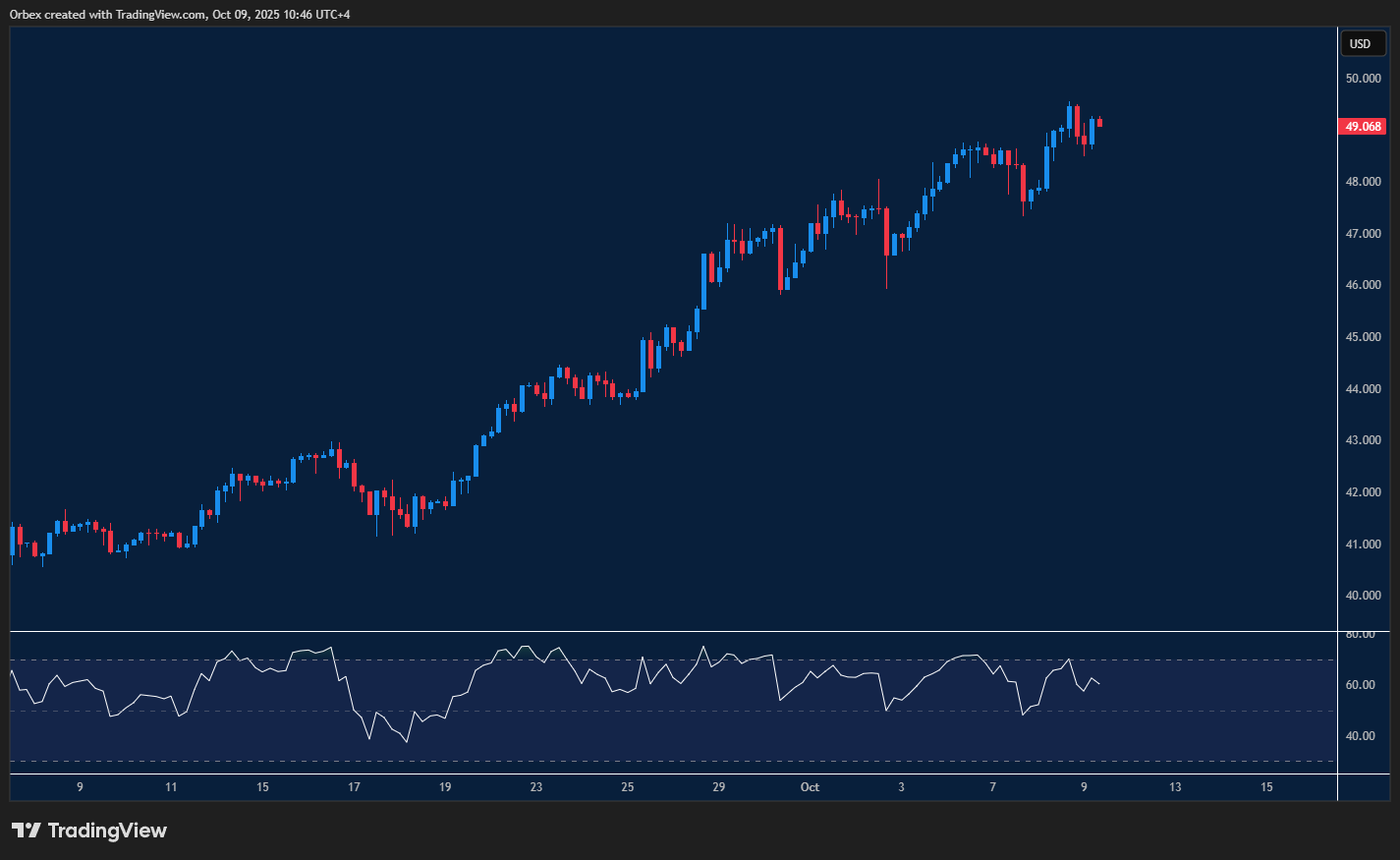

XAGUSD spikes higher

The metal market continues to rally after silver pushed to another yearly high. The precious metal has recouped losses from the recent pullback. The peak of 50.00 is a major ceiling ahead, and its breach would force the remaining bears out, signalling a bullish continuation. However, a bearish RSI divergence in this significant zone could hold back the buy side, at least momentarily, as a combination of fresh selling and profit-taking could drive prices lower. 47.80 is the first support level should this happen.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 10.10.2025 appeared first on Orbex Forex Trading Blog.