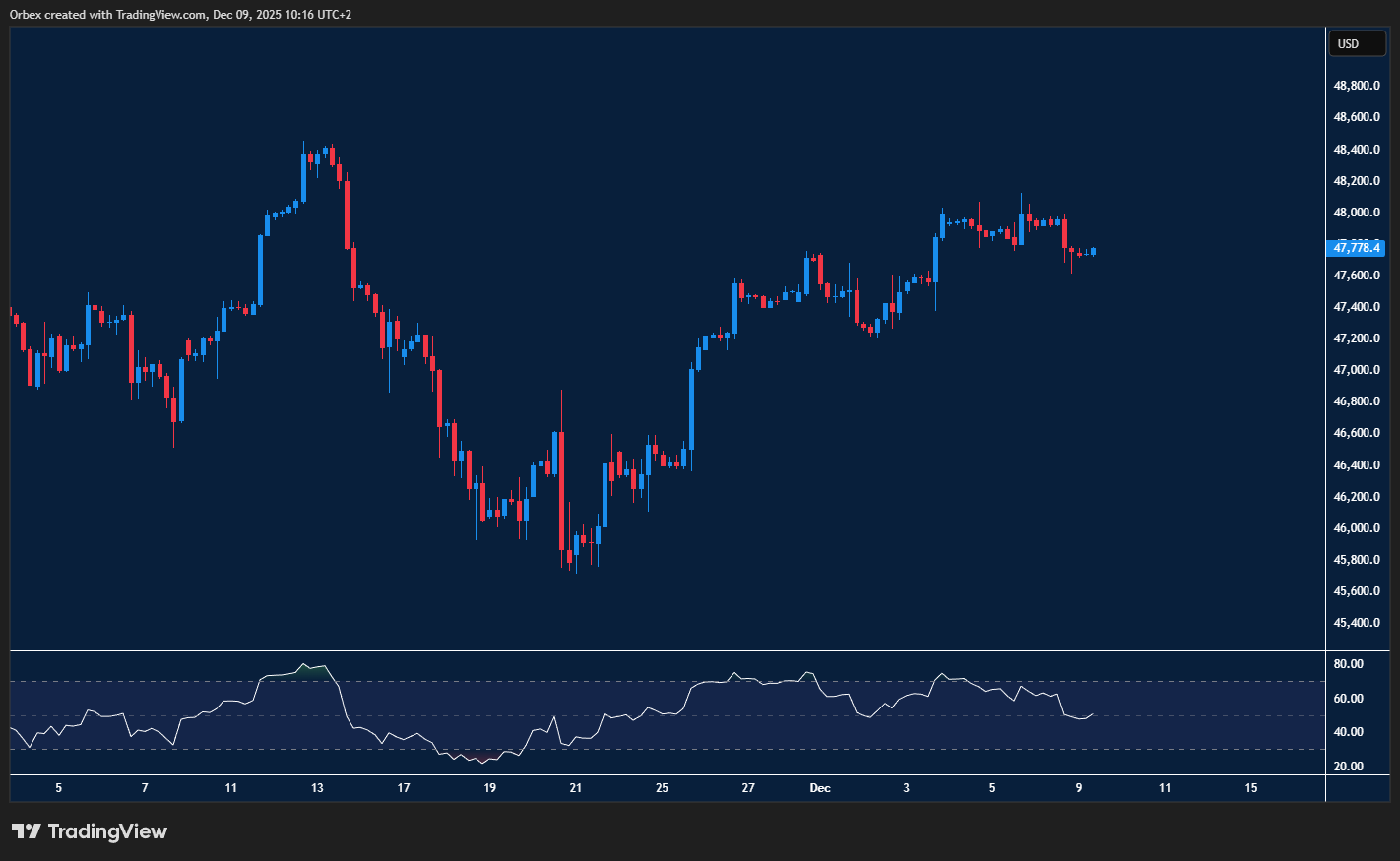

( US 30 ) dow breaks key resistance

The ( US 30 ) dow reached another peak as the US economy is hopeful of a soft landing. By almost wiping out last month’s downturn, the index is looking for a full reversal to reclaim the top spot, helping buyers regain confidence and attracting hesitant ones who have stayed on the sidelines. 48000 is the next target, and its breach could open the door to a sustained rally. 47500 is the immediate support in case the rally needs some breathing room

USDCHF recovering losses

The US dollar gained further traction as prices look to complete a full recovery. A move above the 0.8000 zone led to a liquidation of short bets. 0.8080 is the next threshold to see whether more buyers will enter the market, as sentiment will remain upbeat if the dollar moves back above 0.8100, an important resistance on the daily chart. With the RSI heading towards the overbought area, bargain hunting could be expected, and 0.8020 is the first support level.

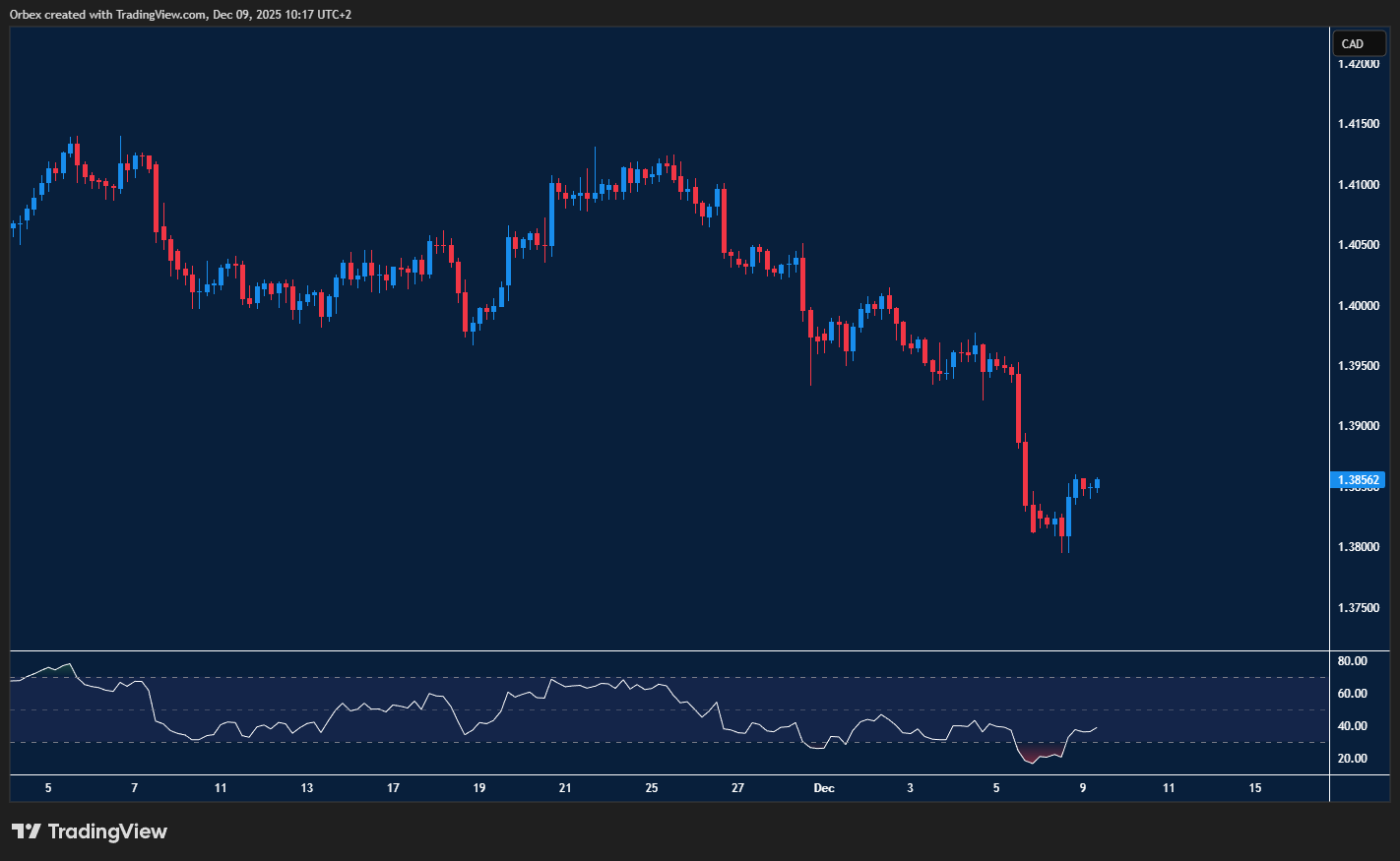

USDCAD testing critical support

The Canadian dollar attempts to stop the downturn, which has seen it break through multiple supports. A hold at 1.3800 is a sign of a recovery after Fed policymakers hinted that they intend to continue cutting rates steadily. On the upside, the bulls will need to reclaim 1.3880 from the previous demand zone to help stabilise the greenback, with a potential lift towards 1.3950 at the previous consolidation.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 10.12.2025 appeared first on Orbex Forex Trading Blog.