EURUSD continues recovery

The Euro continues to grind higher as price action moves away from the 1.15 zone. As we approach the end of the trading week, the pair has found relief after finding support at the 1.1460 area. A previous bullish divergence on the RSI helped with the slowdown in October’s sell-off. 1.1620 now becomes a key resistance, and its breach would then target the previous swing high at 1.1680. The latest drop towards 1.1570 is a fresh support to maintain the recovery bias.

USDCAD remains pressured

The Canadian dollar battles back as the greenback’s weakness is evident across the board, bringing the pair close to a monthly low at 1.4000. A break lower past this psychological level could see a further push towards 1.3880. In the meantime, a pullback towards 1.4040 could give the pair a breather, and the former resistance around 1.4070 is the first target to expect follow-through bids.

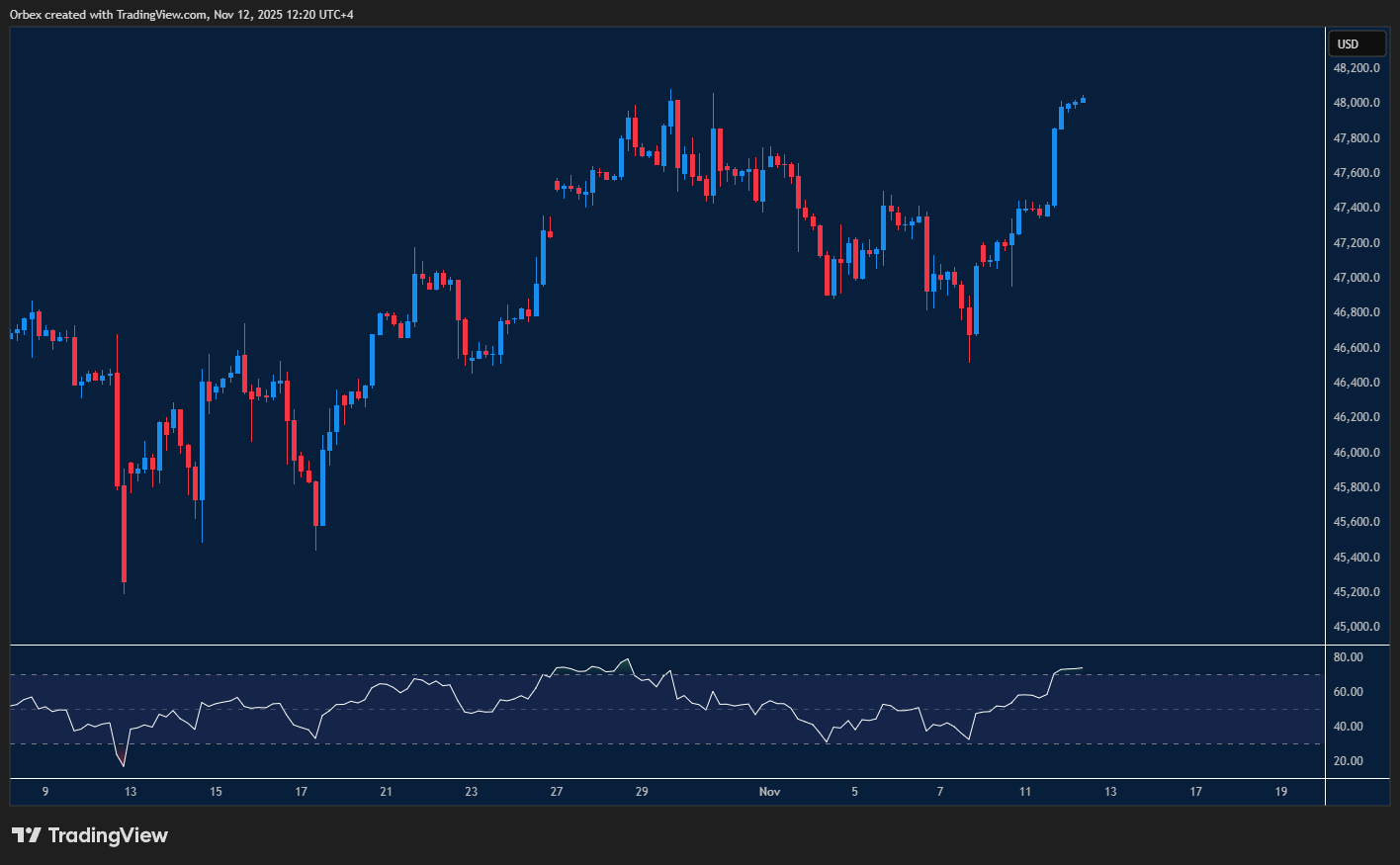

US 30 maintains an upward bias

The Dow index continued to outperform, registering another fresh peak as prices jumped over 500 points. The index is hovering above 48000 as price action attempts to stay afloat, which is a crucial level to maintain the bids. A reversal would force buyers to close positions and trigger a correction towards 47500, putting this week’s rally at risk. A continuation higher above 48200 will flush out some sellers and help the bulls ride another record wave.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 13.11.2025 appeared first on Orbex Forex Trading Blog.