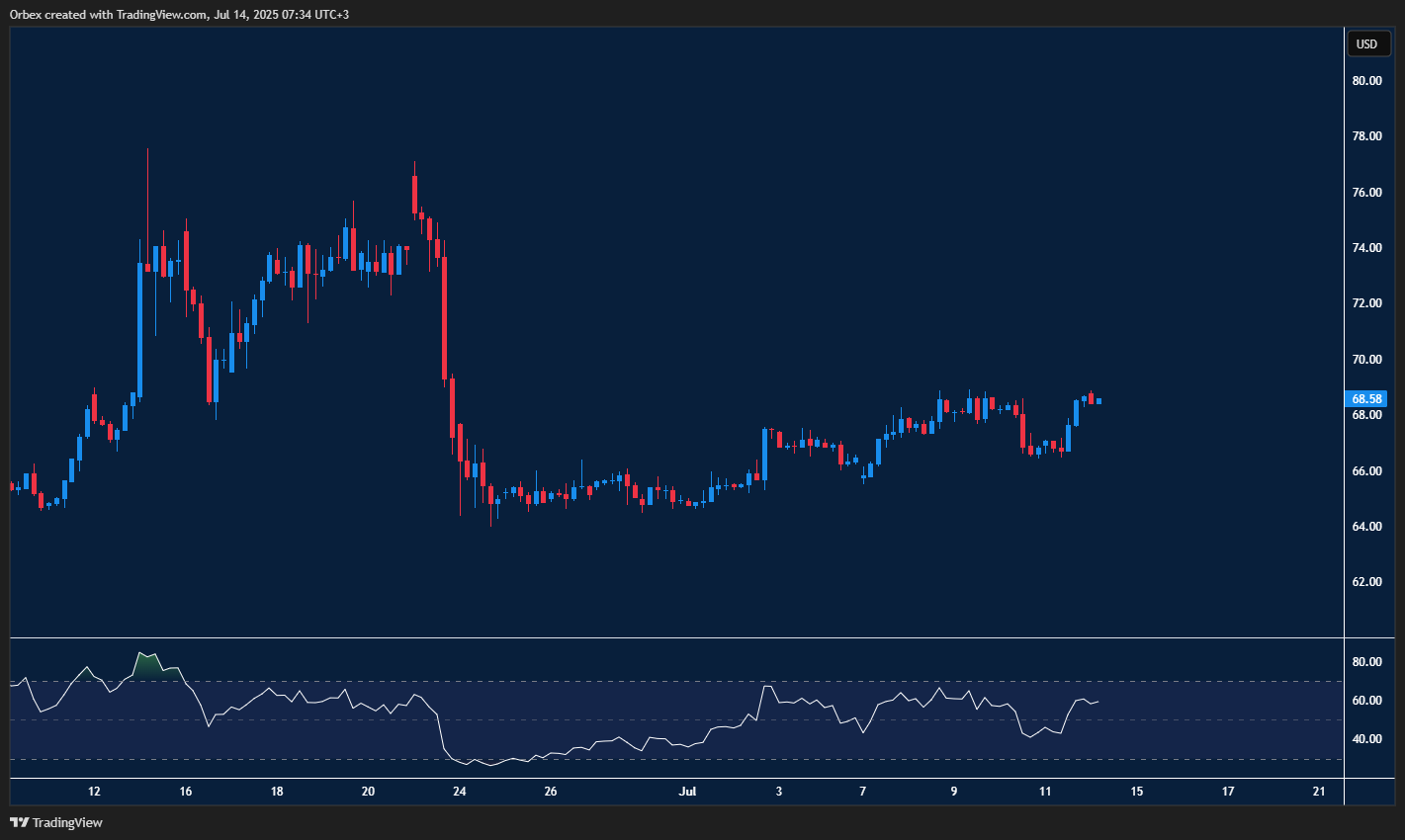

(WTI) USOIL finding momentum

(WTI) USOIL hits another fresh high as economists expect a test at the $70 level by the end of this week. As a show of resilience, the price has managed to stay above the psychological floor of 65.00. A close above the first resistance of 68.00 has eased the downward pressure, but bulls will need to lift the recent peak of 70.00 before they can end the lengthy consolidation and push for a broader recovery. On the downside, 66.00 is the first support to keep the current momentum intact.

GBPUSD falls from multi-year highs

Cable struggles as a progressive dollar has seen over 300 pips wiped off the value of the pair since the start of the month. Not even a lift in GDP data could prevent the pound from slipping towards the 1.3400 level, which has become the latest support. With the RSI majorly oversold, a brief bounce to the upside could ensue. 1.3490 is the first hurdle before a further lift can take the pair back to the recent swing high at 1.3650. A continued sell-off sees a confirmation break at 1.3400 and lower.

USDCAD breaks higher

The American dollar continues its advance as prices move away from the 1.3600 area. The pair remains under pressure, as its recent choppy ascent could lead to a reversal. A bearish divergence on the RSI is likely to attract more selling interest in the near term as previous buyers look to switch sides. 1.3720 is the first resistance point where sellers will close positions. A fall below 1.3640 would extend the sell-off towards 1.3570.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 14.07.2025 appeared first on Orbex Forex Trading Blog.