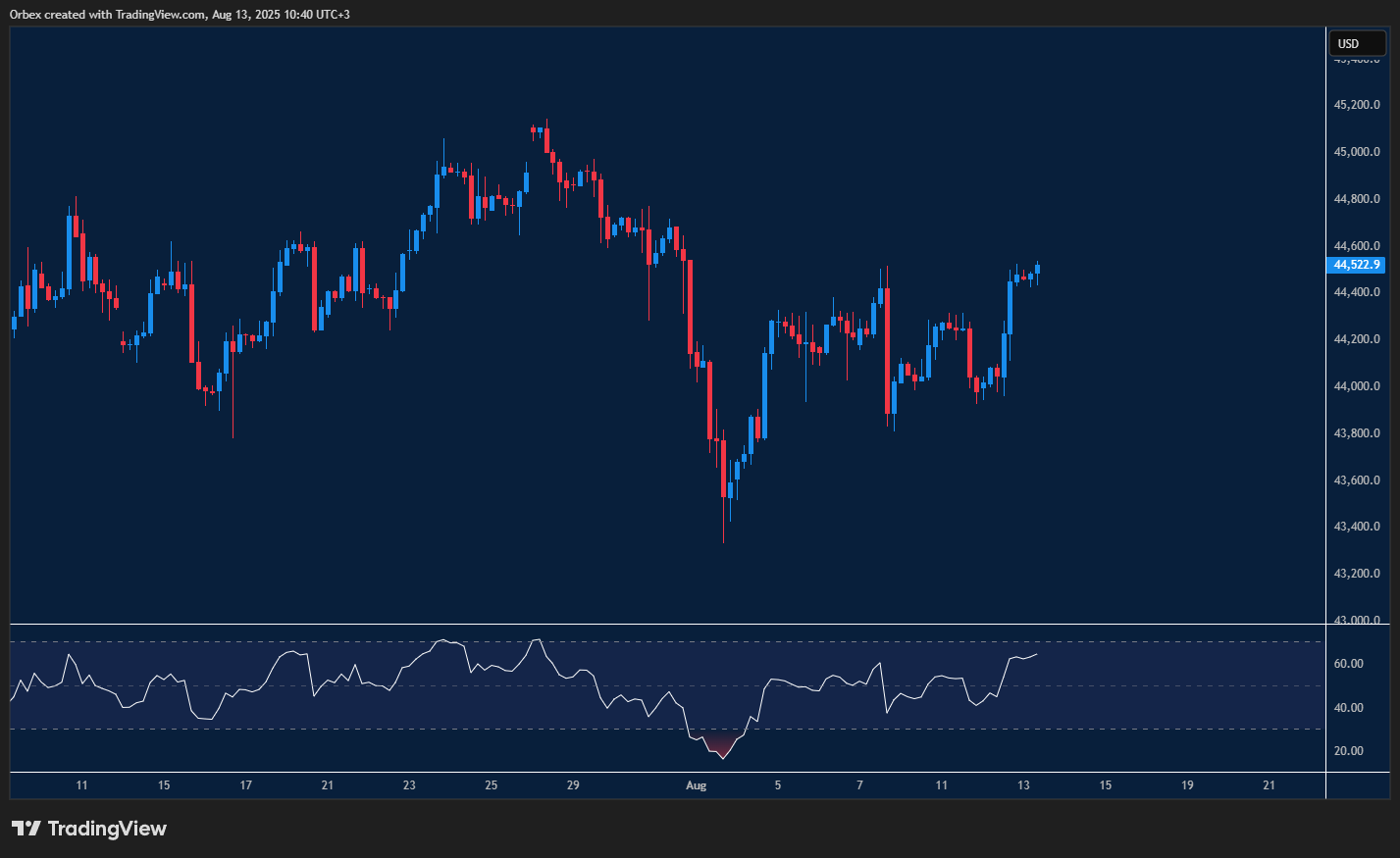

(Dow Jones)US 30 going for a record

The (Dow Jones)US 30 eased the downward trajectory with a bounce away from the lower region of the 44000 area. After a brief dip, a hold above this psychological level has helped bulls regain control of the short-term direction. The recent peak above 45000 serves as a key resistance level where buyers could take some chips off the table. 44200 is the closest support as the RSI ventures into the overbought area, and buyers could see a limited pullback as an opportunity to buy in.

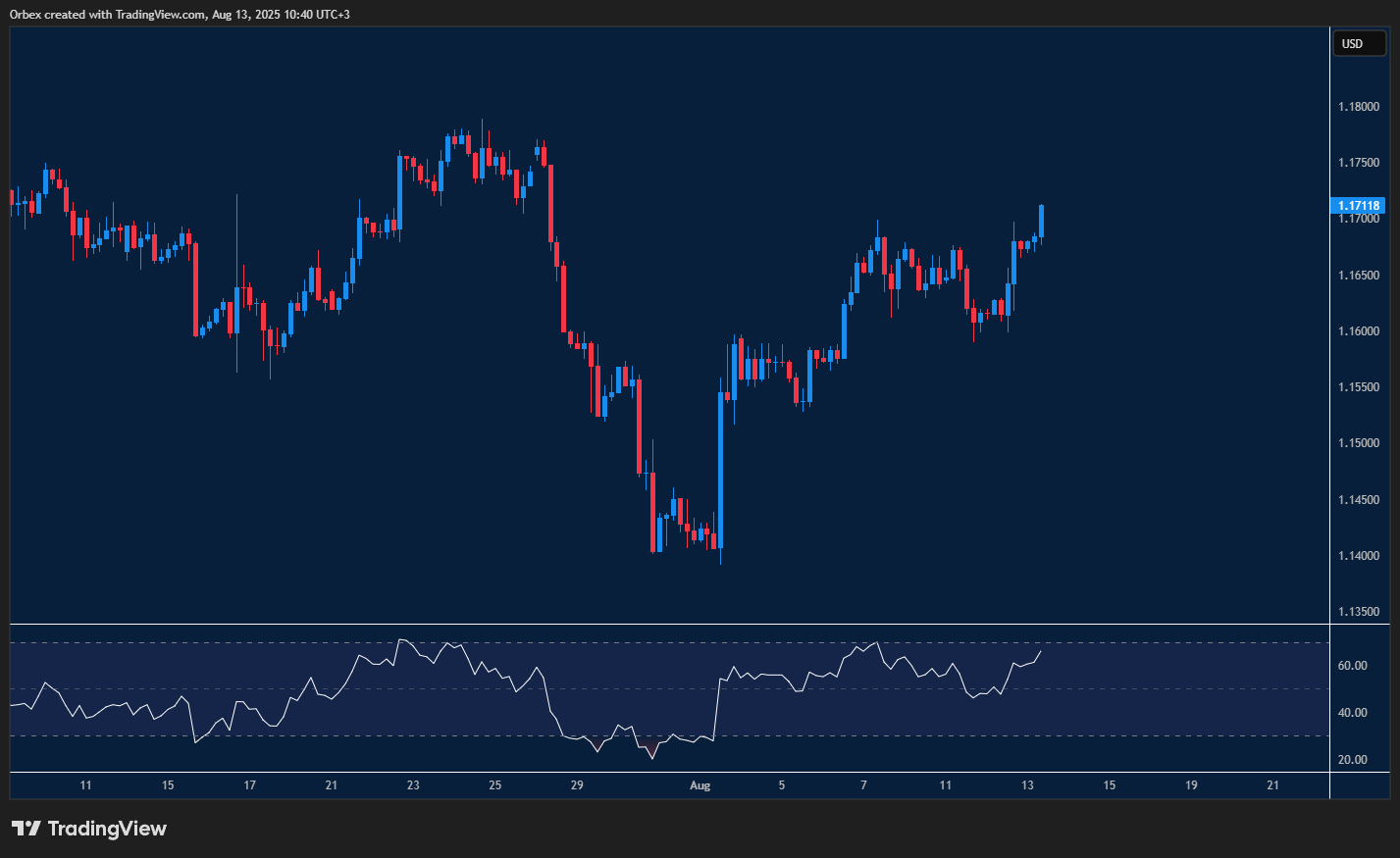

EURUSD bounces back

The Euro attempts to gain some lost ground as US inflation data crept higher. The pair’s trajectory continued higher after reclaiming the 1.1700 level. The rally has so far seen over 300 pips added to the value of the pair, as price action looks to reclaim its top spot at 1.1800, with 1.1750 being the first level to crack. On the flip side, 1.1640 is an important floor, and its breach could lead to a bullish continuation below 1.1600, confirming the bearish divergence on the RSI.

USDCAD drives lower

The American dollar is licking its wounds across the board as traders look ahead to the next Fed meeting. A bounce below 1.3800 has prompted buyers to cover to ease the upward pressure. 1.3780 from a previously brief rebound is the closest resistance if the momentum shifts. On the downside, 1.3680 is the first support for bulls to consolidate their gains, with 1.3600 the next target for sellers.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 14.08.2025 appeared first on Orbex Forex Trading Blog.