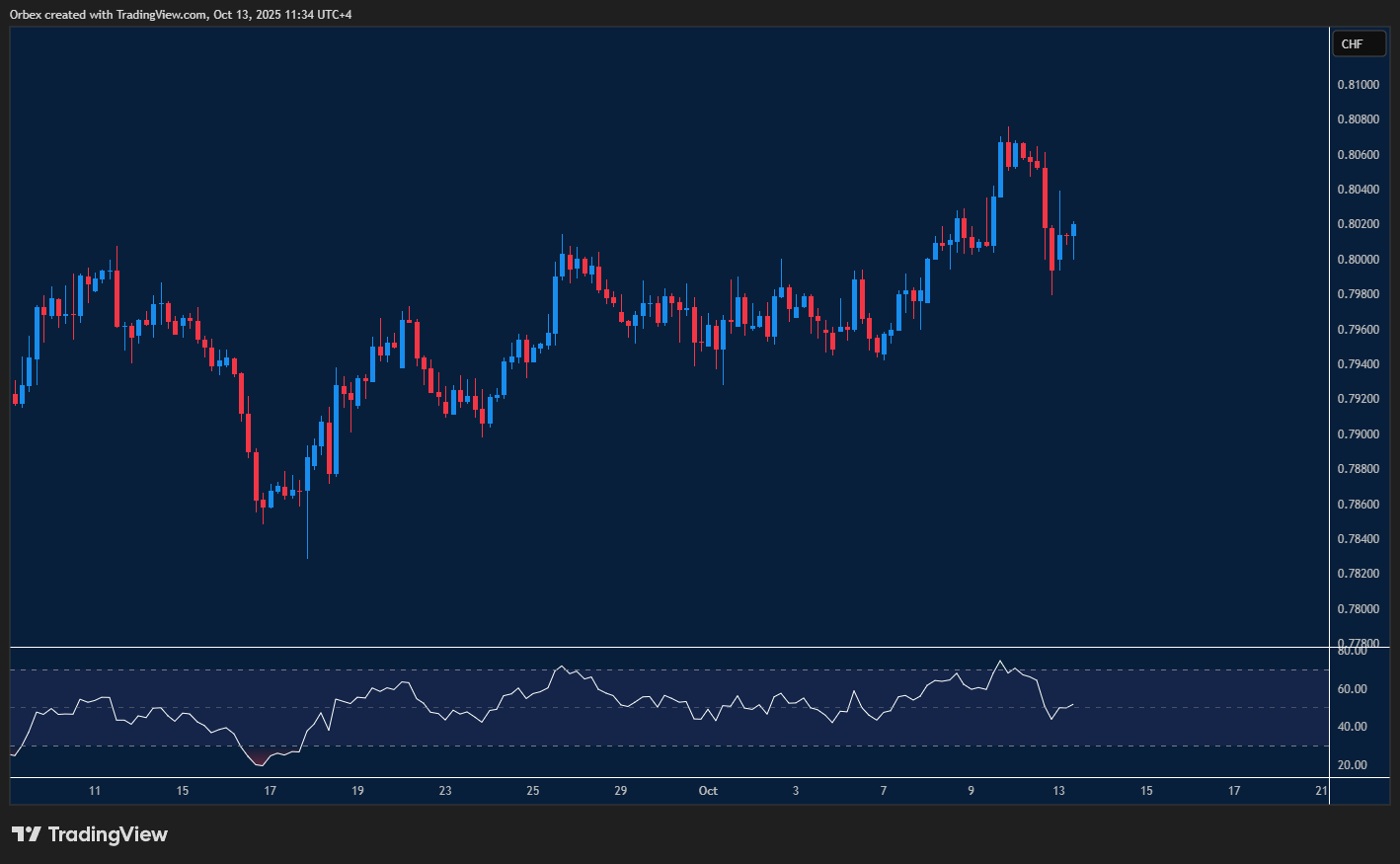

(USDCHF) franc bounces lower

The dollar edged lower after losing ground to the (USDCHF) franc. On the chart, there is a sign that sentiment has improved despite a momentary spike at 0.7980 that has shaken out some weaker hands. A close back above 0.8070 could open the door to the previous swing high above 0.8150. 0.7940 at the base of the latest breakout at the previous consolidation zone is the first support.

XAUUSD breaks the barrier

Bullion moves higher as continuous global tensions and potential further trade conflicts drove traders to the safe haven. The precious metal is slowly grinding a layer of resistance levels between 4040 and 4080. The sell side has become more defensive, but might not have had the last word. An initial drop below 4025 would reveal some profit-taking, and a bearish RSI divergence could lead to a consolidation phase. 4000 is the vital support if this occurs.

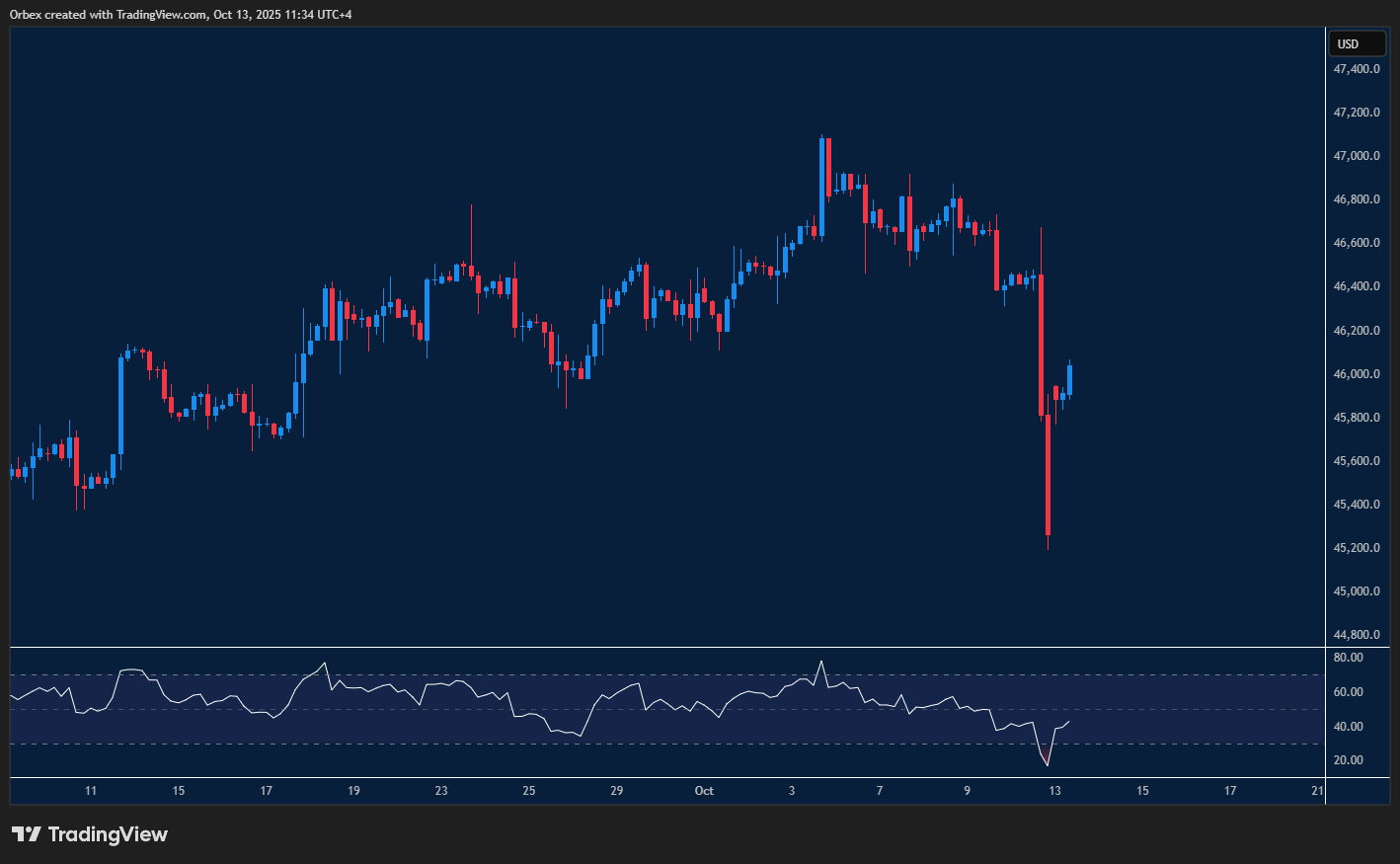

US 30 licking its wounds

Indices are still feeling the effects of the latest collapse as prices attempt to cover some losses. The price is capitalising on a move above 46000, suggesting that the market mood has turned upbeat again. The bulls have brought bids right under the previous consolidation zone around 45800, and a successful breakout would put the bears’ last stronghold at 46250 under pressure. 45600 at the base of the latest momentum is a fresh support, while 45200 is a critical level to keep the rebound intact.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 14.10.2025 appeared first on Orbex Forex Trading Blog.