USDJPY hits resistance

The US dollar retreated as sentiment shifted after a month-long rally. The Yen has clawed back some of the losses from the majority of October’s liquidation. A close below the immediate support of 154.50 suggests that the sell side is still in the game. The next target at 154.00 is a major obstacle that bears must overcome before they can advance. On the upside, a break above the recent peak at 155.20 would expose the pair to another rally.

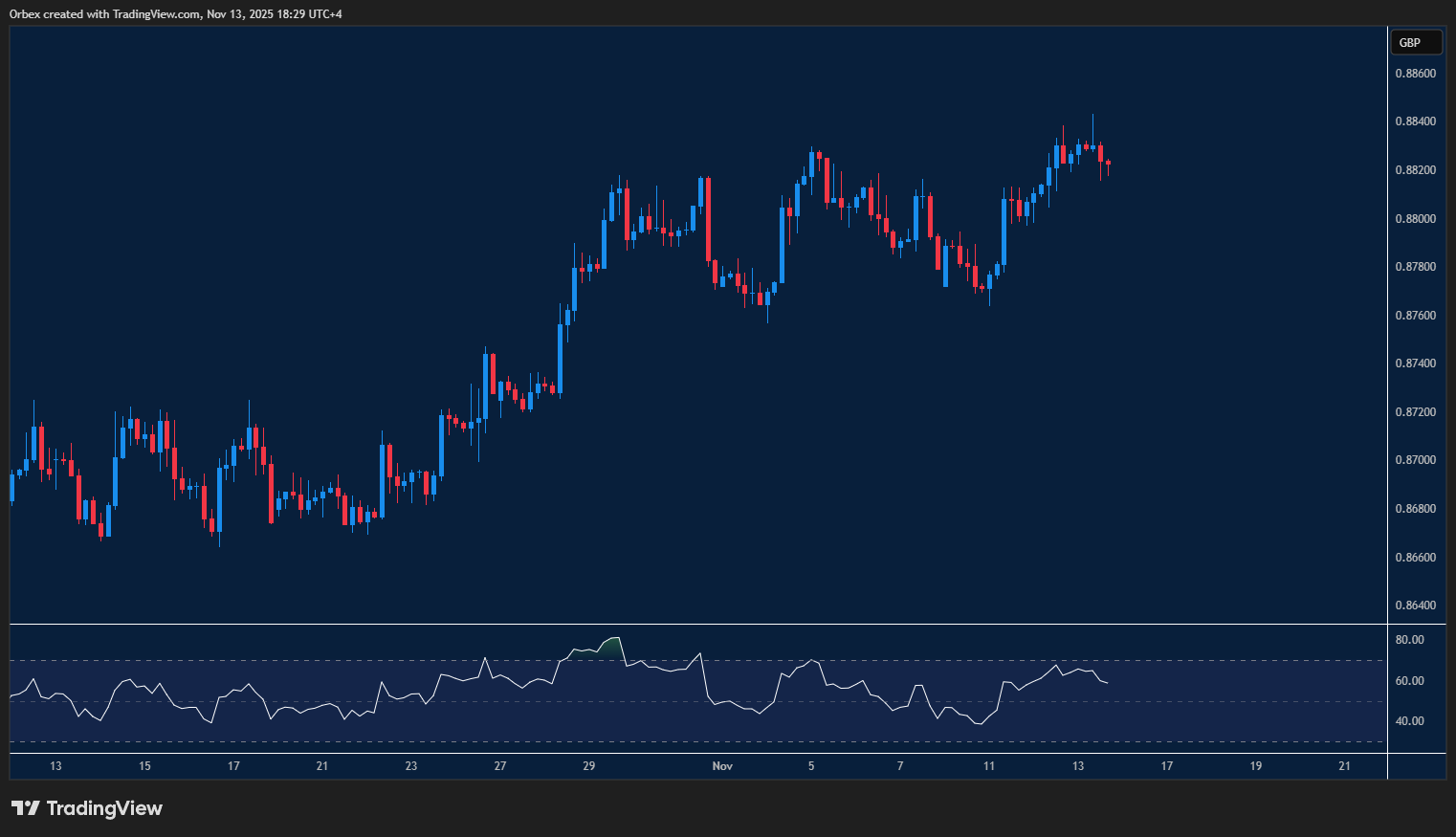

EURGBP losing momentum

The euro softened as its dominance over the pound took a step back. The pair has moved over 100 pips higher before a pullback towards the 0.8800 area. A bullish continuation could prompt sellers to exit further and trigger a move to the multi-year high above 0.8900. On the downside, offers around 0.8780 would be the first support. A close back below the recent low of 0.8750 would resume the slump towards 0.8660.

GER 40 grinds demand area

The Dax struggles as the current sell-off this week rumbles on. The index is looking to hold onto 24000 as a drop below this critical level could shift sentiment to the pessimistic side and trigger a deeper correction towards 23500. A former brief support at 24200 is the first obstacle to clear, and only a rally above the major level of 24500 at the top of the recent peak could initiate a meaningful bounce.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 14.11.2025 appeared first on Orbex Forex Trading Blog.