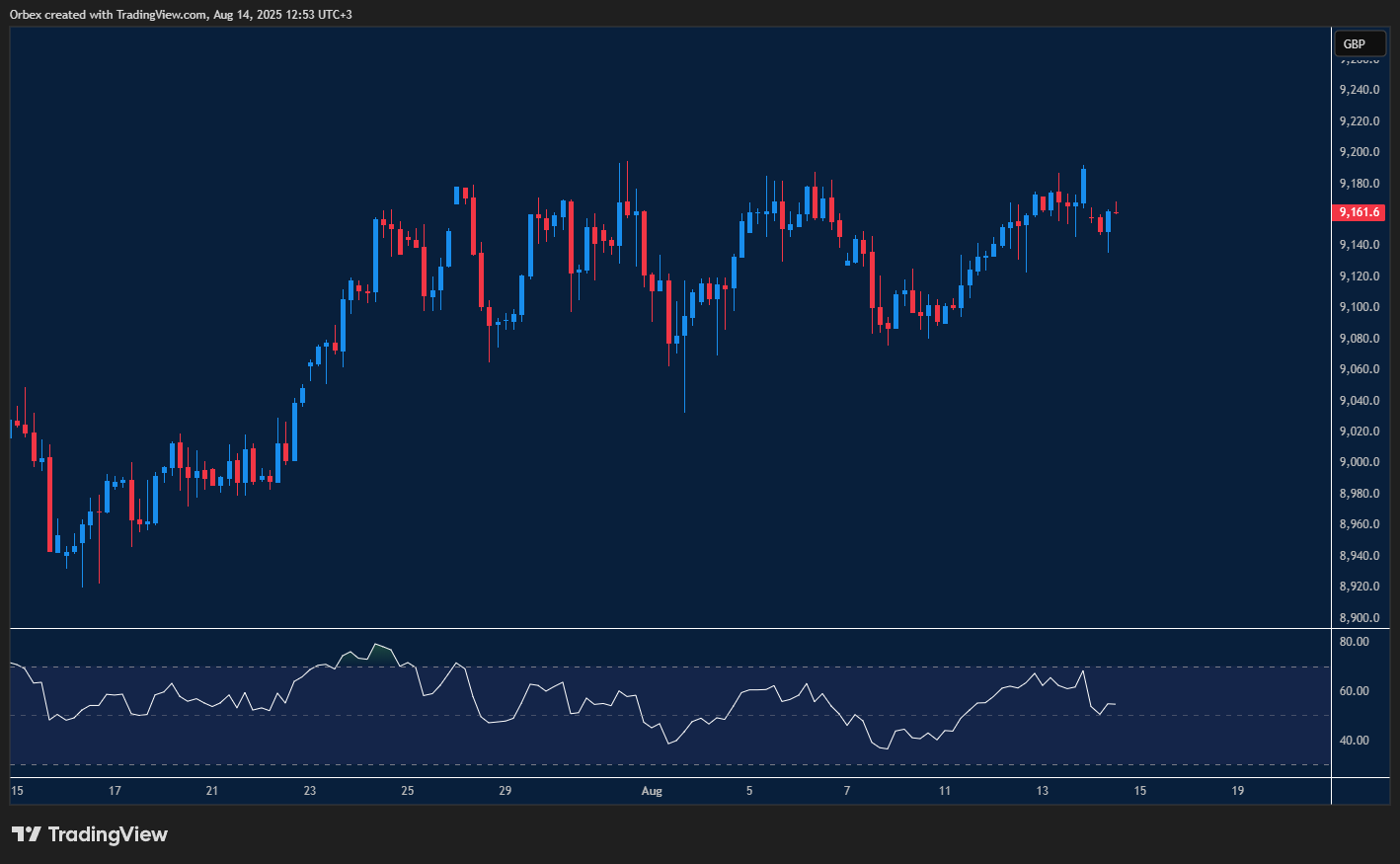

(FTSE)UK 100 hitting peaks and troughs

The (FTSE)UK 100 struggles with momentum despite upbeat UK GDP data. Sentiment has turned cautious after the index saw another firm rejection just below the 9200 level. A bounce above the first resistance of 9170 could prompt short-term sellers to cover and give the buy side some respite, before the index can enjoy a broader recovery. 9100 is a significant level to keep the rebound valid, or a deeper correction could send the index to 8920.

AUDUSD hitting new highs

The Australian dollar was up for another session before a heavy price rejection at the mid-0.6500 region. Price action has fallen around 50 pips but remains elevated above the 0.6500 level. The double bottom at 0.6480 serves as a crucial support level, as its breach would likely prompt more buyers to take profit, further exacerbating downward pressure. On the upside, 0.6560 is the immediate target to keep any chances of rebound with July’s 0.6620 peak in sight.

EURJPY capitulating lower

The Euro plummeted against the Yen after seeing a fresh high on the pair only a few sessions ago. As the price hovers above 171.00, the RSI’s oversold situation could cause a pullback if sellers are reluctant to chase after low offers. Sentiment remains extremely downbeat, and bears could look to keep the direction intact. 170.70 is the first level to expect follow-through bids. Further down, the psychological level of 170.00 sits at the confluence of a previous swing low, making it a major support to monitor.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 15.08.2025 appeared first on Orbex Forex Trading Blog.