USDCAD tests fresh lows

The dollar progressed further as the bull rally continues to pace toward a fresh high. A break above 1.4000 was a strong bullish signal, forcing the remaining sellers to cover and paving the way for a continuation in the medium term. 1.4180 is the next target on the pair’s journey to multi-month highs. Any chance of a rebound first needs to break below 1.4000 to regain some control towards the previous consolidation zone at 1.3930.

EURGBP bounces back

The pound slipped against the Euro as price action bounced away from the recent low. The pair is still striving to hold above 0.8700 and safeguard its latest rebound. A bearish breakout would shatter the bit of optimism left from previous bullish attempts and drive the price back towards 0.8660. On the upside, a close above the current resistance at 0.8720 would expose the swing high of 0.8770 and ease any downward pressure.

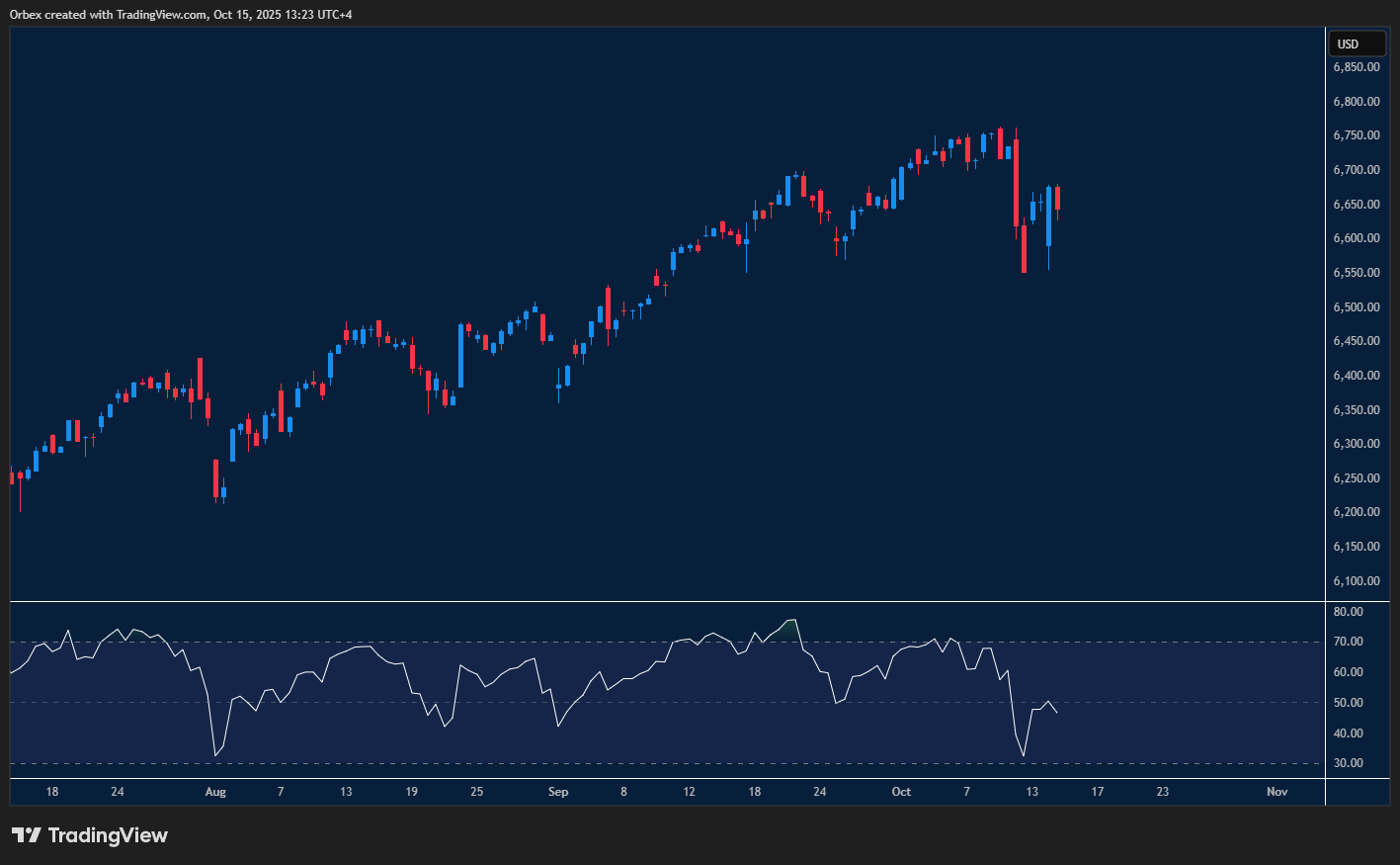

SPX 500 continues to rally

The SPX 500 attempts to close at another record high, with prices looking to bounce back from the latest dip. The rally has hit a slight consolidation at 6650 as a bearish RSI could show a further pullback in momentum, suggesting that intraday buyers have taken some chips off the table. The index is looking to secure a foothold with 6550 at the base of the latest breakout rally, as this is the first level to expect renewed buying interests. 6760 is the first resistance if another test occurs at a fresh peak.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 16.10.2025 appeared first on Orbex Forex Trading Blog.