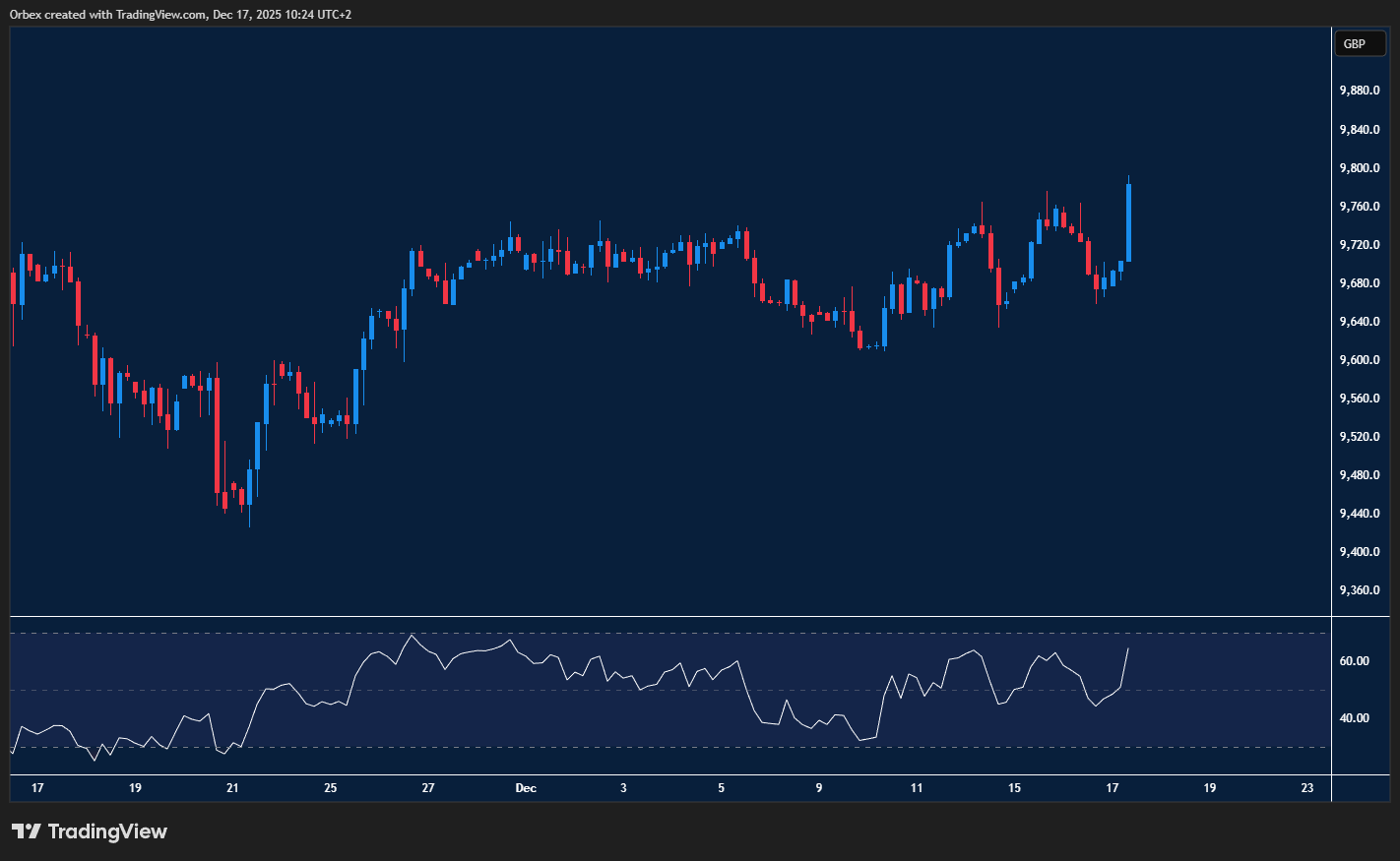

( UK 100 ) The FTSE continues higher

( UK 100 ) The FTSE progressed as UK inflation fell sharply, fuelling the likelihood of a rate cut. The bounce to the recent high at 9800 has met some selling pressure as some buyers exited the market with minimal losses. 9680 is the latest support to keep the momentum intact, as a bearish breakout would put the quadruple bottom at 9600 at risk. However, if the buy side clears 9840, an extended rally could carry the index to fresh highs.

USDCHF looking for a breakout

The US dollar looks poised to pare losses after prices jumped by more than 50 pips. On the chart, the price is holding steady towards the psychological level of 0.8000, which is the next target. Any signs of exhaustion would signal a pullback to test 0.7940, followed by a potential test at 0.7900. If a break above 0.8000 materialises, a bullish extension could push the pair towards the recent peak at 0.8080.

USOIL probes support

Crude edged higher as prices look to capitalise on the recent bounce, which has pushed prices to a touch above 56.00. 55.20 near the base of the breakout could offer buyers some firm support with the RSI recovering into the neutral area. Further up, strong resistance could be expected near 60.00 if the commodity can climb that high, but only a breach above 57.00 would force sellers out and lead to a sustained rebound.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 18.12.2025 appeared first on Orbex Forex Trading Blog.