USDJPY meets major support

The Yen pair hit some support as the dollar regains momentum. The recent upturn has seen a break at the 158.00 level, leading towards a potential continuation if prices can rise above 158.50. From the short-term perspective, the trajectory remains downward even though the immediate price action lifted. 157.30 at the base of the latest bounce is a firm support to stop a complete reversal back down to 156.00.

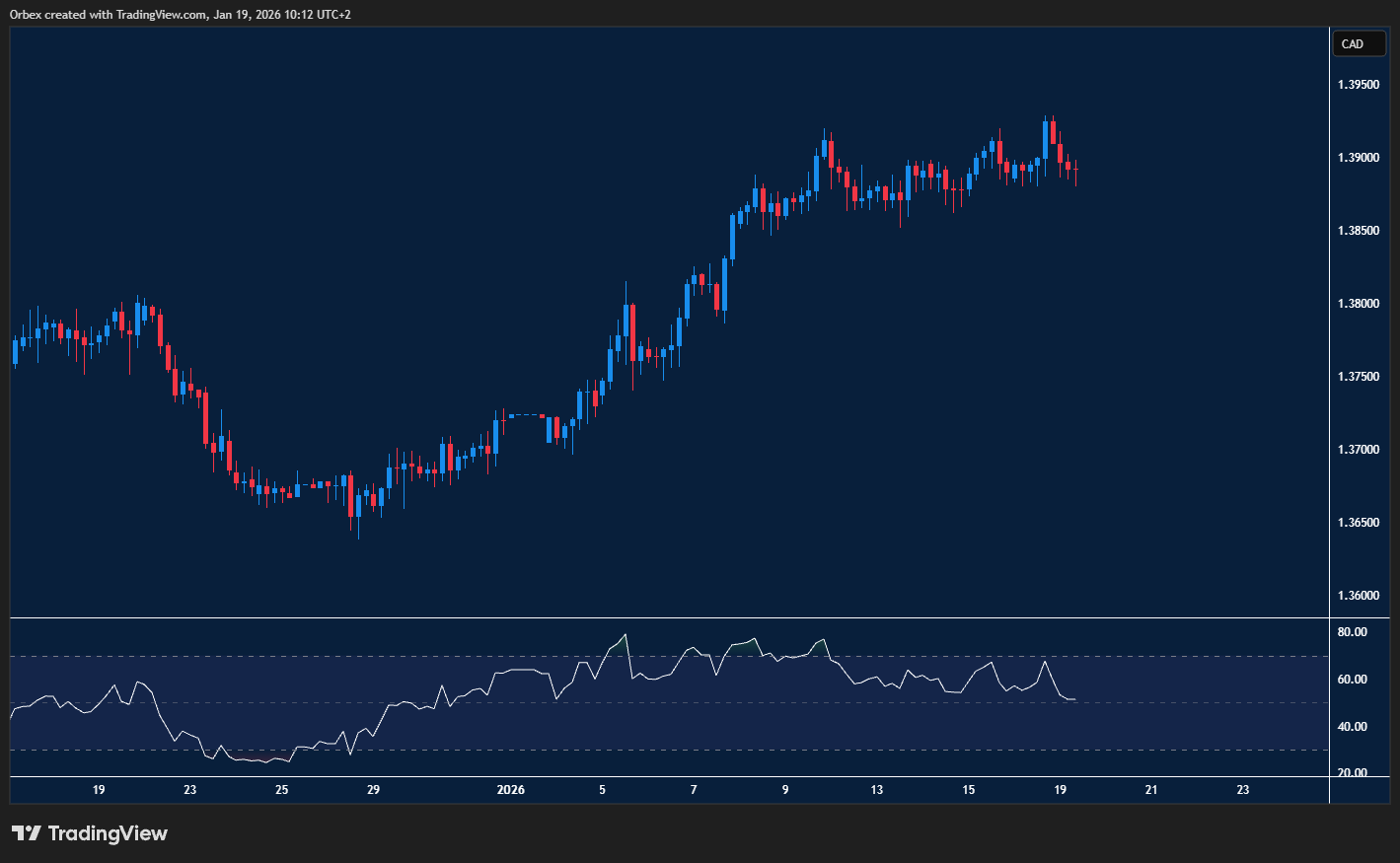

USDCAD remains choppy

The Canadian dollar held strong as the greenback looks to take some profits. The latest rebound has met renewed selling pressure at 1.3900, and its breach might prompt sellers to look towards a full rally. 1.3870 is the immediate support and its breach could drop prices towards 1.3800. Any chance of a turnaround in fortunes would first need a confirmed break above 1.3900 to pave the way for a potential test of 1.3965.

US 30 holds onto gains

The Dow inched lower amid spooked markets over another trade conflict. The index is falling towards 48600, but the psychological level of 49000 is proving a difficult hurdle to overcome. Zooming into the hourly chart, a bullish RSI divergence suggests a deceleration in the downward momentum, and only a jump past 49100 would confirm a turnaround and could create a triple top at 49600.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 20.01.2026 appeared first on Orbex Forex Trading Blog.