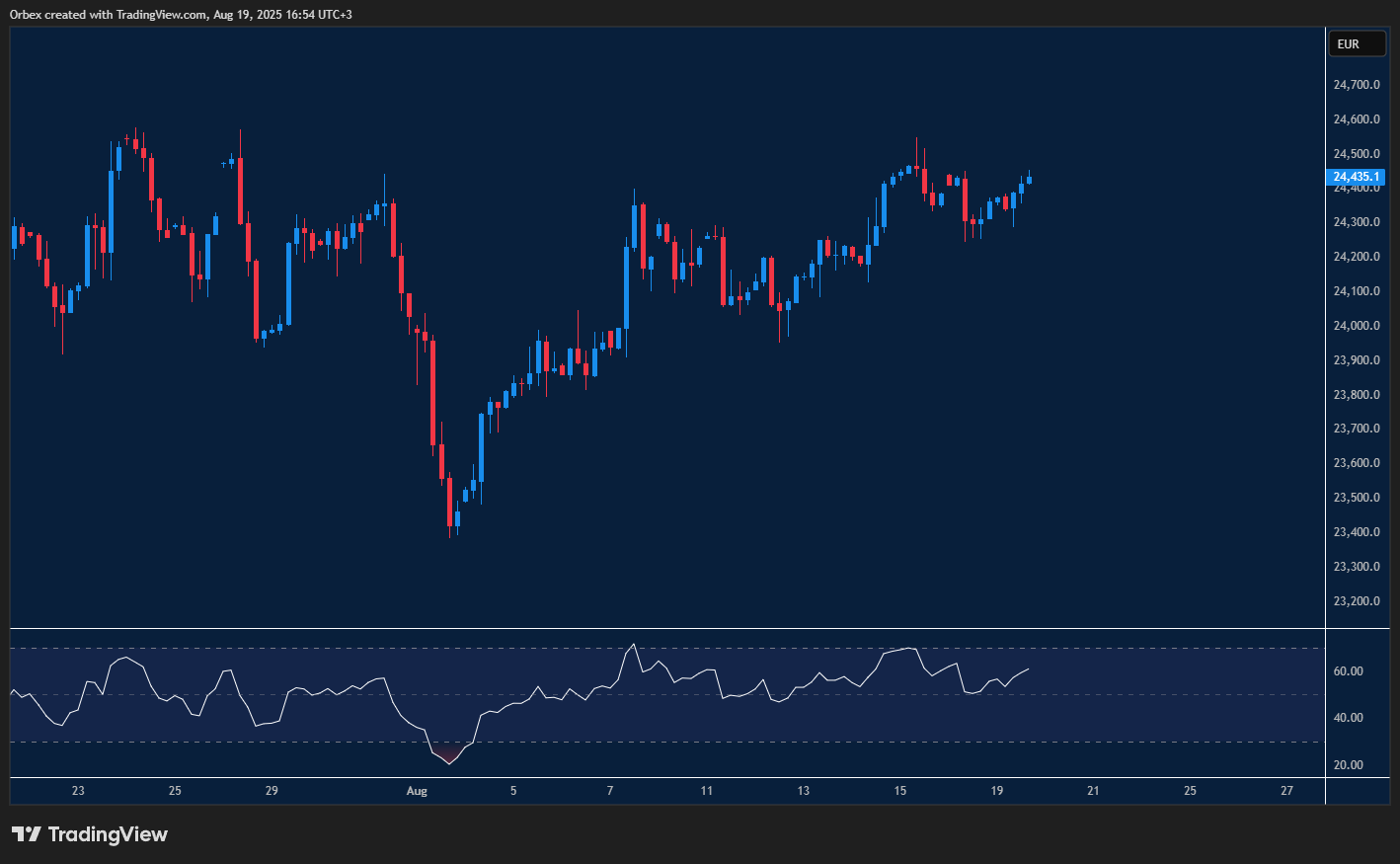

(GER 40)Dax holding on

The (GER 40)Dax remains choppy as the Eurozone awaits the next interest rate decision. A sharp fall away from 24500 is a sign of inconsistency by short-term buyers. The RSI has recovered into neutral territory as sellers took profit, but the index is yet to stabilise as traders might be wary of any surprises from the next ECB meeting. The recent lows at 24250 and 23800 are the levels to see if sellers are making their way back.

EURUSD tests recent high

The Euro continues to fight back against the greenback as price action attempts to hit another higher high. The pair currently found support at 1.1400 at the base of a bullish momentum at the beginning of this month. The directional bias has remained upward from the daily chart’s perspective, with sentiment showing that buyers are in control, as the pair moves to test the 1.1700 level again. However, a bearish divergence on the RSI could turn things around, and a pop below 1.1600 will cause another sell-off, which could hit monthly lows below 1.1400.

GBPCAD continues higher

The pair looks for another fresh peak as prices look to bounce back from the recent correction. A close above the recent high will attract more momentum buyers, sending the pair towards a multi-month high above 1.8800. 1.8730 is the immediate hurdle in its way, and the RSI’s overbought condition could prompt bulls to change sentiment. The recent double bottom at 1.8620 serves as vital support, keeping the bulls challenged for another high.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 20.08.2025 appeared first on Orbex Forex Trading Blog.