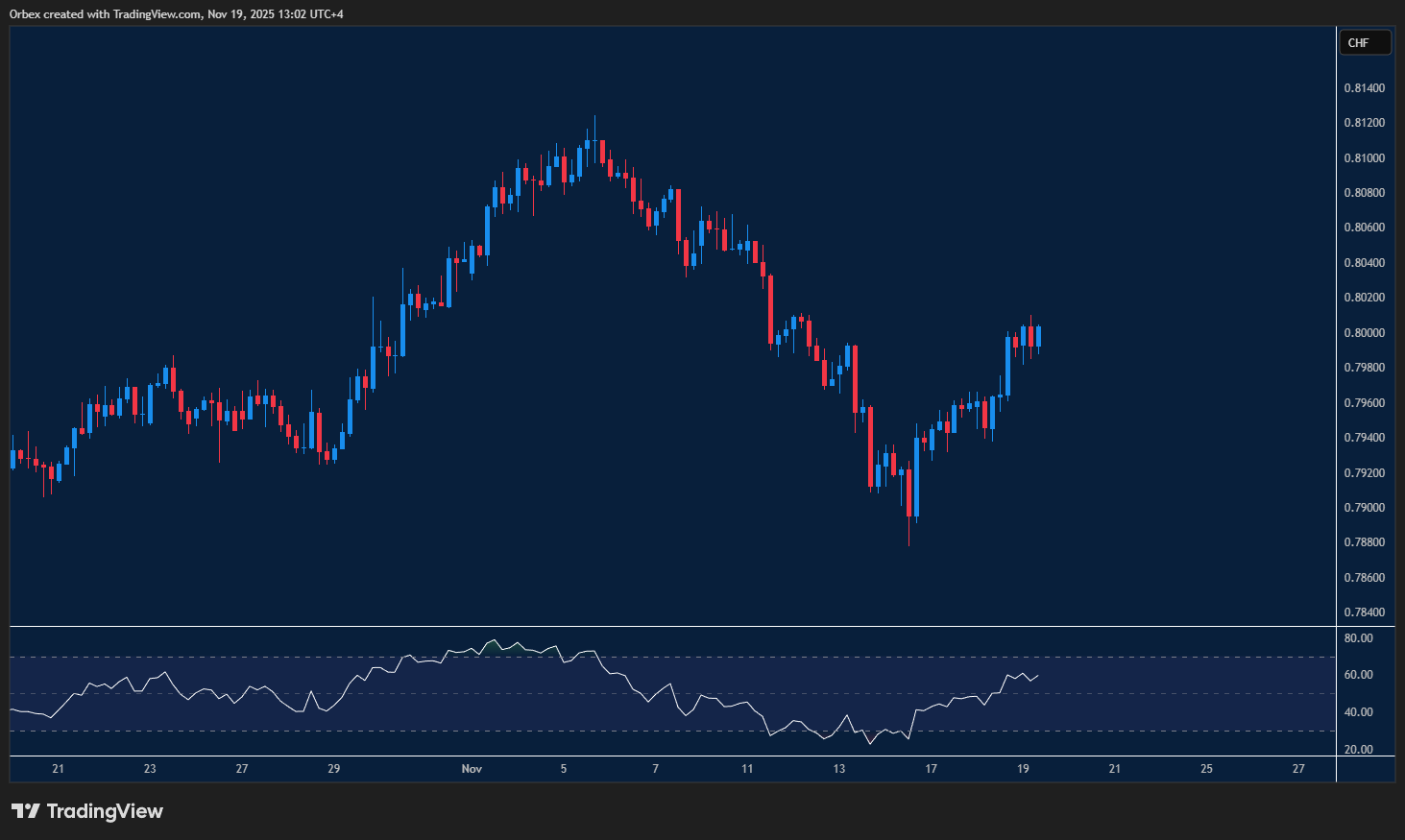

USDCHF testing resistance

The Dollar continues the rally after moving over 100 pips in recent sessions. The pair is now testing the 0.8000 resistance level, which has become a firm psychological target. A jump above this level has led some sellers to trim their bets, but the next level at 0.8040 remains a major hurdle before a full reversal to the recent peak can gain greater traction. A fall below 0.7950 would force the latest buyers to bail out and trigger a potential turnaround.

XAGUSD moves higher

The momentum on the greenback has left the metal market a bit subdued. Silver (XAG) has had a decent run over the past 24 hours but seems to be under some pressure as price action attempts to test the 52.00 level. 51.80 is the immediate support, and a U-turn below it would expose this month’s low towards 47.00. A meaningful recovery would only materialise if buyers manage to push past the spike at 52.50.

GER 40 hits a fresh low

European stocks closed at a weekly low as concerns about tech valuations weighed on trading sentiment. A close above the target at 23300 would give buyers some breathing room, as the RSI sinks even lower. However, the sell-off looks set to continue as the 23000 level becomes the latest support zone, potentially prompting intraday buyers to close their positions and triggering a deeper correction.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 20.11.2025 appeared first on Orbex Forex Trading Blog.