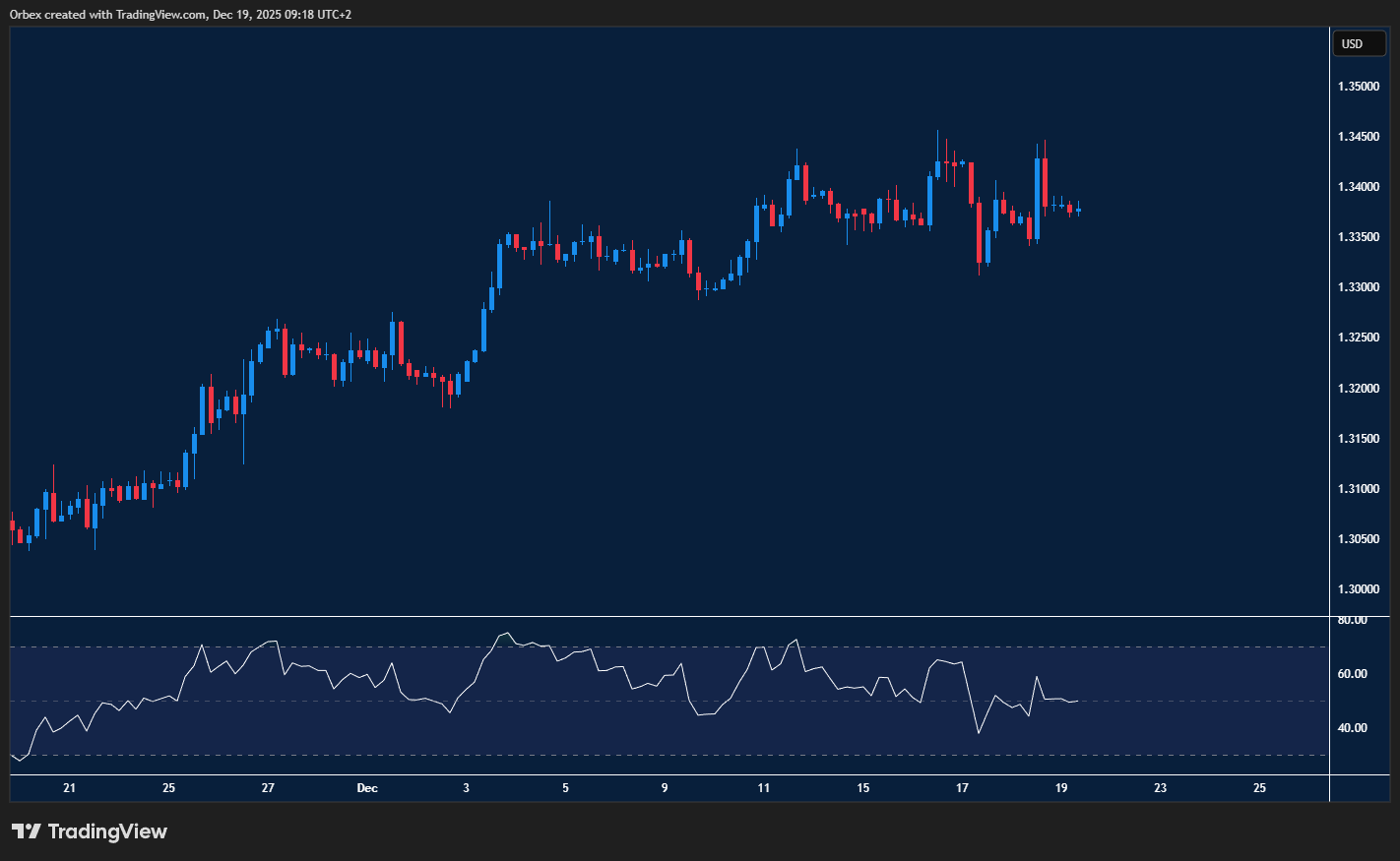

GBPUSD consolidates losses

Cable failed to keep hold of its recent high after last week’s Bank of England rate decision. The recent high of 1.3450 was short-lived after a heavy rejection; however, a surge above this ceiling might open the door to a sustained rebound. In the meantime, the rally could need some breathing room, and a pullback could be seen as an opportunity to stake a claim. 1.3360 is the closest support to expect follow-through buying.

USDJPY breaking out

The Yen struggled to maintain its downward momentum after the Bank of Japan raised its interest rate to its highest level in 30 years. So far, it seems that the buy side is having an easier time lifting offers. A move above 156.50 would reignite volatility by triggering liquidations of short positions. However, 155.80 would see renewed selling interests, and a bearish breakout would lead to an extended rally. Further down, the double bottom at 154.60 is an important daily support level in case of a sell-off.

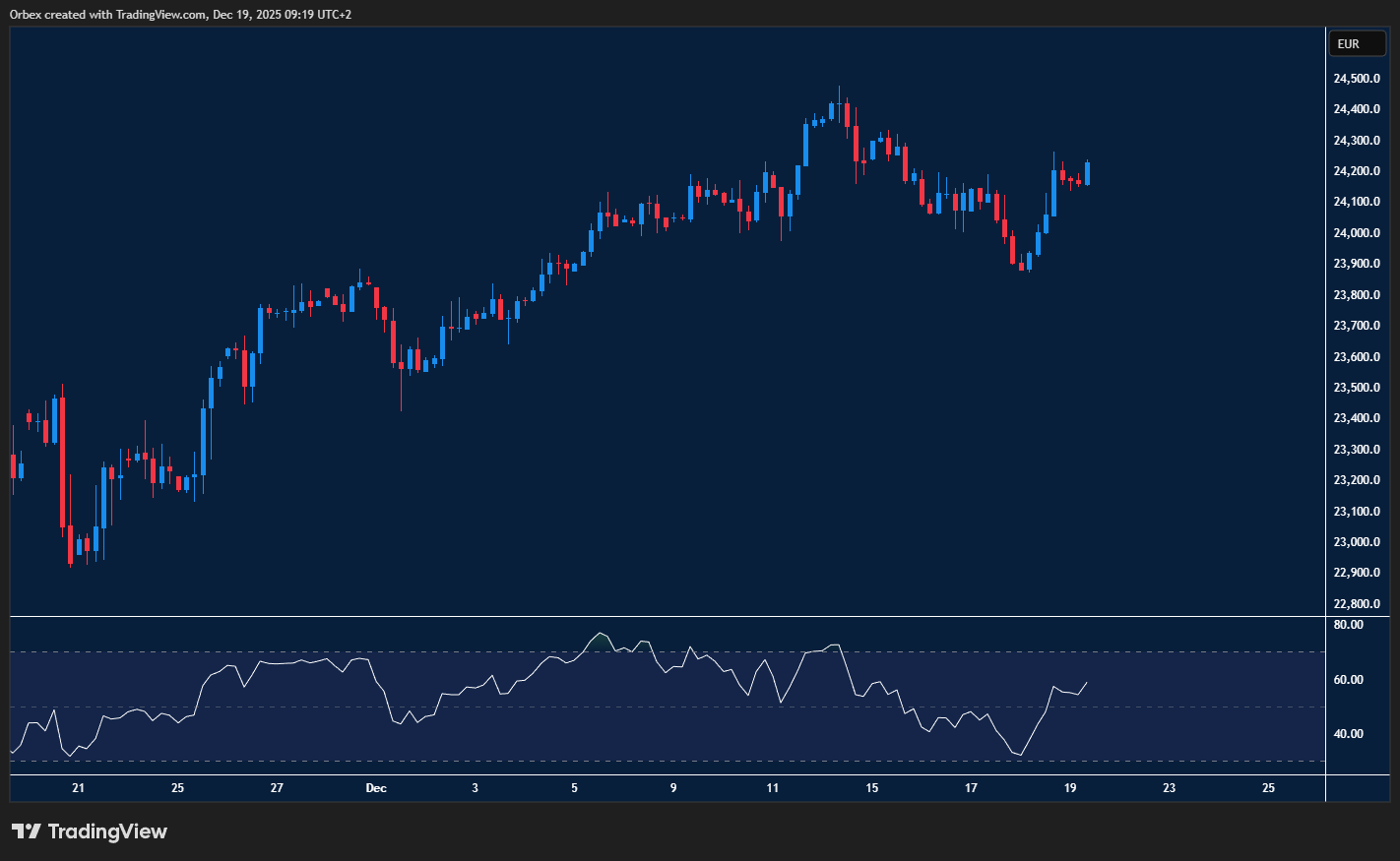

GER 40 index keeps its edge

The index remains bullish as the Dax looks to hit another peak. The index’s decisive break above 24000 put buyers back in the game with a solid footing. The previous swing high at 24400 is the next resistance standing in the way of a near-term bullish continuation. As the RSI spikes, a limited retreat might be due to let the bulls regroup in anticipation of a new round of rally. The former supply zone 24150 has turned into a support.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 22.12.2025 appeared first on Orbex Forex Trading Blog.