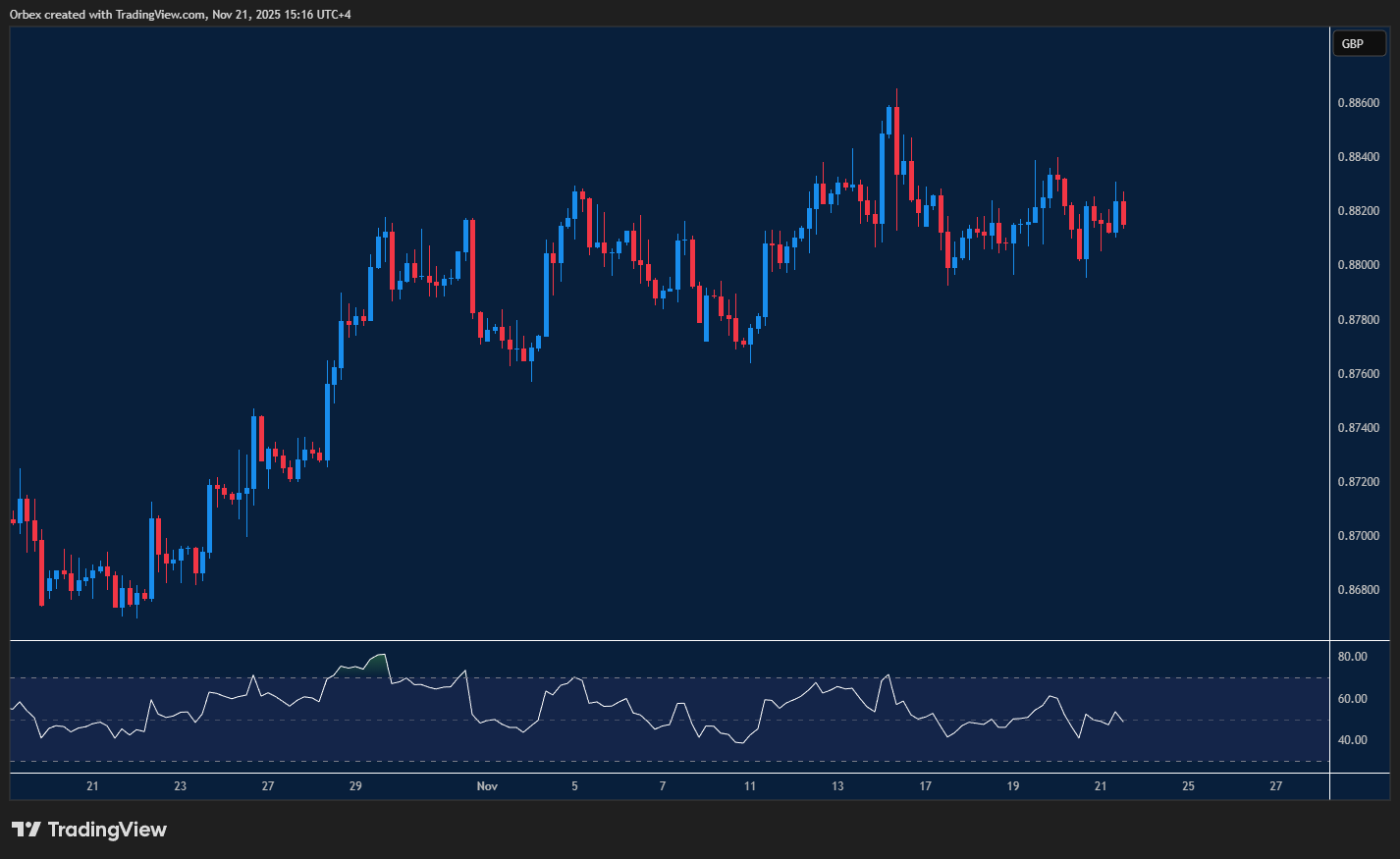

EURGBP stuck in consolidation

The euro remains afloat as prices are still stuck in a lengthy sideways channel. The latest move towards the key support at 0.8800 has forced some buyers to cover, potentially leading to a downturn. A bearish breakout could extend the drop towards 0.8760, as the RSI remains in the oversold area. A bounce higher could materialise, with 0.8840 the first test higher.

XAU (Gold)tests support

XAU (Gold) found support after failing to recapture the 4120 level. The price was recovering towards the said level before shedding most of its gains. A break above 4050 would force bears to switch sides and signal a potential recovery above 4100. Before that, the precious metal might take a breather at 4000, which is a critical support level.

US30 continues falling

The Dow hit another fresh low as traders begin to move away from their AI and tech investments. The index is looking for support after dropping another 700 points in recent sessions. 46000 is an important level to expect follow-through bids, and a sustained bounce might attract momentum buying and push the index to the previous swing high at 46600. A drift below 45600, however, would dent the optimism and send the index lower.

Trading the forex market requires extensive research, and that’s what we do best.

The post Intraday Analysis 24.11.2025 appeared first on Orbex Forex Trading Blog.