FTSE (UK100) tests key resistance

The FTSE (UK100) continues its sideways movement after failing to close above 8500. On the chart, after hitting a bottom at 8380, the rebound is lifting the index back towards its previous peak. A bullish outcome would expose the recent peak, potentially leading to a continuation in the near term. On the downside, 8340 is the first support, while 8260 would be the bulls’ second line of defence.

EURUSD seeking support

The US dollar continued to fight back against its main rival as prices remained distant from the recent peak of 1.1580. A decisive break below 1.1400 has kept the pair subdued as the pair now looks for support. A bearish extension could send prices to 1.1200 in the upcoming days. A double dip in the oversold area on the RSI has signalled a slowdown in momentum as a consolidation phase ensues. A breakback above 1.1400 could trigger another swing higher to test 1.1480.

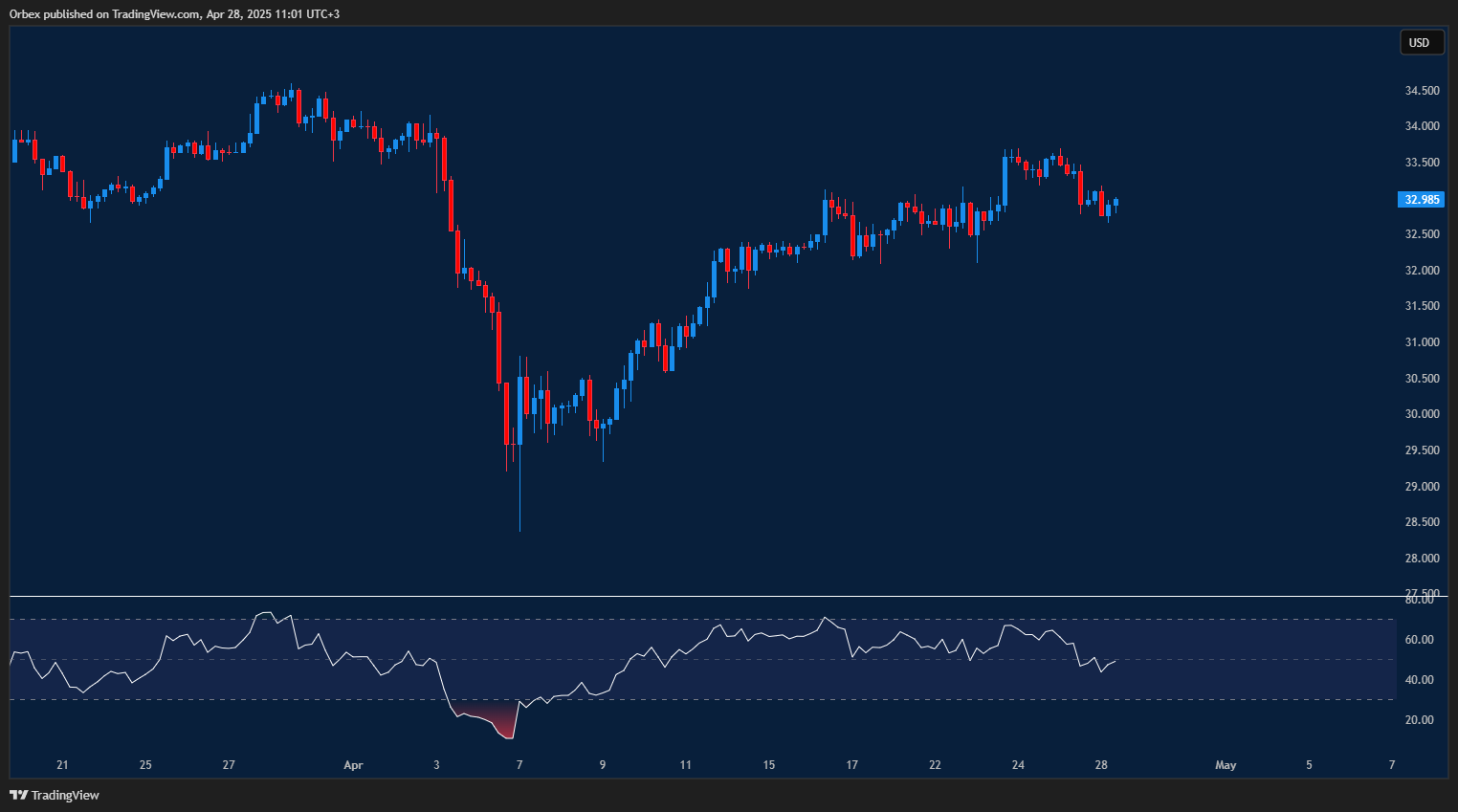

XAGUSD grinding higher

Silver maintains the rally to the upside as it hits a multi-week high. While sentiment has become extremely bullish after a stellar rise, the RSI’s recent bearish divergence could give sellers some room to breathe. The price now consolidates around the 33.00 level after some resistance halted the momentum. A drop below 32.50 would suggest a lack of immediate follow-through, leading to a potential correction. Then 31.60 would be a crucial floor to hold.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 29.04.2025 appeared first on Orbex Forex Trading Blog.