(New Zealand dollar) NZDUSD finds support

The (New Zealand dollar) NZDUSD shared the same rhetoric as the Aussie, with a jump higher to break the recent consolidation. A break above the key area of 0.5900 would suggest a strong bullish drive, forcing sellers to cover their positions and potentially opening the door to a sustained recovery. As the dust settles, the price is consolidating its gains with the former resistance of 0.5820 as the closest support. The RSI’s overbought condition could attract some selling interests, and the price will need to avoid dipping below 0.5800 to prevent a deep correction.

AUDUSD bounces higher

The Australian dollar found its footing after moving higher as a firm bounce saw a break through the recent consolidation zone. The current peak at 0.6530 is a sign of tempered enthusiasm after the recent rally. 0.6580 is the first level to see if buyers start to accumulate again and push prices to monthly highs. A close below 0.6470 would extend the bearish sentiment and pull the pair to the recent bottom at 0.6420.

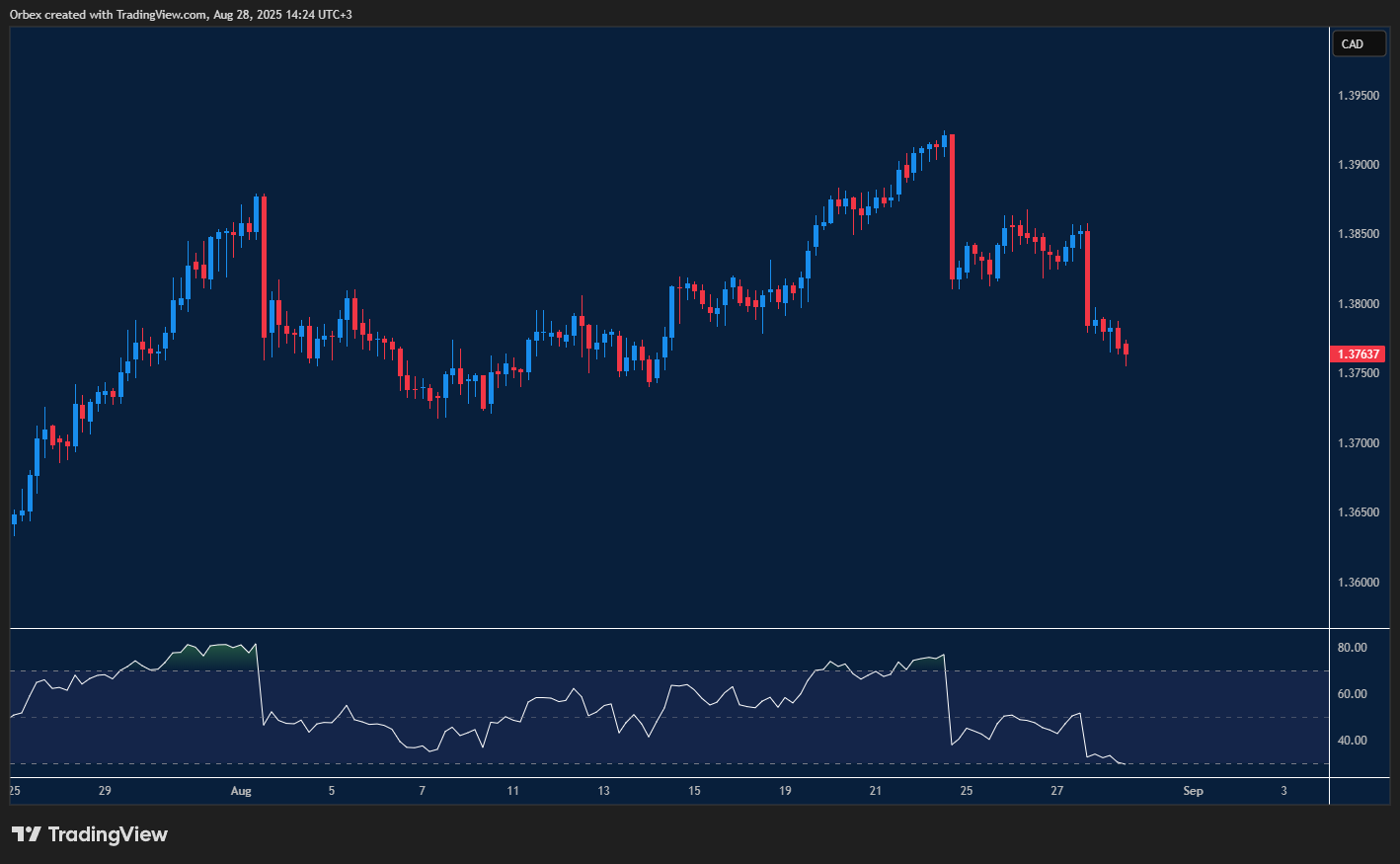

USDCAD grinding lower

The greenback continued to struggle as the Fed’s upcoming meeting keeps traders on edge. Sentiment remains cautious after the pair fell lower, now seeing the immediate resistance of 1.3800 as a critical support level. With a long-term bearish divergence still in effect, traders will be focusing on the 1.3700 zone as the next target. Any sign of a turnaround first needs to break the 1.3850 level before moving back to the recent peak above 1.3900.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 29.08.2025 appeared first on Orbex Forex Trading Blog.