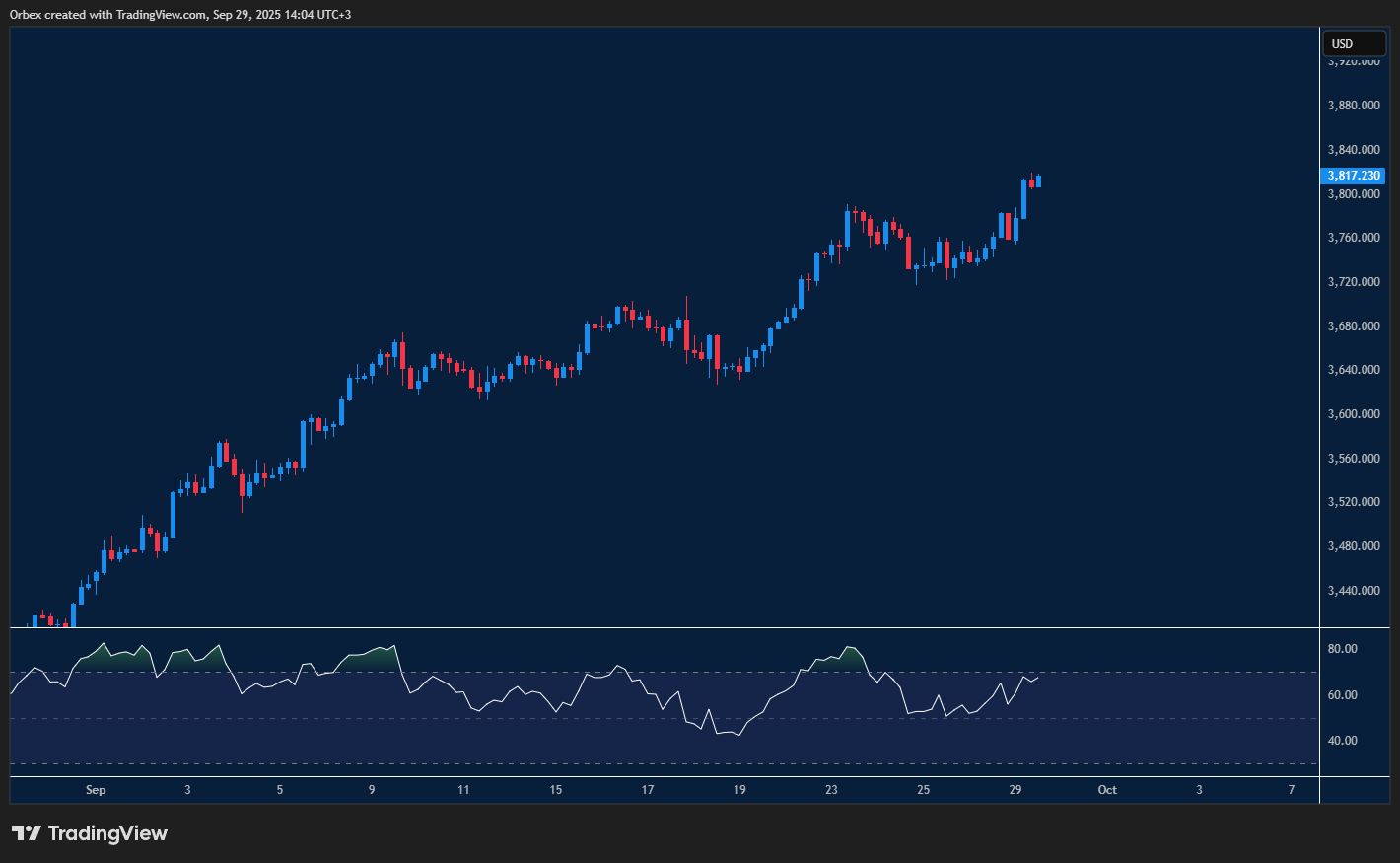

( XAUUSD ) gold hits another peak

( XAUUSD ) gold maintained its bull run as inflation, rate cuts and tariff agendas drive the rally. A break above the daily resistance at the psychological level of 3800 has put sellers on the defensive. Bullion might propel towards 3850 if price action can remain above the 3800 level. On the downside, 3770 has become a fresh support level, and only a close below 3750 would make a bearish rebound sustainable.

AUDUSD looking for a bounce

The Australian dollar continued to struggle as the greenback gained more momentum. The price has remained pressured after it broke below 0.6600. Consecutive lower lows indicate bearish momentum, which may continue to attract sellers. 0.6500 is the next target, and its breach would expose September’s low at the mid-0.6400 level. As the RSI attempts to recover to the neutral area, profit-taking could drive the pair higher; however, 0.6580 is the first hurdle that would signal a recovery.

GER 40 tests major resistance

The choppy nature of price movement continues for the index after a bounce at 23900 saw the Dax regain a foothold on its recent rally. A combination of bargain hunting and short-term sellers’ profit-taking has led to a move, with 24,000 as the first hurdle to clear, easing any signs of downward pressure. Then the top of a previously faded top at 24250 is the ceiling to lift to help the bulls regain control. 23600 is the closest support level to maintain the current momentum.

Test your trading strategy on forex and stocks with Orbex

The post Intraday Analysis 30.09.2025 appeared first on Orbex Forex Trading Blog.