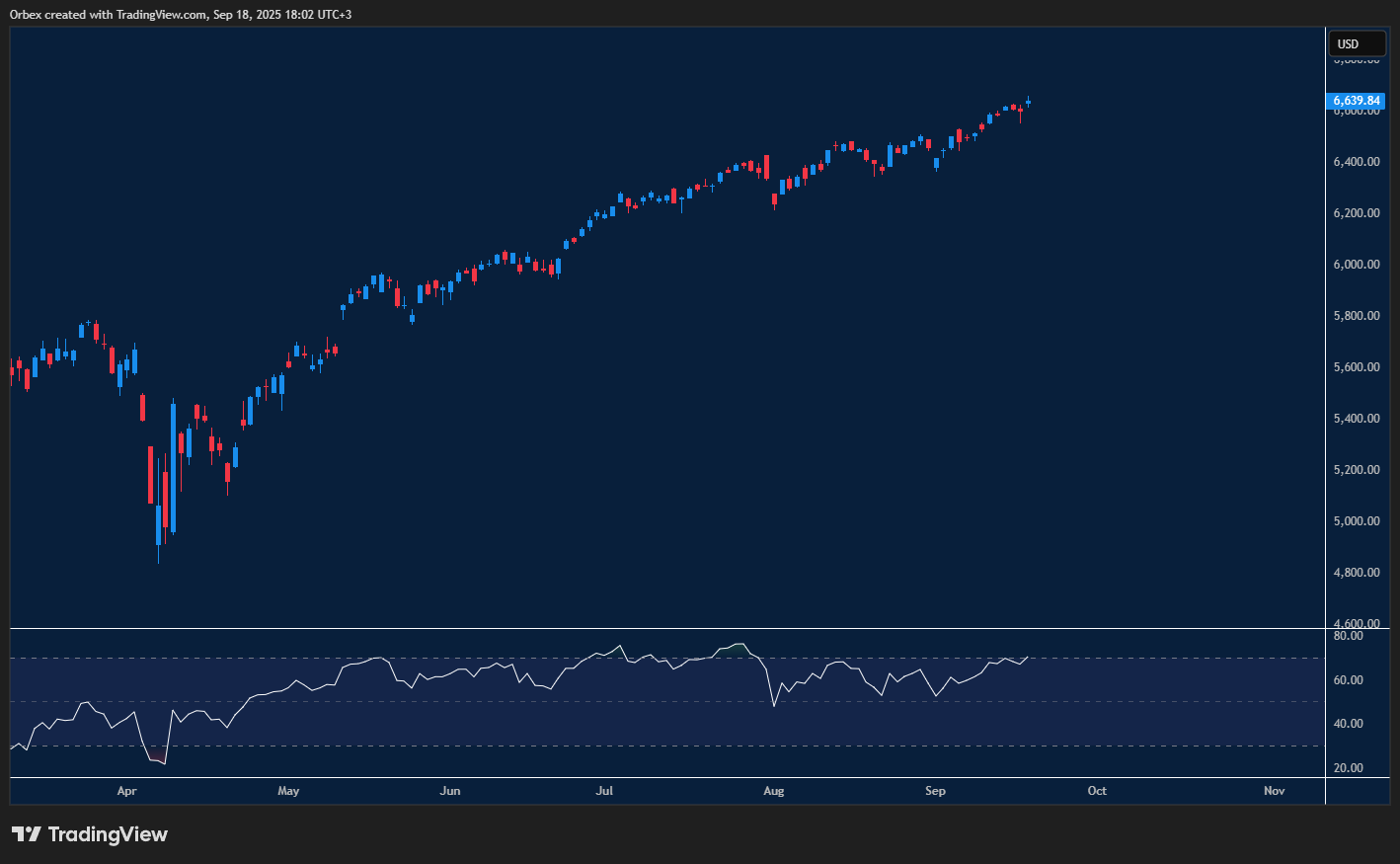

(S&P) SPX 500 reaches for another record

The (S&P) SPX 500 resumed the climb after the latest FOMC press conference lingered in traders’ minds. Stocks are looking to recover from the recent sell-off as focus intensifies on the jobs market. With tech stocks leading the charge, another correction could cause a complete reversal and see the recent gains wiped out. However, with AI leading the way, it looks like the rally could continue for some time. The index is testing the key resistance level of 6700, and 6400 is the first level of support.

EURUSD losing steam

Traders are still digesting last week’s Fed announcement that another two rate cuts are on the horizon in Q4, which could cause more volatility for the Dollar, as well as Gold, as uncertainty continues across the board. With Jerome Powell under increased pressure to amend the current monetary policy, President Trump could get involved if the upcoming jobs data is not sufficient. The pair is falling towards 1.1650 with 1.1900 a firm resistance.

GBPUSD falls from multi-month highs

The pound was unfazed as the Bank of England kept its interest rate unchanged in its latest meeting. With the greenback gaining momentum against its peers, it has been a case of sellers attracting sellers as the bearish rally continues. After the bullish rhetoric continued for most of the month, the overbought RSI brought some relief to bears wanting to make a quick buck. The pair is heading towards 1.3450 with 1.3620 as a fresh resistance.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Breaking through the volatility appeared first on Orbex Forex Trading Blog.